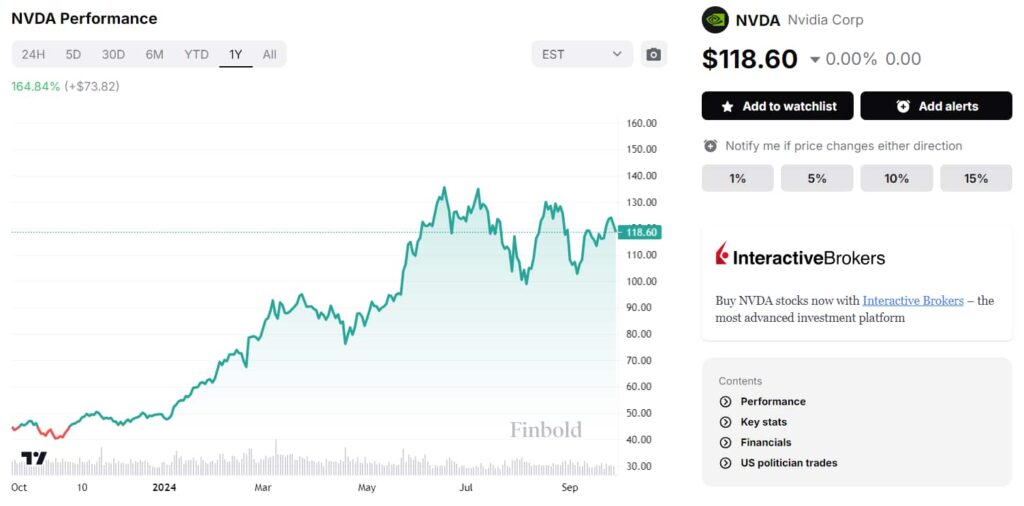

Though the semiconductor giant Nvidia (NASDAQ: NVDA) has been on a strong and unbroken uptrend for years, there are some who question its ability to continue growing, and there has, for some time, existed a level of anxiety that it, and the broader artificial intelligence (AI) sector has already become an unsustainable bubble.

Mark Zuckerberg of Meta Platforms (NASDAQ: META) may have, in a September 25 interview, provided one of the strongest arguments for why the bull case for NVDA stock is the correct one.

Indeed, the technology billionaire explained how the continuation of the AI boom is heavily dependent on hardware infrastructure – infrastructure Nvidia is a key provider of.

Zuckerberg explains the importance of hardware upscaling

Zuckerberg explained that the ongoing artificial intelligence revolution is heavily dependent on the ability to scale up the systems needed to train the AI platforms and commented that progress has been especially strong in 2024.

He pointed toward the growth in the number of GPUs his company has been able to use to train the Llama platform between the versions.

For example, Llama 3 was trained on between 10,000 and 20,000 units, and Llama 4 was trained on approximately 100,000 units, while there are plans to significantly upscale the infrastructure for Llama 5.

Such upscaling is pivotal for the development of more advanced AI as it enhances both the speed and the quality of training and, by extension, designers and manufacturers of needed equipment – Nvidia once more being the standout company – will remain pivotal for the hoped-for technological revolution.

Finally, despite acknowledging the future isn’t entirely certain, Zuckerberg emphasized that he and Meta are confident in the continued growth and development of the needed high-tech infrastructure and have already wagered billions on the bull case.

We’re basically making these bets on how much infrastructure to build out for the future, and this is like hundreds of billions of dollars of infrastructure, so like, I’m clearly betting that this is going to keep scaling for a while, but it’s one of the big questions I think in the field because it is possible that it doesn’t.

Does a NVDA stock bear case hide in Zuckerberg’s optimism?

Despite the overall positive and hopeful tone, Zuckerberg hinted at one possible issue with the bull case. To be precise, the billionaire mentioned that there may again come a plateau in the effort to scale up.

Such a remark is akin to the ‘great filter,’ a term usually discussed in the context of the Fermi Paradox and the lack of signs of extraterrestrial intelligence. The filter is, in a nutshell, the point at which humanity – or any other species – has reached the limits of its ability to progress technology.

While Zuckerberg does not believe the limit of the ability to upscale AI infrastructure is in sight, the issue with the ‘great filter’ is that it is difficult to gauge how near it is until it is reached.

It goes without saying that, at the point the technological plateau has been reached, the growth potential of associated stocks would effectively be removed and the strength of the bull or the bear case would depend on how close to their ‘fair’ valuation the relevant shares are.

Should the plateau for AI infrastructure technology prove close, it would likely bode ill for NVDA stock as it is widely seen as overvalued with a price to earnings (P/E) ratio just under 60 in late September.

Major investors remain confident in continued technological progress

Moving beyond the hypothetical future issues, the consensus among major investors and industry leaders appears to be that there is much room for growth ahead.

Indeed, after OpenAI’s Sam Altman called for a $7 trillion investment in AI infrastructure in late 2023, multiple major companies created an alliance in September 2024 to back technological development with a somewhat less ambitious $100 billion.

This league is comprised primarily of Microsoft (NASDAQ: MSFT), BlackRock (NYSE: BLK), Abu Dhabi’s MGX, and Global Infrastructure Partners (GIP).

Still, in another move that bolsters the NVDA stock bull case by highlighting the company’s importance on the hardware side of the boom, Nvidia is also involved as a critical advisor for designing and running data centers and manufacturing plants.