MicroStrategy (NASDAQ: MSTR), a well-known leader in Bitcoin (BTC) investments, has recently ventured into blockchain technology, capturing significant attention.

At the company’s Bitcoin For Corporations conference on May 1, Executive Chairman Michael Saylor unveiled “MicroStrategy Orange,” a new decentralized identity solution that operates directly on the Bitcoin network.

This service, MicroStrategy Orange, marks a pivotal advancement in using the Bitcoin blockchain for more than just financial transactions.

It utilizes Ordinal-based inscriptions to create decentralized identifiers (DIDs) that store and retrieve data without depending on sidechains. The system is designed for high scalability and efficiency, capable of processing up to 10,000 DIDs in a single transaction.

An unofficial draft shared on GitHub outlines the service’s objective:

The goal of this method is to deliver trustless, tamper-proof, and enduring decentralized identities utilizing only the public Bitcoin blockchain as a data source.

Further expanding its blockchain offerings, MicroStrategy has leveraged the Bitcoin Ordinals Protocol to issue these DIDs, which provide a level of pseudonymity similar to that of Bitcoin transactions. This protocol facilitates data storage and communication on individual satoshis, the smallest unit of Bitcoin.

MicroStrategy has already developed one practical application of this technology, “Orange For Outlook.” This application integrates digital signatures into emails, allowing recipients to verify the sender’s identity, thus enhancing the security and trustworthiness of digital communications.

Criticisms and market response

Despite its innovative prospects, MicroStrategy’s project has faced criticism. Tony Giorgio, co-founder of Mutiny Wallet, has questioned the viability of DIDs and criticized Saylor’s method of utilizing the Bitcoin blockchain for data storage.

On the other hand, some Bitcoin enthusiasts and supporters viewed it as a legitimate extension of Bitcoin’s functionality beyond speculative uses like NFTs.

Fred Krueger pointed out the practical applications of using Bitcoin as a data layer, supporting the integration of Ordinals for such purposes.

MSTR stock analysis

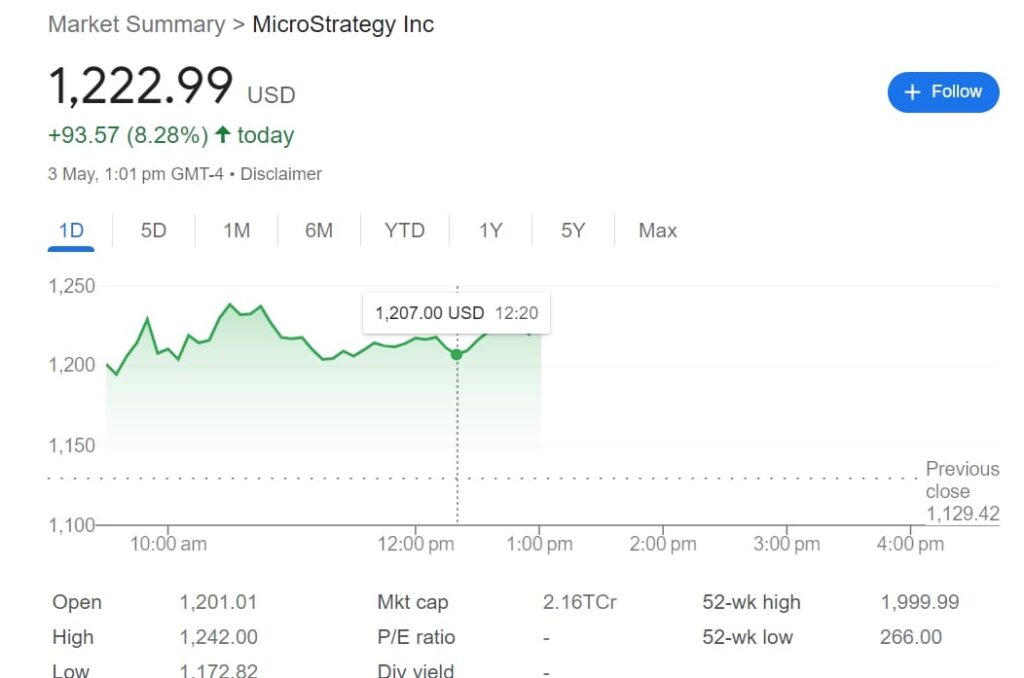

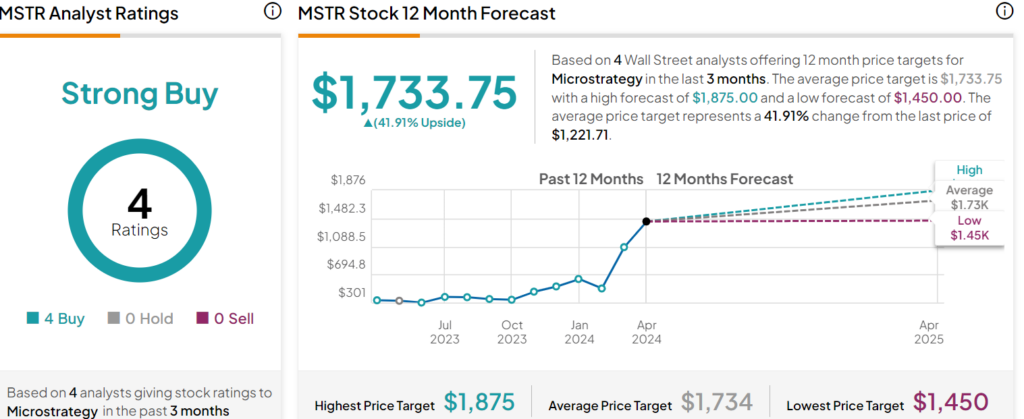

MicroStrategy’s Bitcoin holdings stand at 214,400 BTC, costing an average of $35,180 per Bitcoin. Amidst these developments, MSTR stock has shown significant volatility. As of the latest trading session, the stock is priced at $1,222, down from a high of $1,723 in early April.

This price action reflects a bearish sentiment among investors, compounded by CEO Michael Saylor selling 400,000 shares of his company’s stock since the beginning of the year.

Current analysis indicates a potential further decline in stock prices, despite an average 12-month price target of $1,733.75 by Wall Street analysts.

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.