Despite a massively positive momentum it experienced this year, which has culminated with a new all-time high (ATH) price of $135.58 in June, Nvidia (NASDAQ: NVDA) has been behaving unusually in recent days, with significant price swings reminiscent of a penny stock.

Specifically, since its after-hours low on July 30, Nvidia has added $380 billion in its market capitalization in just 18 hours, shortly after erasing $1 trillion over the past five weeks, as per the observations by global capital markets commentary platform The Kobeissi Letter in an X post on July 31.

Indeed, as the chart posted by The Kobeissi Letter demonstrates, Nvidia has added as much as the entire value of Costco (NASDAQ: COST) to its market cap in mere 18 hours, and the platform’s team has also noted that “big tech stocks are throwing around trillions of Dollars of market cap in a matter of hours.”

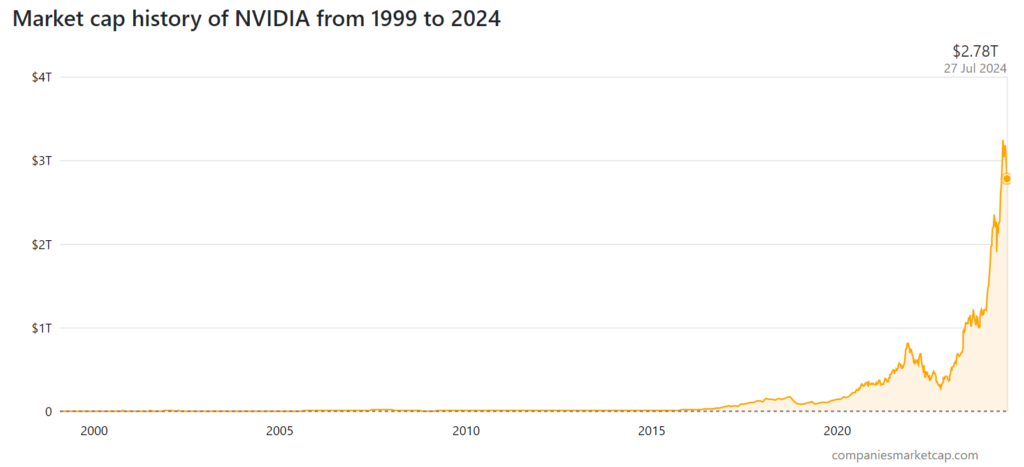

As a reminder, despite its stellar rise this year thanks to the artificial intelligence (AI) craze, the semiconductor behemoth has wiped $1 trillion from its market cap since its peak above $3.3 trillion it recorded in the second half of June to the press time levels, as Finbold reported on July 31.

Nvidia stock market cap analysis

At press time, the market cap of Nvidia stood at $2.878 trillion, making it the world’s third most valuable company by this indicator, according to the data by CompaniesMarketCap, the platform tracking the value of the largest companies and top assets worldwide, retrieved on August 1.

Meanwhile, the most recent changes in Nvidia’s market cap arrive as the company’s CEO Jensen Huang has announced a score of services and tools to help the world’s leading robot manufacturers, AI model creators, and software makers develop, train, and build the next generation of humanoid robots.

Nvidia stock price history

In terms of the price of Nvidia stock, it currently amounts to $119.70, which indicates a 5.42% gain on the day, an accumulated advance of 4.37% across the week, compared to the 3.77% decline in the past month, as it holds onto the 145.08% advance since the year’s start.

So, why is Nvidia stock so high today? Notably, one answer as to why is Nvidia stock going up could be the reaction to the company’s top customer, Microsoft (NASDAQ: MSFT), and rival Advanced Micro Devices (NASDAQ: AMD) quelling fears over a slowdown in the multibillion-dollar buildout of AI servers.

As it happens, Microsoft CEO Satya Nadella and finance chief Amy Hood recently revealed plans to spend even more on Nvidia-based infrastructure in 2025, as well as suggesting that the company was seeing a return on investment from its expensive GPU-based servers.

At the same time, Lisa Su, the CEO of Nvidia’s rival in the chipmaking business, AMD, has reported better-than-expected sales and earnings, telling the company’s investors that demand for its GPU remains strong despite rising anxiety over building too much infrastructure in too short a time.

Combination of factors fuelling penny stock-like activity

Indeed, the volatility could be the result of a combination of different factors, including investor enthusiasm around its dominance in AI and cloud computing, some investors viewing its trading at high multiples as overvalued, and Huang’s recent selling activity – all of which are pulling Nvidia stock in different directions.

Ultimately, time will tell if the volatility in the price of Nvidia stock and market cap continues, particularly as many analysts still see long-term potential in the technology giant’s capabilities and market position, maintaining a ‘Strong Buy’ consensus. Regardless, doing one’s own research is critical when investing large sums of money.

Buy stocks now with eToro – trusted and advanced investment platform

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.