At the moment, one of the stocks with the strongest momentum in the market belongs to Palantir (NASDAQ: PLTR), the Alex Karp-led data analytics and AI infrastructure business.

A longtime favorite of retail investors, PLTR stock initially ran into quite a bit of institutional skepticism. Those concerns seem to have faded away — for the most part. Palantir shares are on a blistering bull run as we enter the last month of 2024.

Over the course of the last thirty days, Palantir stock has rallied by 73.79%, bringing returns over the last six months to 208.88% and year-to-date (YTD) gains up to a staggering 334.25%.

Numerous factors are at play here. The company delivered a standout Q3 2024 earnings call on November 4 — a double beat where both revenue and earnings per share (EPS) came in above analyst estimates. In a reversal of their previous stance, institutions and hedge funds went on a buying spree — bringing institutional ownership of the business to 54.50% of total shares.

In tandem, equity researchers began setting ever-higher price targets. The AI infrastructure venture is also set to join the NASDAQ-100 index in the coming weeks. At press time, PLTR shares were trading at a price of $72 — having closed above $70 for the first time on December 3.

Not everyone remains optimistic about long-term prospects. PLTR’s high valuation has been a consistently sore spot — and many insiders have been selling large quantities of stock over the past couple of months. Now, another key insider has joined in and dumped tens of millions of dollars worth of Palantir stock.

Insiders take major profits on Palantir stock — trouble ahead?

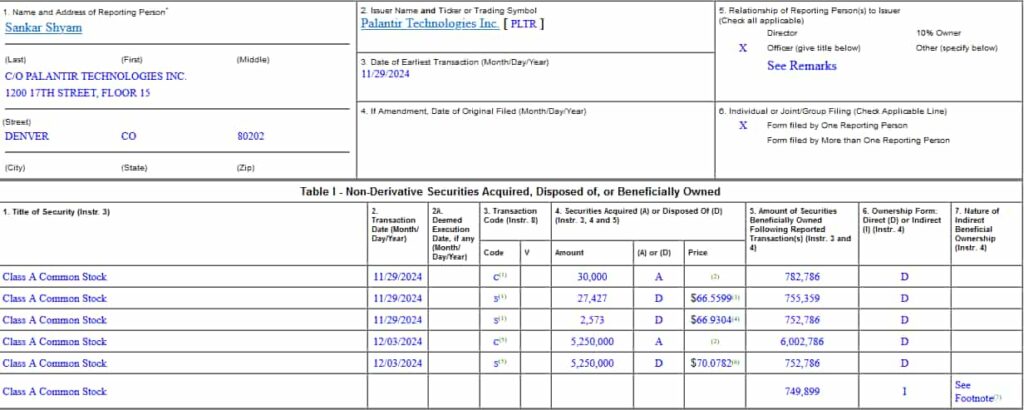

From November 29 to December 3, Palantir’s Chief Technology Officer (CTO), Shyam Sankar, executed three sell transactions, per a SEC Form 4 filing made public on December 3. The first included 27,427 PLTR shares, the second entailed 2,573 units of ownership, and the third, by far the largest, encompassed 5,250,000 Palantir shares.

These transactions took place at average prices ranging from $66.55 to $70.07. In total, the CTO sold 5,280,000 PLTR shares, worth an estimated $358,248,000.

Sankar’s trade was made pursuant to a 10b5-1 plan dating back to August 29. Under this plan, the CTO intends to sell a total of 7,305,000 Palantir shares before March 6, 2026. In November, he sold 169,017 PLTR shares — once this new sale is added to the figure, Sankar has 1,855,983 PLTR stocks left to sell per the plan.

The insider still holds 748,899 shares following the sale. Since he converted Class B Common Stock and exercised employee stock options, his stake in the company remains unchanged.

There is little doubt that Palantir has made a strong foothold for itself — the company is currently even the largest publicly traded defense contractor on top of being a leader in AI. However, continued outperformance will be necessary not for growth, but just to sustain current stock prices — and that’s quite a tall order.

Featured image via Shutterstock