In the world of mega-cap tech giants, the “Magnificent Seven” have emerged as key drivers of major stock market indexes such as the S&P 500 and Nasdaq 100.

This group, recognized in 2023 for their exceptional market performance, comprises of Microsoft (NASDAQ: MSFT), Apple (NASDAQ: AAPL), Nvidia (NASDAQ: NVDA), Alphabet (NASDAQ: GOOGL), Amazon (NASDAQ: AMZN), Meta (NASDAQ: META), and Tesla (NASDAQ: TSLA).

Among these, Amazon and Microsoft stand out notably for their leadership in cloud computing and artificial intelligence (AI), continuously pushing the boundaries of technological innovation.

As investors seek to navigate the complexities of the tech sector, Finbold queried OpenAI’s latest and most advanced artificial intelligence(AI) platform,ChatGPT-4o, to look into the fundamentals of Amazon and Microsoft to determine which stocks show potential buy opportunities.

Key growth drivers for Amazon (NASDAQ: AMZN)

Amazon’s growth is propelled by its diversified business model, with significant contributions from e-commerce, cloud computing, and advertising.

A notable driver is Amazon Web Services (AWS), which continues to be a leader in the cloud computing sector. AWS’s integration of generative AI technologies is expected to further boost its performance, making it a substantial growth engine for the company.

Amazon’s advertising business, a high-margin segment, is another critical growth driver.

With the online advertising market projected to grow significantly in the coming years, Amazon is well-positioned to capitalize on this trend.

In the latest quarter, Amazon reported a 19% increase in AWS sales to $26.3 billion, beating analysts’ forecasts. However, overall net sales rose 10% to $148 billion, slightly missing analysts’ estimates of $148.6 billion.

The AWS unit, a core driver of Amazon’s profits, saw its margins narrow by 2 percentage points to 36%, partly due to a 50% increase in investments in property and equipment to $17.6 billion.

Additionally, Amazon’s operating income forecast for Q3 2024 is between $11.5 billion and $15 billion, below analysts’ expectations of $15.1 billion, signaling potential pressure on profitability from lofty capital expenditures.

Conversely, Amazon faces significant challenges, including geopolitical risks and intense competition. Its reliance on cross-border e-commerce trade, particularly with China, exposes it to potential growth impacts from trade restrictions.

Additionally, fierce competition with other e-commerce giants and cloud service providers could affect its market share and growth trajectory.

Key growth drivers for Microsoft (NASDAQ: MSFT)

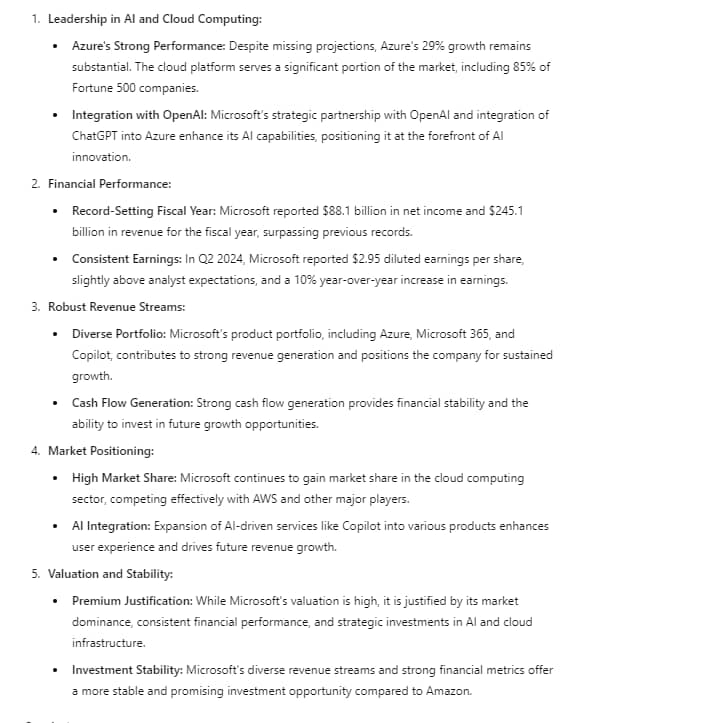

Microsoft’s growth is driven by its strong presence in AI and cloud computing. The company’s Azure platform continues to gain market share, serving a substantial portion of the global market, including 85% of Fortune 500 companies.

The integration of OpenAI’s ChatGPT into Azure enhances its AI capabilities, positioning Microsoft at the forefront of AI innovation.

In gaming, Microsoft now has over 500 million monthly active users, including various consoles, PCs, and mobile devices, following the Activision Blizzard acquisition that closed in October.

Financially, Microsoft reported strong earnings, with its fiscal year 2024 closing out at $245.1 billion in revenue and $88.1 billion in net income.

Despite recent market reactions to slightly lower-than-expected growth in some AI segments, Microsoft’s overall financial health remains robust, supported by consistent cash flow generation and a diverse product portfolio.

ChatGPT- 4o investment outlook

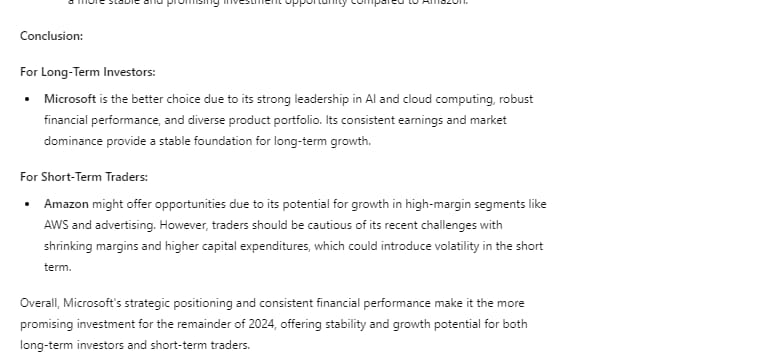

For 2024, ChatGPT- 4o suggests Microsoft as the better buy for risk-averse investors seeking stable income and diverse tech exposure.

The company’s leadership in AI, bolstered by its strategic partnership with OpenAI and the expansion of Copilot, positions it for continued growth.

Microsoft’s robust financial performance, including strong cash flow generation and a diverse product portfolio, provides a compelling case for long-term investment.

While Amazon shows significant growth potential, particularly in high-margin segments like AWS and advertising, Microsoft’s strategic positioning and consistent financial performance offer a more stable and promising investment opportunity for the remainder of 2024.

In conclusion, Microsoft is the overall better option for most investors, providing a blend of growth and stability with lower risk compared to Amazon.

This makes Microsoft a more logical choice for long-term investment, especially for those who value steady returns and robust financial health.

Diversifying investments between both assets could also be a wise strategy to mitigate risks and capitalize on the strengths of each company.

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.