MicroStrategy (NASDAQ: MSTR) is once again making headlines with its ambitious plan to transform into the world’s first “Bitcoin bank,” a move that has sparked renewed interest from investors.

As this plan unfolds, investors are eager to understand where MSTR stock could be headed, especially as the company targets a $1 trillion valuation.

With founder Michael Saylor at the helm, the stock saw a sharp rise, climbing over 13% to $208.23 in just 24 hours—the highest price since March 2020.

In an interview with analysts from research and brokerage firm Bernstein, Saylor outlined his vision for MicroStrategy to expand its Bitcoin (BTC) holdings and establish itself as a cornerstone in the Bitcoin capital market, as reported by The Block.

“This is the most valuable asset in the world. The endgame is to be the leading Bitcoin bank, or merchant bank, or you could call it a Bitcoin finance company,” Saylor said.

MicroStrategy’s bold Bitcoin play

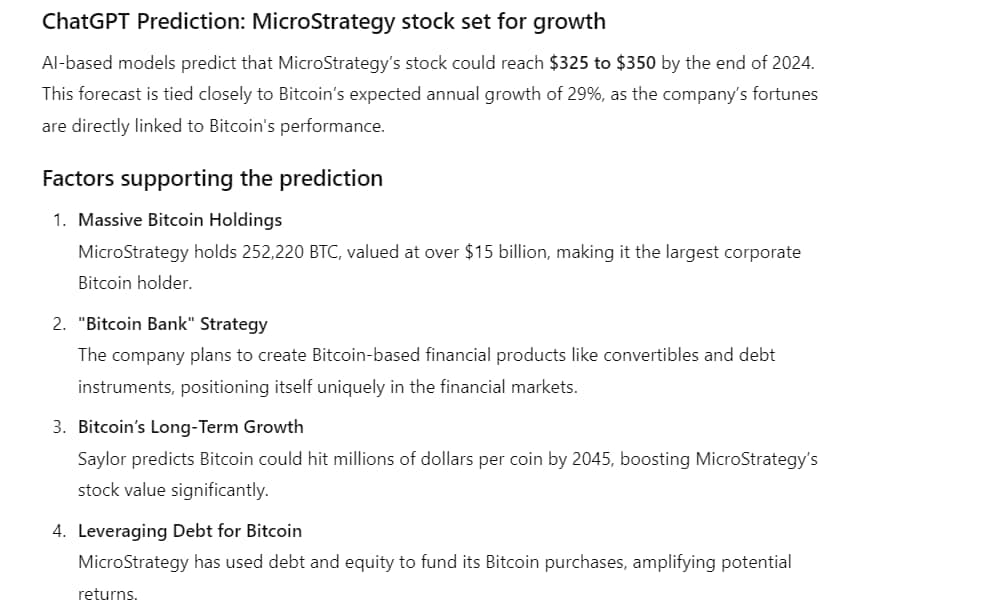

Since 2020, MicroStrategy has aggressively acquired Bitcoin, leveraging debt and equity to scale its holdings to 252,220 BTC, valued at over $15 billion. This positions the company as the largest corporate Bitcoin holder globally, owning approximately 1.2% of Bitcoin’s total supply, according to Bitcoin Treasuries.

Saylor believes that Bitcoin will eventually represent a larger portion of global financial capital, with an estimated price of $13 million per coin by 2045. The firm’s strategy is not based on lending Bitcoin but rather on borrowing capital at low rates and investing it in Bitcoin, which Saylor views as a safer bet than traditional banking.

AI Prediction: MSTR stock price outlook

To provide insight into MSTR’s future, Finbold consulted OpenAI’s AI tool, ChatGPT-4o. According to the AI model, MicroStrategy’s stock is poised for significant growth as the company continues to expand its Bitcoin holdings and execute its strategy.

If BTC continues to rise as forecasted, MSTR stock could potentially reach between $325 and $350 by the end of 2024.

MicroStrategy’s stock has already surged by over 13% recently, as investors react to the company’s long-term vision. This price is tied directly to Bitcoin’s performance, and as Bitcoin continues to gain institutional adoption and rise in value, MSTR’s stock is expected to follow suit.

This projection hinges on Bitcoin’s projected annual growth rate of 29%, as outlined by Saylor, and MicroStrategy’s ability to maintain its aggressive accumulation of the digital asset.

The road ahead for MicroStrategy

MicroStrategy’s long-term vision of becoming a “Bitcoin bank” is not only bold but could redefine how corporations store and manage their capital.

As the company continues to raise capital and accumulate Bitcoin, the AI prediction of MSTR stock reaching $325 to $350 by the end of 2024 seems well-justified. As Bitcoin continues to rise, so too will MicroStrategy, making it a stock to watch closely in the coming months and years.