As one of the most volatile stocks of 2024, Trump Media (NASDAQ: DJT) has experienced wild price swings throughout the year. The budding media business’s stock price hasn’t correlated with fundamentals at all — instead, it largely reflected public perception of Donald Trump, particularly with regard to his now-successful bid for the White House.

That same volatility made DJT a prime choice for short-term traders willing to take on significant risk, many of whom doubtlessly made triple-digit returns from the stock in October.

Now, it seems like the party could finally be over — with DJT share price having dropped from its $51.51 October 29 peak down to $28.93 at press time. In tandem with this significant 43.84% drop, which has slashed year-to-date (YTD) returns down to 65.79%, several key insiders have sold off significant parts of their stakes in the company.

Three insiders sold more than $16 million in DJT stock

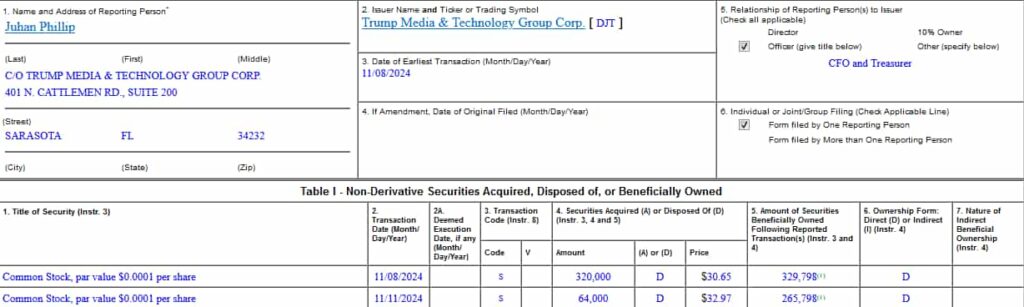

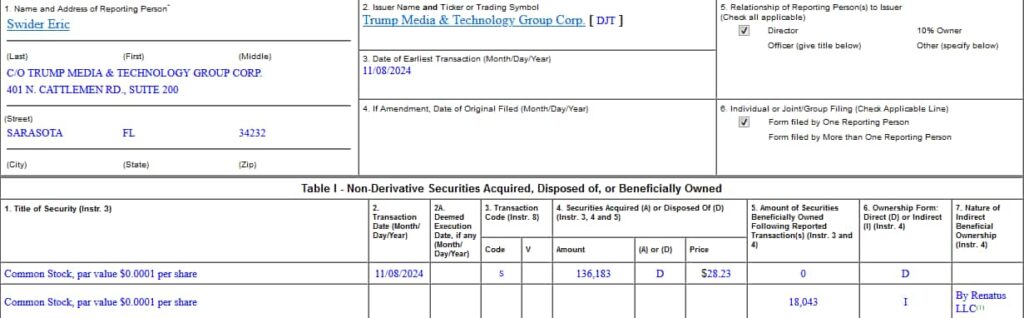

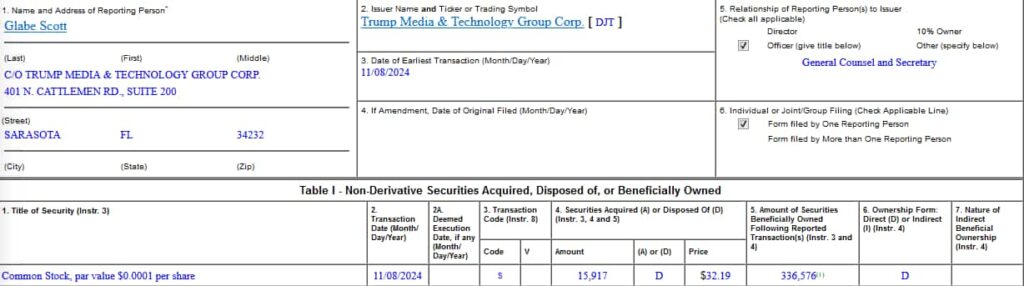

Juhan Phillip, the CFO and Treasurer of the business, as well as director Eric Swider and General Counsel and Secretary Scott Glabe have sold off more than $16 million in DJT shares, as revealed by SEC Form 4 filings made public on November 12.

Phillip’s transactions were the largest in scope — on November 8, he sold 320,000 DJT stocks at a price of $30.65 per unit, followed by a November 11 sale that encompassed an additional 64,000 shares sold at $32.97 apiece. In total, the CFO earned $11,918,080 — however, he still holds 265,798 Trump Media shares.

Eric Swider disposed of 136,183 DJT shares on November 8, at an average price of $28.23 per unit of ownership. The sale netted the director $3,844,446 — although his company, Renatus LLC, still holds 18,043 shares.

Finally, General Counsel Scott Glabe reduced his stake in the media business through the sale of 15,917 Trump Media stocks, at an average price of $32.19. Glabe walked away from the divestment with roughly $512,368 — and currently holds 336,576 shares.

Altogether, the three insiders’ trades are worth roughly $16,274,894. None of the transactions were made pursuant to a pre-scheduled 10b5-1 plan.

Is the Trump Media stock frenzy over?

While these transactions cannot be taken as a bearish signal on their own — as Phillip and Glabe continue to have a significant stake in the business, we’ve most likely seen the end of DJT’s wild price swings — at least until Trump’s inauguration in January.

The interest surrounding the stock was, in essence, betting on election outcomes — there is no fundamental case to be made that can support current DJT stock prices, particularly as traders continue to take profits and increase selling pressure. On November 5, the same day that Trump won the election, the company reported revenue of just $1 million for Q3 2024 — despite having a market cap of $6.28 billion at the time of writing.

Truth Social, the company’s platform, could eventually become an important part of conservative media in the United States — but as it is struggling with advertising and growing its user base, that possibility is still years away at this point.

Featured image via Shutterstock