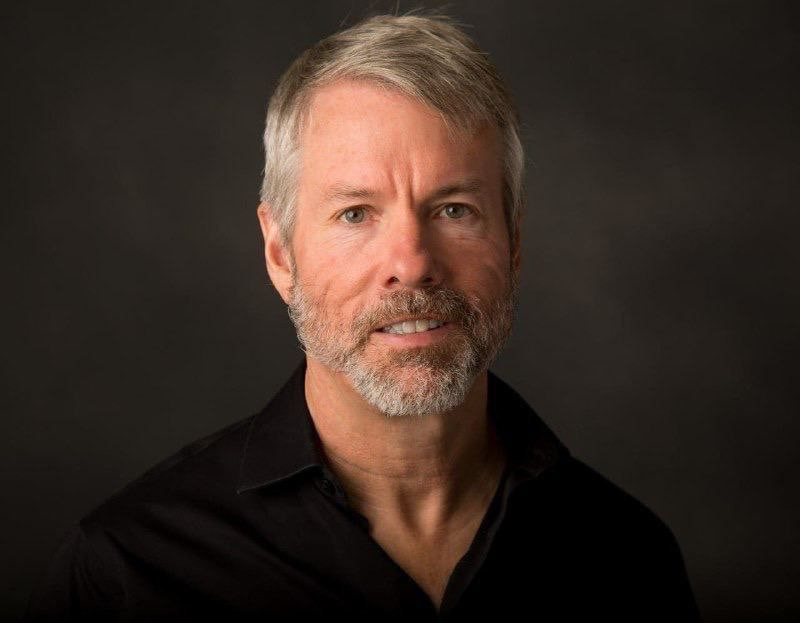

Michael Saylor, the former CEO of MicroStrategy Inc. (NASDAQ: MSTR), is one of the most prominent and controversial Bitcoin (BTC) advocates in the world. Saylor is now forecasting Bitcoin to reach $5 million per unit due to three possible catalysts.

Notably, if 1 BTC were priced at $5 million USD, Bitcoin would have a fully diluted market capitalization of $105 trillion. This would be 4.5 times higher than the United States GDP of $23.32 trillion in 2021, which looks like an unrealistic price target.

Nevertheless, the former CEO of MicroStrategy seems convinced about this possibility. MicroStrategy is often considered an informal spot Bitcoin ETF due to its high exposure to the leading cryptocurrency.

Interestingly, the company reportedly holds 158,400 BTC ($5,50 billion) for approximately 0.8% of the current circulating supply. Under Michael Saylor’s leadership, MSTR would extremely benefit from a surge in Bitcoin, either due to fundamental reasons or for a positive speculative sentiment that this bullish forecast could generate.

3 catalysts for $5 million per BTC, according to Michael Saylor

Michael Saylor spoke in a Spaces on X (Twitter) on November 6, and Bitcoin Archive (@BTC_Archive) shared a cut of the talk when Saylor said the following:

“[Bitcoin] is going to grind up to replace gold. It will go to $500,000 a coin regardless. But there are three things that are massive catalysts to cause an acceleration. Those three things don’t take us to $500,000, they take us to $5 million a coin.”

— Michael Saylor

In the sequence, the MicroStrategy leader lists the three catalysts to $5 million per BTC in his thesis:

“‘A spot ETF where someone can go ahead and buy $100 million in Bitcoin by an ETF security, I think that’s one. Two is: Your bank will custody it for you and lend against it. And three is: I can mark it up or mark it down in my balance sheet based on fair value.”

— Michael Saylor

Essentially, Saylor believes that any of these three things could already be isolated catalysts for price surges, but the three things combined would generate massive demand for BTC as a store of value asset.

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk