According to a recent SEC filing, Alphabet Inc. (NASDAQ: GOOGL) has seen a wave of insider activity following its impressive Q3 2024 earnings report on October 29.

This filing details substantial share transactions by key individuals as Alphabet’s stock approaches the $176 mark, gaining nearly 10% since the earnings announcement.

Receive Signals on SEC-verified Insider Stock Trades

This signal is triggered upon the reporting of the trade to the Securities and Exchange Commission (SEC).

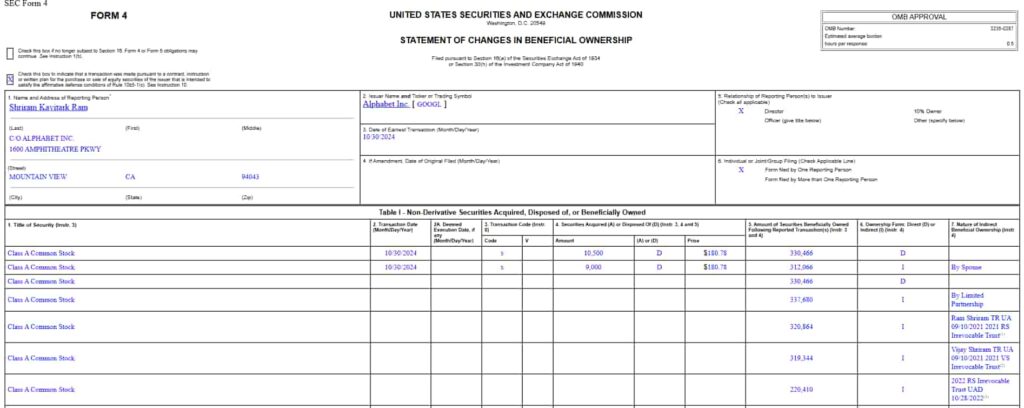

Leading the recent insider sales, Director Shriram Kavitark Ram sold a total of 19,500 Class A Common Stock shares in two significant transactions on October 30. Ram sold 10,500 shares, followed by an additional 9,000 shares, at $180.78 per share, yielding approximately $3.5 million.

Despite this divestment, Ram continues to hold over 330,000 Class A shares, a position that underscores his continued commitment to Alphabet.

In addition to Ram’s transactions, Chief Accounting Officer Amie Thuener O’Toole also joined the recent selloff, offloading 1,367 shares of Class C Capital Stock on November 1, totaling $234,331.

Thuener O’Toole’s holdings remain significant, with 26,349 shares alongside her vested units, maintaining a balanced position in Alphabet.

Additionally, Director Frances Arnold executed a smaller sale on November 4, disposing of 441 Class C shares valued at $75,437 and retaining 16,490 shares along with vesting GSUs linked to her board role.

Understanding the structure of the sales

These transactions were conducted under Rule 10b5-1 trading plans, which allow major shareholders, including corporate insiders, to sell a predetermined number of shares at scheduled intervals, a common practice to avoid concerns about trading on non-public information.

While insider selling often sparks speculation about confidence, the routine and scheduled nature of these transactions suggests a regular portfolio rebalancing rather than a shift in outlook. All of them maintain a substantial stake in Alphabet, reflecting long-term alignment with the company’s future.

GOOG stock outlook

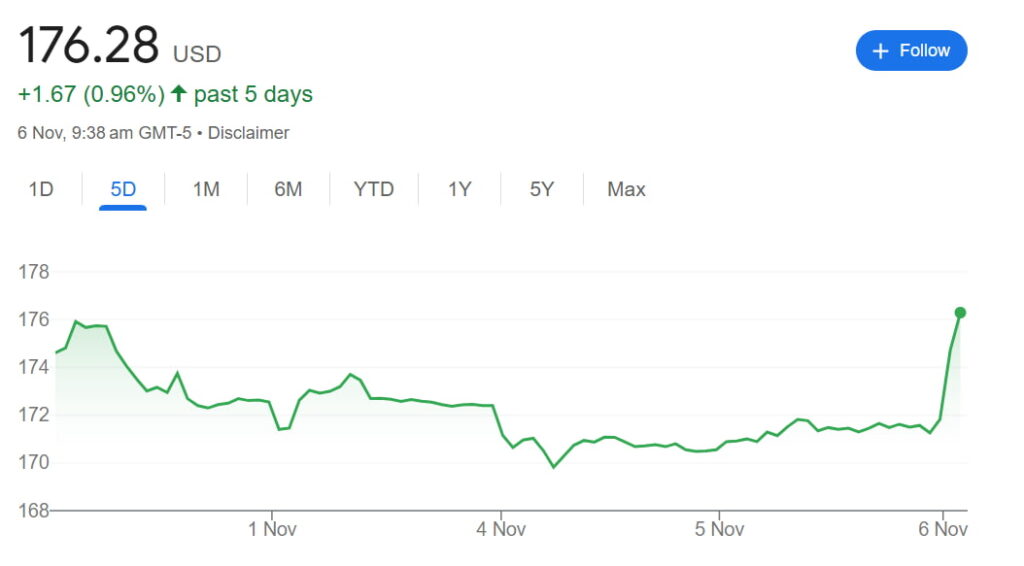

As of press time, GOOG stock was trading at $171.90, up 0.6% over the past five days. Zooming out, GOOG stock brought in an impressive 22% gain in value on a YTD chart.

Alphabet’s strong Q3 results, marked by 16% revenue growth and a 32% increase in operating income year over year, are largely fueled by its core advertising business, driven by Google Search and YouTube.

Both platforms saw 12% growth, bolstered by increased advertising spending, particularly during the election cycle.

Additionally, Alphabet’s cloud division, Google Cloud Platform (GCP), emerged as its fastest-growing segment, with a 35% revenue jump due to advancements in generative AI, attracting new customers and deepening product usage.

However, regulatory and competitive pressures loom, especially from ChatGPT’s newly launched search tool which, if it draws users from Google, could impact Alphabet’s advertising revenue.

While insider selling has attracted attention, the company remains resilient with its diverse revenue streams and continued innovation in AI-driven solutions, setting the stage for sustained momentum despite industry headwinds.

Featured image via Shutterstock