Under Michael Saylor’s leadership, MicroStrategy (NASDAQ: MSTR) has become the publicly-traded company that has most closely tied its prospects to leading cryptocurrency Bitcoin (BTC).

The business is the largest corporate holder of Bitcoin — and there are no signs to indicate that its accumulation strategy is slowing down. With the bull market already in full swing and BTC set to cross the $100,000 threshold any time soon, MSTR shares have benefited greatly.

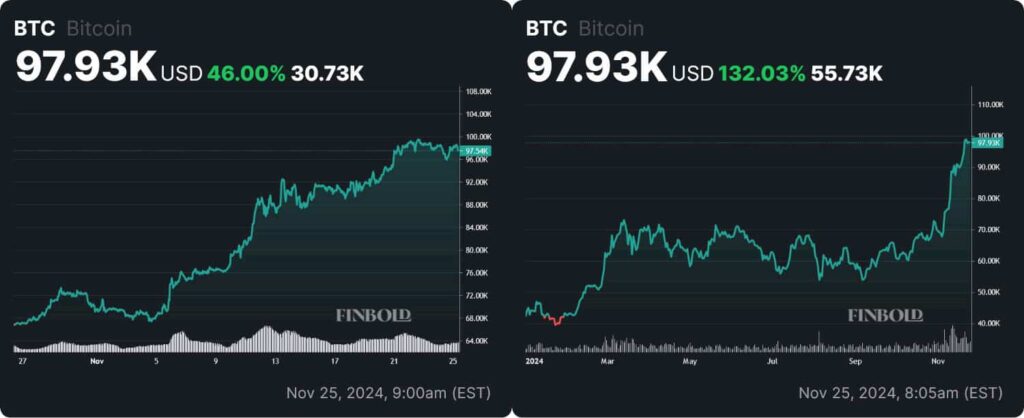

Saylor and MicroStrategy keep doubling down and purchasing BTC regardless of market conditions — but for now, it obviously seems to be working, as the accumulation strategy is outpacing even the most fervent miners — more to the point, it’s actually outperforming BTC itself. At press time, one Bitcoin was worth $97,930,000 — after a 46% rally on the monthly chart that has brought YTD gains up to 132.03%.

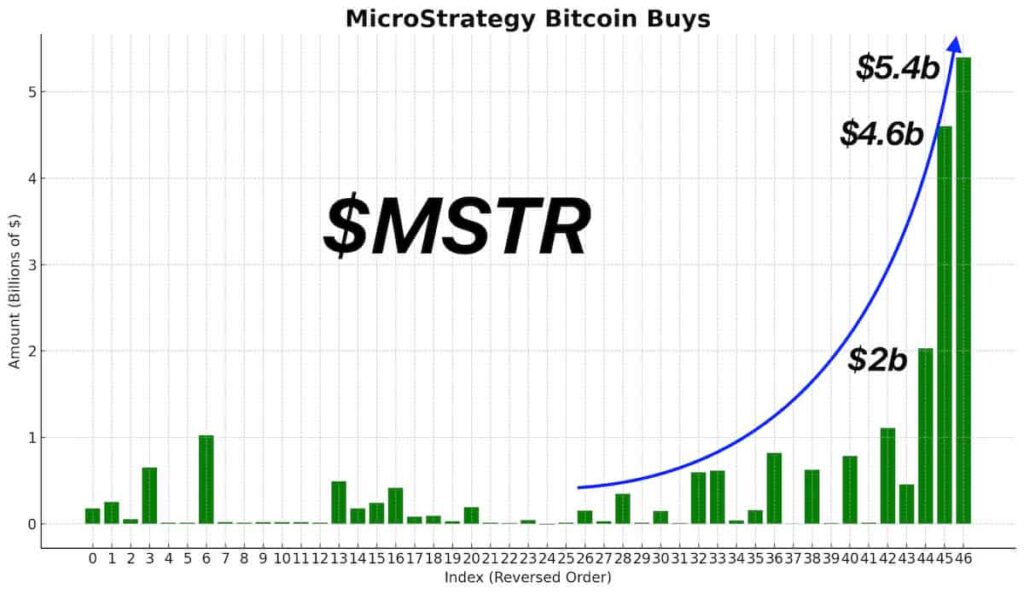

In a sign of unequivocal bullishness, on November 25 MicroStrategy announced that it had completed its largest acquisition to date — buying 55,000 BTC for $5.4 billion, per its latest form 8-K filing.

MicroStrategy’s Bitcoin buys keep unlocking shareholder value

The company’s latest acquisition came at an average price of $97,862 per Bitcoin. MicroStrategy now holds 386,700 BTC, acquired at an average price of $56,761 — looking back, the company has spent a total of $21.9 billion on the digital asset.

In its filings, Microstrategy uses a metric called Bitcoin yield — in essence, it contrasts the company’s BTC holdings with diluted MSTR shares outstanding. By tracking the percentage change of this ratio, the business can tell whether or not its acquisition strategy adds value.

At the time of the company’s last 8-K filing, the YTD BTC yield stood at 41.8% — with this latest purchase, it has increased to 59.3%.

Although MSTR stock is extremely exposed to BTC price swings, in the present bull market, the strategy is performing admirably. However, as warned by numerous analysts, in the event that a recession is followed by a bearish crypto market, MicroStrategy would likely be forced to sell off its holdings — which would result in prices dropping even further.

With so much of its operations tied to a single asset, MSTR stock is inherently risky — however, with the advent of widespread institutional adoption, Saylor and company just might be able to fulfill their ambitions of becoming the first ‘Bitcoin bank’, effectively diversifying away from this current, highly-concentrated mode of operation.

Featured image via Shutterstock