United States House Representative Nancy Pelosi continues to reap significant gains from her investment in the stock of semiconductor giant NVIDIA Corp. (NASDAQ: NVDA) despite questions regarding potential conflicts of interest.

The success of Pelosi’s investments is underscored by the fact that the lawmaker has generated substantial profits within two months, surpassing her annual salary.

Specifically, the former House Speaker has realized over $700,000 in profit in two months by exercising call options on Nvidia stock, as indicated by data published by Unusual Whales on January 24.

The gains indicate that Pelosi almost tripled her annual salary of $223,500.

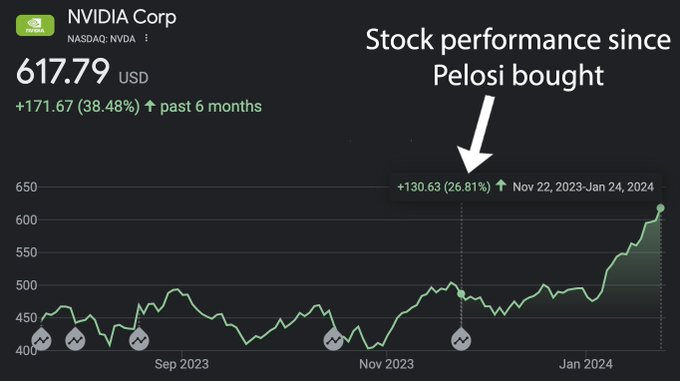

Notably, the profit gains can be traced back to November 22, when Pelosi reportedly purchased $1.8 million of NVDA calls just 20 minutes before the market closed. These options, providing the holder the right to buy NVDA shares at a specific price by a certain date, have since appreciated by approximately 30%, translating to an estimated profit of over $700,000.

It’s important to highlight that, in accordance with filing requirements, amounts are reported in ranges. For Pelosi, the reported range was between $1 million and $5 million, making it impossible to ascertain the original investment amount. Therefore, the calculated return is based on the assumption of the upper limit of the range.

Following the November purchase, Pelosi potentially holds up to $5 million worth of NVDA calls purchased in November, with the possibility of an additional $1.35 million in profits thanks to the stock’s 27% climb since their purchase.

Pelosi’s controversial stock purchases

These significant financial gains from tech sector investments have drawn scrutiny of the possibility of insider knowledge influencing investment decisions.

Notably, the profits coincided with the announcement from the United States government, facilitated by The National Science Foundation (NSF), unveiling plans to collaborate with major companies such as Nvidia, Microsoft Microsoft’s (NASDAQ: MSFT), and OpenAI to initiate the National Artificial Intelligence Research Resource (NAIRR) pilot program.

According to the NSF, the NAIRR pilot is crafted to establish a national resource, providing researchers and educators access to cutting-edge AI technologies. The ultimate aim is to safeguard the United States’ leadership position in AI research and innovation.

While Pelosi is not legally barred from trading stocks, concerns remain about whether her access to sensitive political and economic information gives her an unfair advantage in the market.

Pelosi’s recent financial success is primarily attributed to the significant rise in Nvidia’s stock value, driven partly by the high demand for its chips in artificial intelligence (AI) computing.

In fiscal 2023, Nvidia demonstrated outstanding financial performance, reporting a third-quarter revenue of $18.1 billion and a net income of $9.2 billion. This success follows the company’s strategic emphasis on AI and accelerated computing. Meanwhile, Nvidia is trading at 624.08, having registered year-to-date gains of almost 30%.