Congressional stock trading is a contentious issue — with many arguing that the unfair informational edge that sitting lawmakers have presents an inherent ethical problem. Senators and congresspeople tend to secure far greater returns in the stock market than their constituents do.

Of all the politicians on Capitol Hill, Nancy Pelosi is assuredly the most notorious trader. The former Speaker of the House and current representative of California’s 11th congressional district has made millions in the financial markets over the course of her long tenure.

Many have turned to emulating her investments in a bid to replicate her successes. Despite a few notable missteps, on the whole, Pelosi is still firmly in the green — over the course of 2024, her stock portfolio secured a 146.2% return.

Receive Signals on US Congress Members' Stock Trades

Stay up-to-date on the trading activity of US Congress members. The signal triggers based on updates from the House disclosure reports, notifying you of their latest stock transactions.

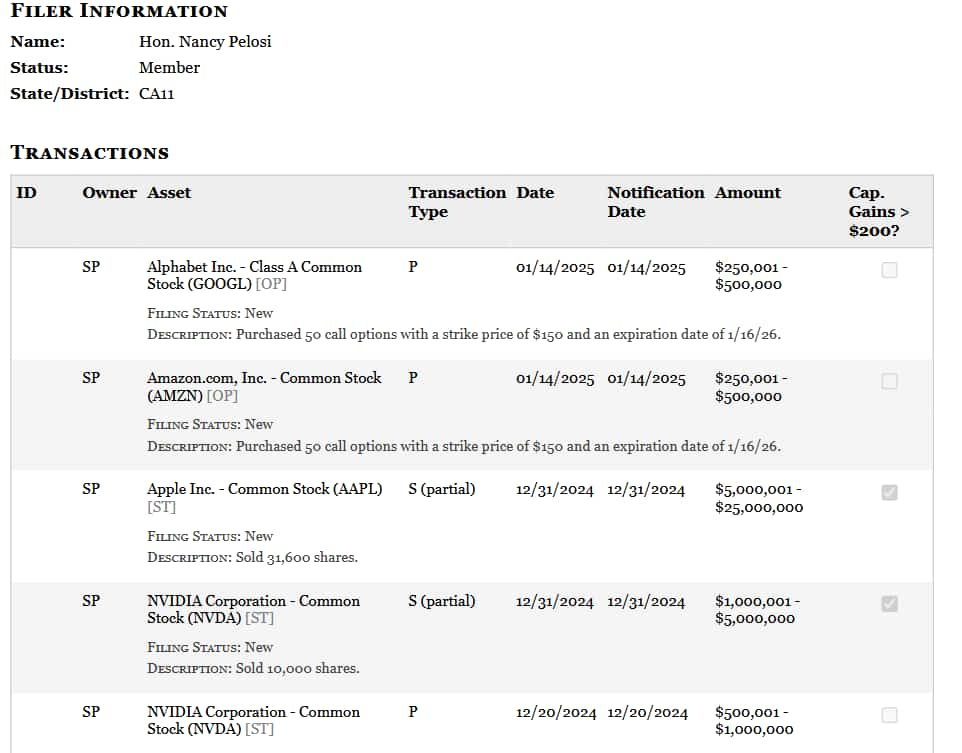

A January 17 periodic transaction report from the Clerk of the House of Representatives retrieved by Finbold’s congressional trading radar revealed that the congresswoman has given her portfolio quite a significant update.

Nancy Pelosi purchased millions of dollars worth of stock options

From December 20 to January 14, Nancy Pelosi made a total of 9 transactions. A majority — 7, to be precise, were purchases — although even her 2 sales were valued in the millions.

On December 31, Pelosi sold 31,600 Apple (NASDAQ: AAPL) shares. At the time, Apple stock was trading at $250.42 — meaning that the sale was worth $7,913,272. On the same day, the representative also sold 10,000 Nvidia (NASDAQ: NVDA) shares for $134.29 apiece — netting her an additional $1,342,900.

Put together, Pelosi made $9,256,172 — roughly 53 times her $174,000 annual salary as a representative. Her timing was impeccable, as it usually is — since the sale, AAPL stock has gone down 5.69%.

Even more interestingly, Pelosi’s purchases did not entail directly buying stocks — instead, the former speaker opted instead to purchase call options. Most of her purchases gravitated toward the tech industry. The congresswoman purchased 50 call options with varying strike prices, depending on the underlying stock in question — but the expiration date on all of her options is the same — January 16, 2026.

Receive Signals on US Senators' Stock Trades

Stay up-to-date on the trading activity of US Senators. The signal triggers based on updates from the Senate disclosure reports, notifying you of their latest stock transactions.

Apart from tech giants she has previously invested in, such as Amazon (NASDAQ: AMZN), Alphabet (NASDAQ: GOOGL), and Palo Alto Networks (NASDAQ: PANW), Pelosi added two companies that she had not previously invested into her portfolio — Vistra Corp (NYSE: VST) and Tempus AI (NASDAQ: TEM).

Featured image via Shutterstock