Marvell Technology (NASDAQ: MRVL) stock is currently witnessing a surge in insider trading activity, marked by both buying and selling from the company’s top executives.

Most notably, Matthew J. Murphy, the Chairman and CEO, purchased 13,000 shares of Marvell stock on October 14, 2024, at a price of $77.63 per share, totaling approximately $1.01 million.

This acquisition, disclosed in an SEC filing, brings Murphy’s direct holdings to 221,915 shares.

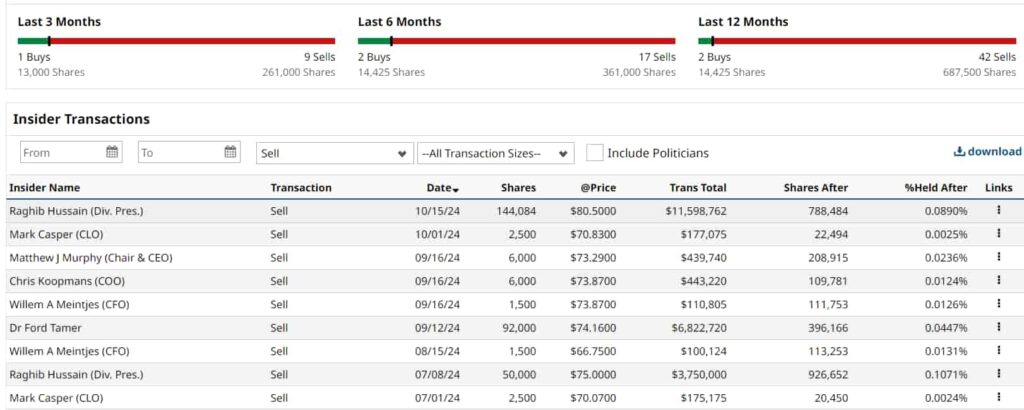

However, while this purchase suggests bullish sentiment, it’s essential to consider the broader context. Over the past three months, there have been nine insider sell transactions, totaling 261,000 shares sold, compared to just one insider buy.

Over the last 12 months, the disparity is even more pronounced, with 42 insider sells amounting to 687,500 shares, against only 2 insider buys totaling 14,425 shares.

Insider selling surge: What does it mean for investors

The recent insider selling activity has caught the attention of investors. Top executives, including Raghib Hussain (Division President), Mark Casper (Chief Legal Officer), and Willem A. Meintjes (Chief Financial Officer), have all sold substantial portions of their holdings.

For instance, on October 15, 2024, Raghib Hussain offloaded 144,084 shares at $80.50 per share, totaling $11.6 million. CFO Willem A. Meintjes also sold 1,500 shares on September 16, 2024, at $73.87 per share.

While insider selling is not uncommon, especially after strong stock performance, it is often viewed with caution by investors.

The discrepancy between buying and selling might raise concerns about whether executives are capitalizing on a peak in stock value, particularly as Marvell’s stock has surged nearly 50% since its August 2024 lows.

As of the close on October 19, MRVL stock is valued at $79.85, marking a 10% gain over the past month.

Recently, Broadcom insiders made significant stock sales totaling over $7 million, and Nvidia has also seen a wave of insider selling in 2024. Nvidia insiders have also sold over $1.8 billion worth of stock, or almost 11 million shares, in 2024, marking the highest level since 2020, as Finbold reported.

JPMorgan’s bullish outlook remains

Despite the significant insider selling activity, JPMorgan maintains an optimistic outlook on Marvell’s future.

Analyst Harlan Sur has reaffirmed his ‘Overweight’ rating on the stock, highlighting Marvell’s strong positioning alongside Broadcom (NASDAQ: AVGO) to benefit from the growing demand for artificial intelligence infrastructure in data centers.

“In custom AI ASICs [application-specific integrated circuits], we continue to see strong customer adoption/design win pipeline expansion from Broadcom and Marvell,” – Harlan Sur

With key customers like Amazon Web Services, the company is deeply integrated into the global tech ecosystem. JPMorgan believes that the recent pullback in the semiconductor sector presents a potential buying opportunity for long-term investors, especially as Marvell continues to gain momentum in AI and data center innovations.

Volatility and opportunities in the semiconductor sector

The semiconductor sector has been volatile in recent weeks, with stocks like Marvell experiencing sharp movements.

The iShares Semiconductor ETF saw a 5% drop following a disappointing outlook from ASML, a major chip equipment maker. However, JPMorgan remains bullish on the sector as a whole, noting that the temporary pullback could offer buying opportunities for long-term investors.

While insider selling can be a signal of caution, the company’s long-term prospects remain solid, particularly as it continues to innovate in high-demand areas of the tech industry.

Investors should weigh insider activity against Marvell’s growth trajectory as they make their decisions.