One of the most influential media conglomerates in the world, Disney (NYSE: DIS) hasn’t exactly been on a smooth trajectory over the last couple of years.

After the outsized impact that Covid-19 had on the business, its foray into streaming with Disney+ ran into roadblocks. All the while, Disney was faced with boycotts, box office failures, and an inability to navigate the modern media ecosystem without current CEO Bob Iger, who has had to return to the role after a brief retirement.

In early 2021, DIS stock hit an all-time high (ATH) of almost $200 — followed by a long, steady collapse to a 10-year low in September 2023. The first quarter of 2024 was promising, as Disney shares reached a high of $122.36 in March — although this was followed by a drop to just $90.38 in late July.

Since then, Disney stock has been on a steady path of recovery — most recently, after the company’s Q4 and full-year 2024 earning call on November 14, which was a beat in terms of revenue and earnings, the stock surged by 8.2%.

At press time, DIS shares were trading at $113.92 — with monthly gains of 18.37% bringing year-to-date (YTD) returns up to 25.59%. With the post-earnings rally still in effect, one key Disney insider has decided that now was a good time to take profits.

Insider dumps $568,000 in Disney stock

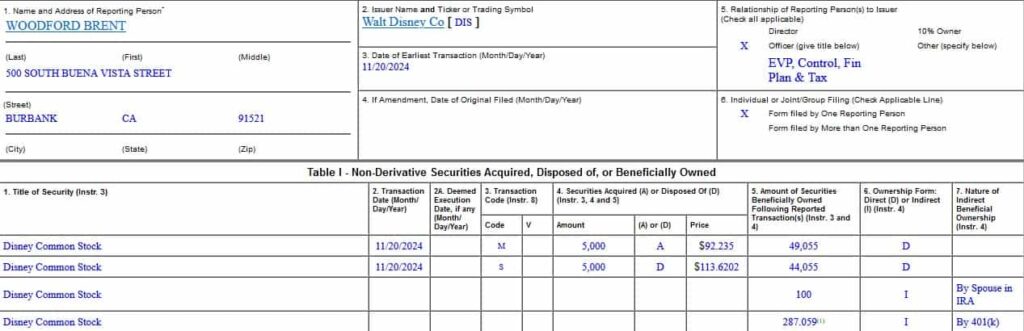

On November 20, Brent Woodford, Executive Vice President, Controllership, Finance and Tax for Disney executed a transaction that saw the sale of 5,000 Disney shares, per an SEC form 4 filing made public on November 21.

Receive Signals on SEC-verified Insider Stock Trades

This signal is triggered upon the reporting of the trade to the Securities and Exchange Commission (SEC).

Woodford sold Disney stock at an average price of $113.62 apiece — meaning that the total value of his trade is approximately $568,101. Following the sale, he still holds 44,055 shares directly. Interestingly enough, unlike most insider transactions, this sale wasn’t made pursuant to a 10b5-1 plan — in other words, it wasn’t preplanned.

His total stake in the company hasn’t actually changed, however — as the Vice President exercised stock options to acquire 5,000 DIS shares at a price of $92.24 per unit. At that price point, the purchase set Woodford back roughly $461,200 — leaving him with a tidy $106,901 profit.

Given this, the sale cannot serve as a bearish signal — with prices still well below all-time highs and the company’s raised guidance for 2026 and 2027, DIS stock remains an attractive opportunity for long-term investors.

Featured image via Shutterstock