Amid the lackluster performance of Nvidia (NASDAQ: NVDA) stock, Jensen Huang, the CEO of the artificial intelligence (AI) chipmaking titan, has continued to dump his company’s shares in the amount that has, with his most recent sale, surpassed $633 million since June this year.

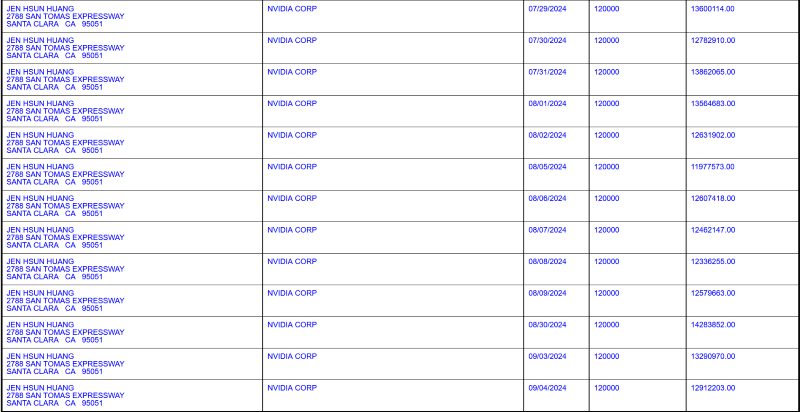

Indeed, the Nvidia CEO has sold over 5 million NVDA stocks in recent months in a series of trades, split into 120,000 shares in each tranche between June 13 and September 4, according to a filing with the United States Securities and Exchange Commission (SEC) from September 5.

Specifically, this brings the total to 5.16 million Nvidia stocks, worth about $633.1 million, sold by Huang over the previous three months, starting on June 13, 2024, with the final sale taking place on September 4, 2024, and filed on September 5.

As it happens, Huang’s most recent Nvidia stock trades were part of a Rule 10b5-1 trading plan set up earlier this year – on March 14 – according to which the technology company’s largest individual shareholder plans to sell up to 6 million shares by March 31, 2025.

Nvidia’s troubles

Although the Nvidia stock sales seem to be a part of a pre-planned and informed sell-off, other investors seem to be fearful, particularly as the company has been facing some problems and its stock price might have reached its natural top for now.

As a reminder, Nvidia has reportedly received a subpoena from the United States Department of Justice (DoJ) as part of the investigation into its alleged antitrust practices, leading to a drop in stock price that started a domino effect on the stocks of other technology companies.

On the other hand, Nvidia has denied that it had received the subpoena, leading to a slight recovery in the price of its shares, as the company’s spokesperson explained that:

“We have inquired with the US Department of Justice and have not been subpoenaed. (…) Nonetheless, we are happy to answer any questions regulators may have about our business.”

Meanwhile, the stock market has seen the shares of Tesla (NASDAQ: TSLA) gather strength amid widespread bearishness, raising speculation that electric vehicle (EV) stocks might replace semiconductor companies as the dominant force in the stock market.

Nvidia price analysis

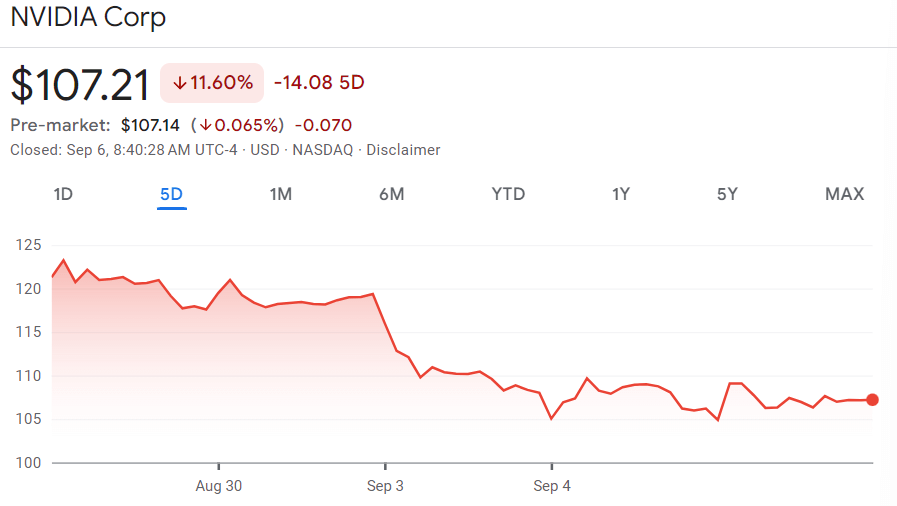

At press time, the price of Nvidia stocks stood at $107.21, down 11.60% across the week, up 2.84% over the month, and advancing 122.57% year-to-date (YTD), as well as gaining 0.26% in pre-market, according to the most recent data retrieved on September 6.

That said, Nvidia’s next-generation Blackwell products are arriving this year, expecting to rake in at least $3 billion in revenue in the fiscal fourth quarter ending January 2025, which, in addition to positive results for the previous quarter and strong forecasts for the October quarter, should give bullish winds to NVDA stock.

Buy stocks now with eToro – trusted and advanced investment platform

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.