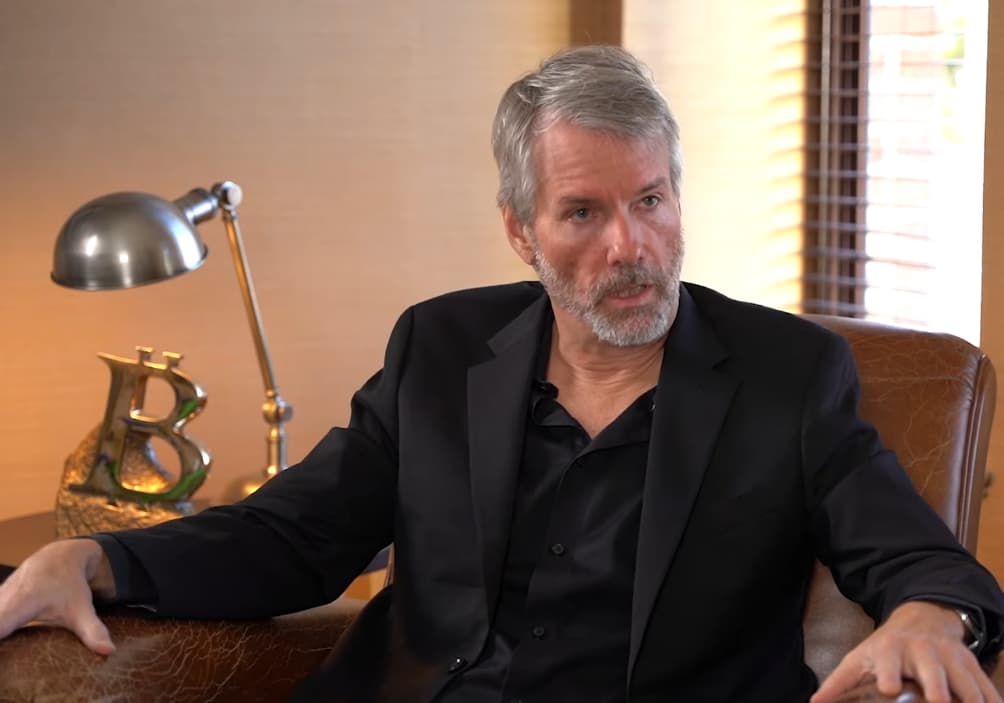

MicroStrategy executive chairman and former CEO Michael Saylor has acknowledged that regulators will be forced to act after the FTX cryptocurrency exchange crisis.

According to Saylor, regulators are likely to crack down on the crypto sector by opting to ban any innovations, a scenario he suggested would benefit assets like Bitcoin (BTC), he said during an interview with Natalie Brunell on November 14.

He stated that Bitcoin, as the ‘apex’ cryptocurrency, is the ultimate store of value likely to gain in the existence of effective regulations while suggesting that jurisdictions can also opt to be progressive in crypto laws.

Picks for you

“Regulators will either move much more aggressively in a fairly regressive conservative approach, and that means they will just shut down all the other crypto innovations, in which case Bitcoin will still be a beneficiary because in a conservative world, Bitcoin is the apex crypto property and people will simply hold it as a long-term store of value,” Saylor said.

Progressive regulation approach

At the same time, Saylor noted that regulators could adopt a progressive approach by providing clarity in the sector. For instance, he pointed out that clarity can be beneficial by offering guidance on registering crypto products to avoid the FTX exchange fate. According to Saylor:

“The other extreme would be the regulators act progressively, and they provide a path to the registration of a digital commodity, a path to registration of a digital security, a path to registration of a digital token, a path to registration of a digital exchange and a path to registration of a digital currency.”

Saylor’s stand on Bitcoin’s sustainability in the wake of possible regulations aligns with his bullish stand on the flagship cryptocurrency. As reported by Finbold, Saylor has previously termed Bitcoin as a channel toward freedom.

Impact of lack of regulations

Interestingly, Saylor blamed the lack of regulations for recent events in the crypto space, stating that the government has adopted a slow response.

“A lot of the pain that the Bitcoin community has absorbed is because of the slow response of the regulators. If the regulators had moved more aggressively in 2018 or 2019 you

wouldn’t have seen all of these, you know, crypto casinos spin up the way they’ve spun up,” he added.

Saylor generally termed the FTX collapse that was triggered by the liquidity crunch an expensive financial lesson.

Saylor’s take on SBF

Additionally, in an interview with Yahoo Finance on November 15, Saylor shared his opinion regarding Bankman-Fried for overseeing the FTX collapse. Interestingly, Saylor drew comparisons between Bankman-Fried and former stockbroker, commonly known as the “Wolf of Wall Street,” Jordan Belfort.

“I mean, in fact, in a sense, SBF is like the Jordan Belfort of the crypto era. Instead of ‘The Wolf of Wall Street,’ they’ll make a movie called ‘The King of Crypto’.<…> He was working to corrupt regulations and corrupt the political process. When you have actors that use corrupt counterfeit, stolen money in order to undermine the industry, it’s not good for anybody. So yeah, I mean, I think that people need to decipher this,” Saylor said.

It is worth noting that amid the FTX crisis, the United States is among the jurisdictions working on pieces of legislation to manage the space. Some of the regulations include the comprehensive crypto bill by Wyoming senator Cynthia Lummis.

Indeed, after the FTX saga, the White House is among the entities that have called for the sector’s regulation.

Watch the full interview below:

Featured image via Natalie Brunell YouTube