The cryptocurrency market is reaping the rewards of a long-awaited bull run — one that kicked off in early November following the re-election of Donald Trump to the presidency.

While it wasn’t completely smooth sailing, with the leading digital asset hitting several speed bumps on its way to $100,000, Bitcoin (BTC) has now surpassed that mark, and was trading at approximately $104,807 by press time on December 16.

Over the last week, BTC has seen prices rise by 6.52% — bolstering monthly returns to 14.78% and year-to-date (YTD) gains up to 146.81%.

There are a lot of favorable tailwinds at play as we draw closer to the end of the year. A favorable regulatory environment is expected going forward, and the creation of a strategic Bitcoin reserve would go a long way in cementing the cryptocurrency’s role as an authentic store of value.

Investor activity is also showing signs of a strong, robust uptrend — with volume having experienced a sustained rise since the beginning of November.

While the actions of retail investors should never be underestimated, it’s the undertakings of large market participants — hedge funds, institutional investors, and banks, that have a much more pronounced effect on price action. This point is increasingly relevant as Bitcoin continues to see accelerated institutional adoption and mainstream appeal.

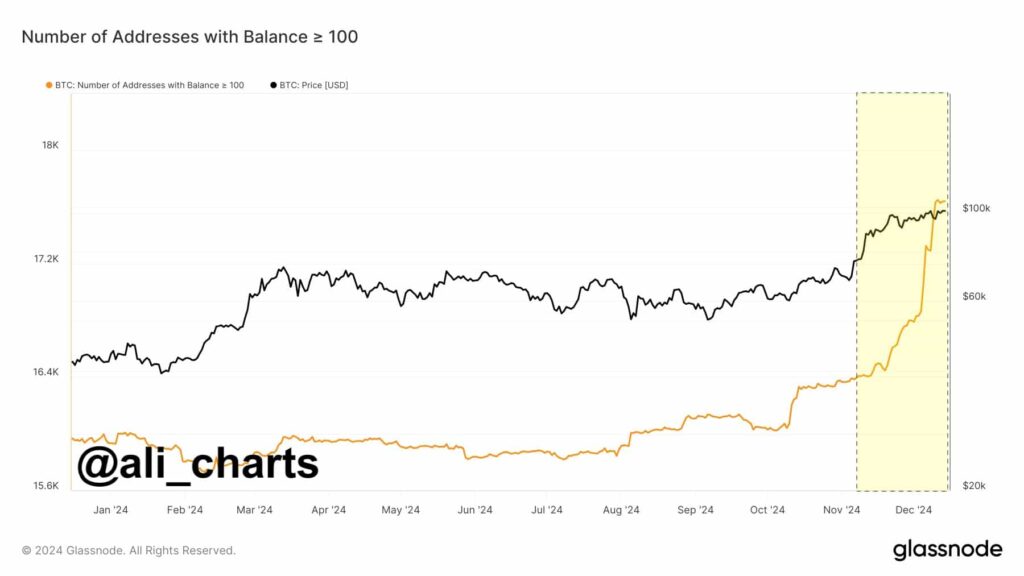

Now, one cryptocurrency analyst has pointed out that the number of whales — accounts in this case holding more than 100 BTC, has skyrocketed since early November.

Thousands of BTC whales have entered the market

It cannot conclusively be stated that these were investments made by institutions — however, seeing as how Bitcoin prices have ranged from approximately $67,000 at the beginning of the rally to $104,807 at press time, buying 100 BTC would have required between $6,700,000 and $10,480,700.

And transactions of this caliber have indeed skyrocketed — the number of addresses holding more than 100 BTC has increased from roughly 16,400 at the beginning of the rally to approximately 17,600, as explained by cryptocurrency expert and on-chain analyst Ali Martinez in a December 15 X post.

Beyond the scale of these addresses, how numerous they’ve become is also notable — suggesting that this is, after all, an influx of either institutional investors or high-net-worth individuals entering the market

Readers should note, that while there is no set definition of a ‘whale’ in the cryptocurrency market, the term is generally used to refer to addresses holding more than 1,000 BTC — whereas Martinez used a significantly lower cutoff point of 100 BTC.

However, the influx still constitutes a strong bullish signal — as analysts are eyeing price targets as high as $150,000 or $250,000 for 2025, this degree of optimism only serves to bolster the case that BTC is set for another year of stellar gains.

Featured image via Shutterstock