As Bitcoin (BTC), the world’s largest cryptocurrency, continues its fluctuation after recently pulling back to the $63,000 mark. In response, MicroStrategy (NASDAQ: MSTR) stock saw a significant drop of over -13% since the markets opened on March 19.

The losses extended to as much as -20% from when options traders opted to sell off MSTR stock, effectively shorting it via weekly put orders.

This move coincided with a bet against the stock’s performance, driven by the declining price of BTC, as over $230 billion vanished from crypto’s total market cap amid over $650 million in liquidations.

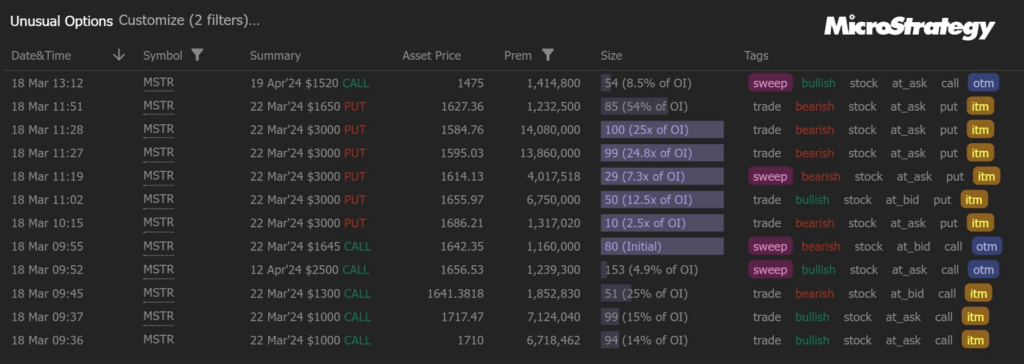

This comes after MicroStrategy shares witnessed significant unusual options activity, with a notable surge in weekly put options purchases totaling over $35 million at the asking price on March 18.

MicroStrategy remains committed to buying Bitcoin

Despite the increasing volatility of maiden crypto and interconnection with MSTR stock, Michael Saylor continues to promote cryptocurrency acquisitions made by MicroStrategy

On March 19 Saylor announced that MicroStrategy purchased an additional 9,245 BTC for approximately $623.0 million, utilizing funds from convertible notes and excess cash, equating to roughly $67,382 per Bitcoin.

As of March 18, 2024, the company held 214,246 BTC acquired for approximately $7.53 billion, with an average price of $35,160 per Bitcoin.

Bitcoin and Microstrategy stock chart

While it may be challenging to definitively establish a direct correlation between BTC and MSTR stock, significant similarities can be observed in their price charts. For instance, over the past 7 days, Bitcoin’s price has dropped by over -12%, leading to a corresponding -20% decline in the value of MSTR stock.

Expanding our view to year-to-date (YTD) charts, even more pronounced correlations emerge. BTC’s rise of 42.77% has correspondingly boosted MSTR stock by over 87%.

It appears that Saylor’s desires have finally come true, as it’s now impossible to think of MicroStrategy without immediately linking it to Bitcoin, whether for better or for worse.

Buy stocks now with eToro – trusted and advanced investment platform

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.