New York, USA, July 11th, 2023, Chainwire

Florida Street’s seed round features Hack.vc, Foundation Capital, Dragonfly Capital, Pantera Capital, 6th Man Ventures and others

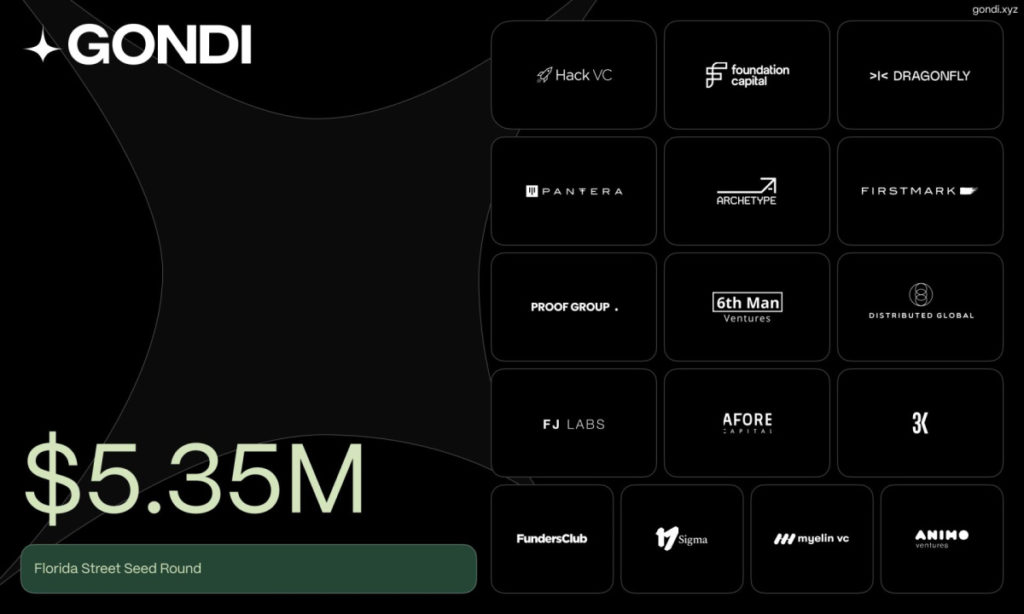

Cutting-edge NFT lending protocol Gondi launched July 11 with support from a $5.35 million seed round by some of the most notable firms in crypto. Lenders and borrowers can now capitalize on the value of blue-chip NFT collections on Ethereum mainnet with unprecedented flexibility and efficiency.

The seed round for Gondi developer Florida Street was co-led by Alex Pack at Hack.vc and Rodolfo Gonzalez at Foundation Capital, with participation from Dragonfly Capital, Pantera Capital, and 6th Man Ventures, along with prominent individuals like Joyce Yang from Global Coin Research, Ken Nguyen from Republic, Matthew Ball, Daniel Vogel, co-founder at Bitso, Nader from DeSo Foundation, Jack Herrick from wikiHow, and Jake Zeller, partner at AngelList.

“We are thrilled to have co-led Florida Street’s seed round, and we are excited about the solutions they are bringing to Web3 users. Gondi’s instant refinancing will enhance the NFT lending market, allowing borrowers to access more affordable credit and fostering a growing market,” said Alex Pack, Managing Partner at Hack.vc.

The NFT lending market has surged to record-breaking highs, with new entrants such as Blend, BendDAO, and NFTfi vying for market share. While these platforms have brought innovation and increased adoption, Gondi stands out as the most distinctive player in the ecosystem, with features including instant and partial refinancing.

A non-custodial and peer-to-peer (P2P) platform, Gondi enables more affordable lending for borrowers and greater flexibility for lenders. This unique approach ensures that Gondi remains a significant and pioneering force amid the rapidly evolving NFT lending landscape.

“We are thrilled to announce the launch of Gondi, an NFT lending platform that enables a better credit market through a global, decentralized, and permissionless ecosystem for underwriting and refinancing,” said Florida Street co-founder 0xburga.

Borrowers can use their NFT assets as collateral to request a loan from the open market. Once a loan has been initiated, prospective lenders can instantly refinance the loan in a permissionless fashion, as long as they provide better economic terms for the borrower.

P2P protocols are ideal for the NFT sector, as the underwriting of NFTs requires domain knowledge. At Gondi, borrowers only pay interest based on the outstanding loan duration. Moreover, borrowers benefit from instant refinancing, ensuring they always get the best loan terms available, even after having initiated the loan.

Blue-chip NFT collections that have partnered with or been whitelisted on Gondi at launch include CryptoPunks, AutoGlyphs, Bored Ape Yacht Club, Chromie Squiggle, Fidenza, Ringers, Anticyclone, Gazers, Archetype, Meridian, Memories of Qilin, Doodles, and Azuki, with plans to whitelist more collections in the weeks ahead.

The Gondi protocol has been audited by top Web3 security firms Trail of Bits and CertiK.

How is Gondi different?

How does Gondi’s instant refinancing mechanism work? At any moment while a loan is outstanding, a prospective lender can execute a refinancing to the loan and become the new lender of record. To do so, they need to repay the original lender the lent principal and accrued interest. They can only refinance if the loan terms are better for the borrower. Loan terms include principal, duration, and APR. No variable of the loan can be worse, and at least one of the principal or APR must be improved for the borrower by at least 1%, or the duration by at least 10%.

Lenders also greatly benefit from Gondi’s instant refinancing mechanism by being able to underwrite any asset in the market (new or existing loans). This provides them with far better lending dynamics and the ability to lend on their terms whenever they want. Consequently, less time is wasted, and there is no need to constantly refresh to see which new listings have appeared. Lenders can now earn more interest by accessing a larger base of NFT collateral more quickly than ever before.

The magic of Gondi extends far beyond its amazing instant refinancing mechanics. Lending to high-value NFTs like CryptoPunks or Autoglyphs is prohibitively expensive for most users, excluding them from more stable collateral. Gondi is making NFT lending more composable and accessible for retail by introducing tranche (partial) refinancing, so any lender has the capacity to participate with any asset class.

Additionally, Gondi allows borrowers to renegotiate with their current lender and consider new terms from potential lenders. This new feature alleviates complications that arose when only the borrower and lender had renegotiation power.

NFT loan term negotiations have now gone from 1-to-1 to 1-to-ALL.

About Gondi

Gondi is a decentralized NFT lending protocol engineered to create the most capital-efficient, transparent, and open credit market for NFTs. The peer-to-peer protocol on Ethereum enables continuous underwriting, refinancing, and renegotiation of loans, creating a more efficient and composable market. The key contributor to Gondi is Florida Street, a software company building Web3 products and protocols. Imagine if lenders could instantly refinance any given existing loan. What if borrowers could get more favorable terms on an outstanding loan without any action? All of that, and much more, is possible with Gondi. White-listed collections include CryptoPunks, AutoGlyphs, Bored Ape Yacht Club, Chromie Squiggle, Fidenza, Ringers, Anticyclone, Gazers, Memories of Qilin, Doodles, Azuki and more.

For more information: Official Website | Florida Street | Twitter | Discord | Docs

Contact

PR Director

Patrick Brendel

Scrib3

[email protected]