In recent months, leading technology companies have dominated the stock market, primarily due to their ventures into the artificial intelligence (AI) sector.

As we move into the second half of 2024, investors are closely monitoring semiconductor giants Nvidia (NASDAQ: NVDA) and Qualcomm (NASDAQ: QCOM) to identify which stock offers the more promising opportunity.

Both Nvidia and Qualcomm are well-positioned within the tech landscape, yet their distinct market focuses and valuation metrics suggest divergent prospects for the coming months.

Nvidia’s reliance on TSMC’s (NYSE: TSM) facilities in Taiwan adds a layer of uncertainty, particularly amid rising geopolitical tensions following comments from Donald Trump regarding Taiwan and U.S. defense commitments.

Meanwhile, Qualcomm continues to grapple with a weakened smartphone market, which has impacted its growth over the past three years.

Given the current market conditions, investors are evaluating whether Nvidia or Qualcomm offers a better opportunity for the second half of 2024. To address this question, Finbold consulted ChatGPT-4o for insights on which stock is poised to be the best performer.

Nvidia stock

Nvidia has been a standout performer in the technology sector, particularly due to its dominance in the AI and GPU markets.

However, Nvidia’s stock has faced significant pressure recently, correcting nearly 26% from its 52-week high and declining by about 20% in just one month. This decline has been driven by macroeconomic uncertainty, a broader selloff in tech stocks, and concerns about the company’s high valuation.

Compounding these issues, reports have suggested potential delays in the launch of Nvidia’s next-generation Blackwell platform due to design flaws.

While these delays could impact future performance, Nvidia’s second quarter (Q2) fiscal 2025 earnings, scheduled for release on August 28, 2024, are still expected to show strong growth driven by AI-led demand.

Nvidia’s Data Center revenue has been a significant driver of its financial performance. In first quarter (Q1) fiscal 2025, Nvidia reported Data Center revenue of $22.6 billion, a year-over-year increase of 427%.

The company has projected total revenue of approximately $28 billion for Q2, indicating a 107% year-over-year improvement. Analysts expect Nvidia’s earnings per share (EPS) to more than double in Q2, reflecting strong demand for AI-driven applications.

However, Nvidia’s high valuation remains a concern. The stock trades at a trailing PE ratio of 61.18 and a forward PE ratio of 35.45. Despite the recent correction, Nvidia’s market cap still stands at a staggering $2.57 trillion.

The PEG ratio of 1.19 indicates that the stock is expensive relative to its growth potential, and investors should be cautious about entering at current levels, especially with potential delays in the Blackwell platform on the horizon.

Qualcomm stock

Qualcomm, traditionally focused on the smartphone chip market, is repositioning itself as a key player in the emerging AI-enabled smartphone segment.

The company’s recent Q3 fiscal 2024 results suggest a turnaround, with revenue increasing by 11% year-over-year to $9.4 billion and adjusted EPS rising by 25% to $2.33 per share. Qualcomm’s optimistic guidance for the current quarter, with expected revenue growth of 14% year-over-year, further bolsters its outlook.

Qualcomm is poised to benefit from the expansion of the AI-enabled smartphone market, expected to grow significantly in the coming years. This strategic positioning could drive substantial growth in its top and bottom lines, making Qualcomm an attractive investment for those seeking both stability and growth.

From a valuation perspective, Qualcomm’s valuation is more conservative than that of Nvidia. The stock trades at a trailing PE ratio of 21.03 and a forward PE ratio of 15.25, making it significantly cheaper than Nvidia.

With a market cap of $183.23 billion and an enterprise value of $184.75 billion, Qualcomm reflects a strong financial position with minimal debt concerns. The PEG ratio of 1.17 suggests that the stock is reasonably priced relative to its growth potential.

ChatGPT’s verdict on the best stock

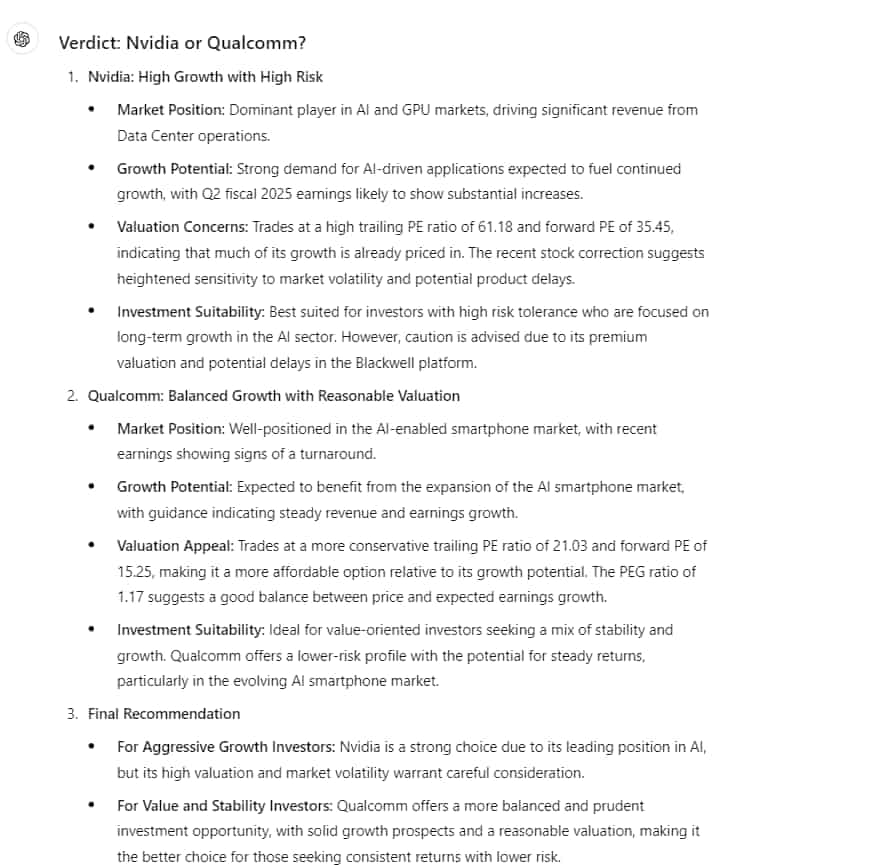

In conclusion, ChatGPT-4o highlighted that both Nvidia and Qualcomm present solid investment opportunities with strong growth potential, particularly within the AI sector.

Nvidia offers significant growth potential in the booming AI market but comes with high risk due to its premium valuation and recent stock price correction, making it suitable for investors with a high-risk tolerance.

On the other hand, Qualcomm, with its balanced growth and reasonable valuation, is better suited for value-oriented investors seeking stability with growth potential in the AI-enabled smartphone market.

Nvidia is ideal for aggressive growth seekers, while Qualcomm is the more suitable choice for those prioritizing a balanced approach.

Investors should weigh their risk tolerance and investment objectives when deciding between these two tech giants.

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.