Palantir Technologies Inc. (NYSE: PLTR) is making headlines after its CEO, Alexander C. Karp, sold an astounding 6,323,602 shares, generating over $398 million.

This “monster trade” coincides with Palantir stock recently achieving new highs, driven by strong market momentum and anticipation of its transition from the NYSE to the Nasdaq.

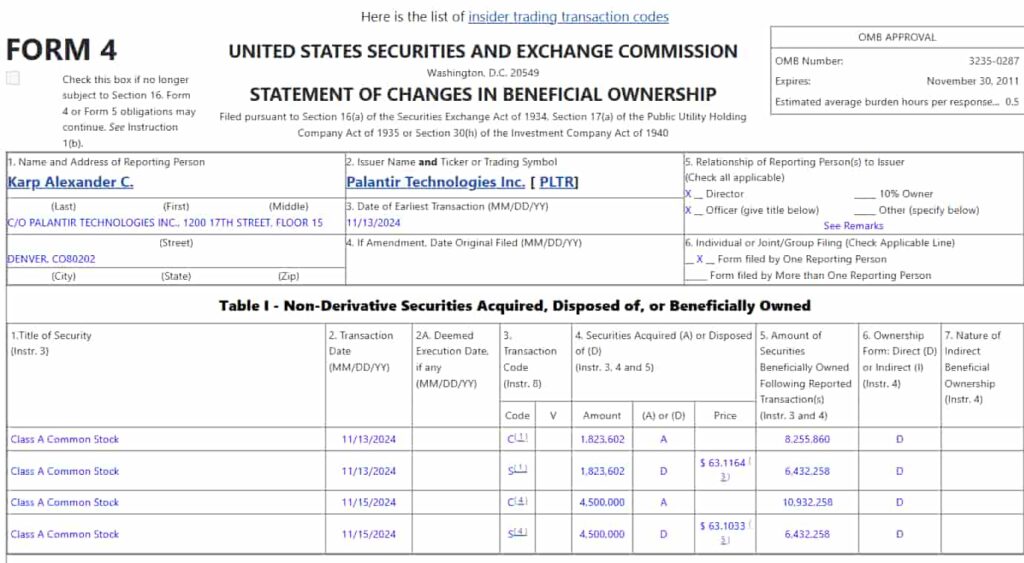

These transactions, disclosed via SEC Form 4 filings, were executed under a Rule 10b5-1 trading plan. This allows executives to sell shares on a prearranged schedule, ensuring compliance with insider trading laws while capitalizing on favorable market conditions.

Receive Signals on SEC-verified Insider Stock Trades

This signal is triggered upon the reporting of the trade to the Securities and Exchange Commission (SEC).

Breaking down the transactions

On November 13, 2024, Karp exercised 1,823,602 employee stock options at an exercise price of $11.38 per share.

These shares were converted from Class B to Class A Common Stock on a 1-for-1 basis and sold at an average price of $63.11 per share, yielding significant gains.

Two days later, on November 15, Karp sold an additional 4,500,000 shares, also at an exercise price of $11.38 per share, achieving a weighted average sale price of $63.10.

The trading range for these transactions was between $63.00 and $63.48 per share, reflecting strong market liquidity and consistent investor demand.

Despite these large sales, Karp still retains 107,676,398 shares of Class B Common Stock.

By the close of trading on November 15, Palantir’s stock was priced at $65.77, reflecting an 11% increase in just 24 hours.

Over the past week, the stock gained more than 9%, securing its position as one of 2024’s top-performing equities, with a staggering year-to-date increase of 296%.

Key drivers of Palantir’s growth

Palantir’s impressive performance can be attributed to its robust Q3 earnings and expanding government contracts. Government sector revenue grew by 40% year-over-year in Q3 2024, fueled by high-profile projects like the Department of Defense’s Open DAGIR initiative.

Recent contracts further highlight its dominance in defense, including a three-year $7.15 million deal with the Australian Department of Defence and a $99.8 million military AI contract with the DEVCOM Army Research Laboratory.

Palantir’s partnership with L3Harris (NYSE: LHX), aimed at developing AI-enhanced solutions for U.S. and allied national security, further strengthens its strategic positioning in national defense and AI innovation.

Palantir’s valuation sparks concern

While Palantir’s growth trajectory is compelling, its soaring valuation raises red flags. The company’s reliance on high-value clients narrows its addressable market.

U.S. commercial customers generate an average annual revenue of $2.15 million, indicating a focus on large corporations with substantial data needs.

This limits opportunities for broader market penetration, particularly as Palantir faces mounting competition from tech giants like Google Cloud, which offers similar AI-driven solutions for enterprises, posing strong headwinds to future growth.

Analyst skepticism amid insider selling

Valuation concerns continue to weigh heavily on the stock. Even bullish analysts, such as Wedbush’s Dan Ives, who referred to Palantir as the “Messi of AI“, have set a conservative price target for the stock.

Compounding these concerns is the recent insider selling, with CEO Alex Karp having already offloaded over $1.2 billion worth of shares in the past three months. This significant activity has prompted analysts like Jefferies’ Brent Thill to downgrade the stock to “Underperform.”

Palantir’s inclusion in the Nasdaq-100 may attract institutional investors, but its $150 billion market cap leaves little room for error. With much of its potential already baked into the stock price, the risk of a sharp pullback looms large, especially if the company’s growth fails to live up to its lofty expectations.

A risky bet even for bulls

Palantir continues to remain a polarizing investment. Its government contracts and AI innovations bolster its growth story, yet significant insider selling, valuation concerns, and mounting competition cast a shadow over its future prospects.

For investors, the stock’s remarkable performance must be weighed against the risks of its lofty market cap and limited market scope, making it a high-stakes choice even for the most bullish supporters.

Featured image via Shutterstock