As the majority of participants in the stock market anticipate an upcoming stock split by Nvidia (NASDAQ: NVDA), which will offer additional shares to current holders, consequently bringing down the price of each individual share, an insider has taken the opportunity to profit.

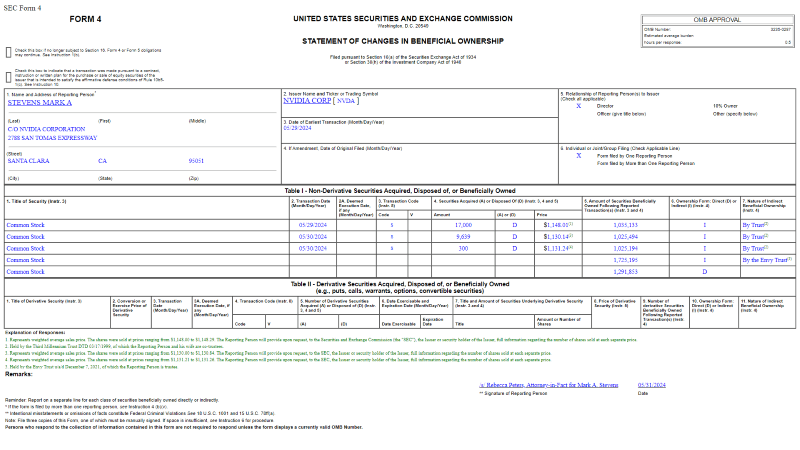

Indeed, Mark Stevens, the second-largest Nvidia shareholder and board member since 2008, has recently sold 26,939 NVDA shares for a total value of $30.7 million, according to the filing with the United States Securities and Exchange Commission (SEC) from May 31.

Specifically, Stevens reported selling 17,000 Nvidia stocks on May 29 at the average price of $1,148.01, as well as 9,939 in two transactions on May 30, one at the price of $1,130.14 (9,639 stocks sold) and the other at $1,131.24 (300 NVDA shares sold), as the filing shows.

As a reminder, Nvidia’s Board of Directors member Dawn Hudson earlier sold 20,000 NVDA shares at an average price of $1,079.41, profiting $21.5 million, while Director Tench Coxe offloaded 200,000 NVDA shares on March 5 for a profit of $170 million, as Finbold reported on March 7.

Nvidia stock price analysis

At the moment, the price of Nvidia shares stands at $1,169.05, which means it has increased about 2.6% since Stevens’ sales, up 1.23% on the day, growing 0.86% in the last week, and gaining 26.88% across the past month, adding up to the 142.70% advance since the year’s start, as per data on June 5.

Meanwhile, the announced 10-1 Nvidia stock split is a promising sign for investors, as such actions often serve as an optimistic signal from a company’s leadership that its future looks positive and the stock price will continue to make bullish advances despite the NVDA stock split lowering its market price.

Furthermore, Wall Street analysts, including those at Bank of America (NYSE: BAC), have revised their price targets for Nvidia shares, with the majority of them agreeing that NVDA stock is a ‘strong buy,’ and the average price target presently standing at $1,205.43, which suggests an increase of 3.11% from its current price.

Overall, Nvidia has seen an increasing number of insider sales by its executives in the last six months, surpassing half a million in 2024 alone as its business takes off, with shareholders taking profit. That said, doing one’s own research is critical before acting on any major investment decisions.

Buy stocks now with eToro – trusted and advanced investment platform

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.