With Netflix (NASDAQ: NFLX) recently hitting a record high following its strong Q3 2024 earnings report, an investment firm has projected that the stock is on track to breach the $840 mark by the end of 2024.

This upward momentum is largely driven by the company’s strategic focus on expanding its core movie and TV offerings, alongside efforts in gaming and improving its advertising strategy.

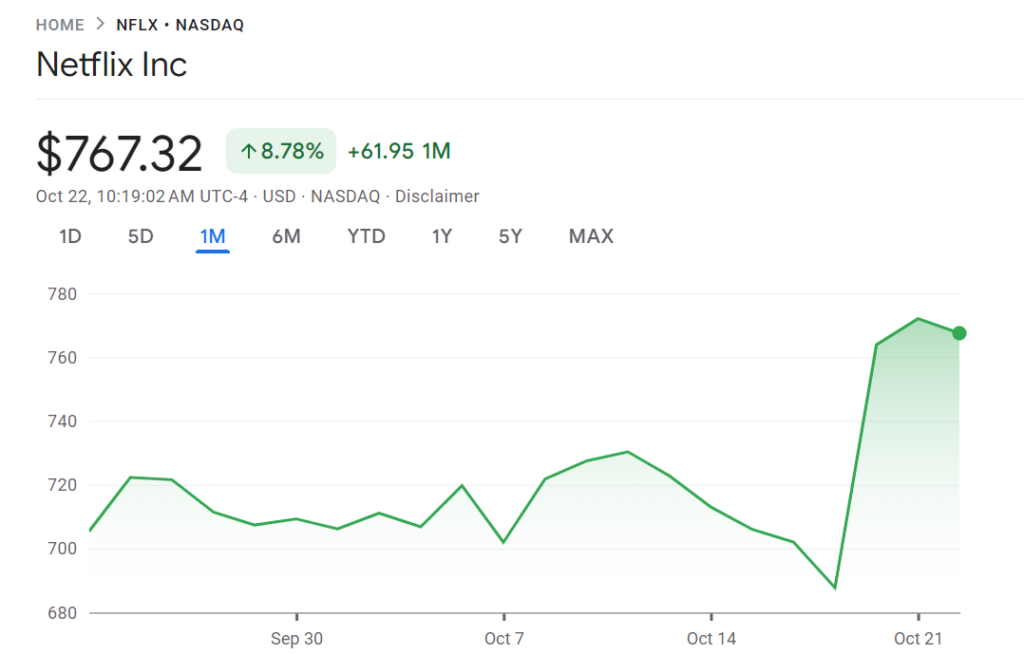

The streaming giant’s stock surged to a record close of just over $772 on October 21, 2024, marking a 34% gain over the past six months and an 8% increase over the past five days. As of press time, the stock is trading at $767.

According to an analysis by the investment firm TradingShot, the recent earnings beat has boosted investor confidence and provided the technical setup for a potential rally toward the $840 mark.

With the stock hitting new highs, the current boost is projected to serve as a foundation for further gains in the coming months.

“The stock has been trading within a Channel Up for a whole year and now has the perfect fundamental excuse to aim higher. “ –TradingShot

Technical setup points to more upside

According to the analysis, the momentum after the earnings marked a technical bounce, with the stock breaking above the 50-day moving average for the first time in two months. The stock has been steadily rising within a Channel Up pattern since October 2023.

The Relative Strength Index (RSI) echoes previous bottoms within this channel, aligning with patterns observed on August 5, 2024, April 22, 2024, January 17, 2024, and October 18, 2023. Each instance saw the stock rebound significantly after testing support levels.

With the confluence of technical factors, including support from the MA50, the continuation of the Channel Up pattern, and a bullish RSI, the analysis suggests a potential 3.0 Fibonacci extension or a +25% rise from current levels. This projects a target of approximately $840, consistent with past price movements within the channel.

Analysts’ take on Netflix stock price

Beyond the technical setup, analysts have also turned increasingly bullish on Netflix’s prospects following its strong Q3 2024 performance. Wedbush, for instance, raised its price target to $800 from $775, emphasizing Netflix’s dominant position in the streaming industry and its diversification into ad-supported content and gaming.

Similarly, Morgan Stanley raised its target to $830, citing Netflix’s ability to sustain double-digit revenue growth and expand margins through initiatives such as paid sharing, advertising, and live content offerings, which are expected to drive further growth into 2025.

However, not all analysts share the same level of optimism. Benchmark analyst Matthew Harrigan, for instance, raised his price target to $555 from $545 but maintained a ‘Sell’ rating.

He expressed concerns that Netflix’s stock might be overvalued in the current market, with future growth heavily reliant on newer revenue streams like ads and gaming.

Despite these cautious views, the broader consensus leans toward continued growth, with most analysts expecting Netflix to reach $840 by year-end.

With Netflix showing strong performance after its impressive Q3 2024 earnings report, the stock appears well-positioned to reach the $840 mark by year-end.

While some analysts remain cautious, the majority agree that Netflix’s strategic initiatives and technical strength point to continued growth, making the target a realistic goal as the company builds on its current upward trend.