Carvana Co. (NYSE: CVNA), a leading e-commerce platform for buying and selling cars, has captured significant investor attention following notable insider trading activity by its Chief Product Officer, Daniel J. Gill.

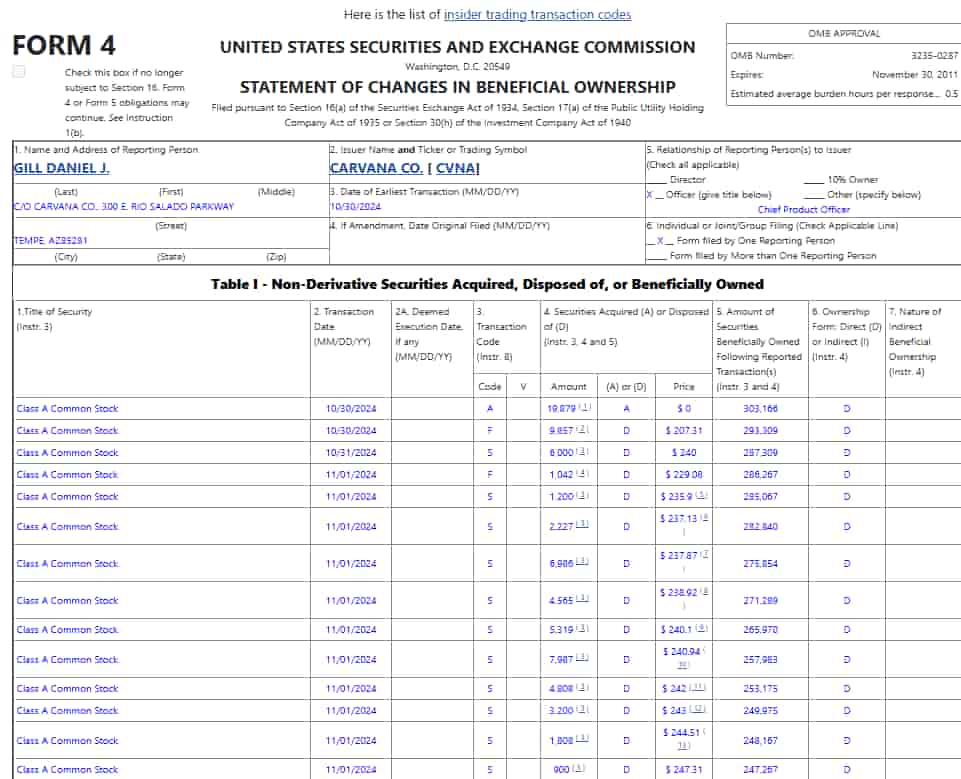

According to a recent SEC filing, Gill executed several stock transactions under a Rule 10b5-1 trading plan adopted on June 14, 2023. On October 30, 2024, Gill acquired 19,879 shares through restricted stock units (RSUs) granted earlier in the year.

To cover tax obligations related to these vested RSUs, he disposed of 9,857 shares at $207.31 per share on the same day, leaving him with a total holding of 303,166 shares.

The following day, on October 31, Gill sold an additional 6,000 shares at $240 per share, bringing his holdings down to 287,309 shares.

On November 1, 2024, he conducted a series of sales totaling 22,247 shares, executed at prices ranging from $229.08 to $247.31 per share, yielding approximately $10.8 million in proceeds.

However, these sales were conducted under a Rule 10b5-1 trading plan, which is designed to prevent concerns about trading on non-public information. These plans allow insiders to execute predetermined transactions, meaning the sales don’t necessarily indicate a lack of confidence in Carvana’s future.

Investors are closely monitoring these transactions, particularly as Carvana’s stock continues its upward momentum. Despite the significant sales volume, Gill still holds 247,267 shares, signaling ongoing confidence in the company’s trajectory.

Strong Q3 2024 earnings boost confidence

This insider activity coincides with the company reporting its Q3 2024 earnings on October 30, significantly surpassing Wall Street expectations.

Earnings per share (EPS) came in at $0.64, well above the consensus estimate of $0.29 while the revenue reached $3.66 billion, outpacing the forecasted $3.45 billion.

Additionally, Carvana achieved a record-breaking gross profit per unit (GPU) of $7,685, driven by higher-than-expected vehicle sales and profitable loan sales.

These strong financials propelled Carvana’s stock from $207.34 on October 30 to $251.70 in premarket sessions, marking an impressive 24% surge. This pushed the year-to-date (YTD) return to a staggering 343%, further reinforcing Carvana’s position as a leader in the online automotive retail space.

At press time, Carvana’s stock is trading at $229, reflecting a 31% gain over the past month.

Despite the bullish sentiment, Carvana’s valuation metrics raise some concerns. The trailing PE ratio stands at a staggering 1,731.71, while the forward PE ratio is 94.86, according to StockAnalysis data.

These figures indicate exceptionally high investor expectations for future earnings growth, which could prove challenging to sustain.

Analyst reactions and sustainability concerns

Wall Street analysts responded positively, revising their price targets upward. However, concerns remain about the sustainability of Carvana’s valuation, particularly its heavy reliance on GPU as a key performance metric.

While the company reported a GPU of $7,685, a significant portion stems from loan sales rather than actual vehicle sales. The SEC filing revealed that retail vehicle gross profit per unit was $3,497, more aligned with the industry average but less impressive than the headline figure.

That being said, Gill’s sales may be viewed as either profit-taking or strategic financial planning. However, his substantial remaining stake indicates continued confidence in the company’s growth.

Nevertheless, with Carvana’s high valuation ratios and its dependence on loan sales for a significant portion of its profits, investors should carefully assess the long-term sustainability of its growth narrative.

As the company continues to deliver strong results, its valuation will likely remain under scrutiny, particularly if insider sales persist at this pace.