As American semiconductor giant Nvidia (NASDAQ: NVDA) gears up for its November 19 Q3 earnings release, the stock is displaying extraordinary strength, likely propelling it toward its $250 record high.

In this regard, analysis by charting platform TrendSpider in an X post on November 9 indicated that the stock is showing the “biggest green flag” for bullish investors. Notably, the stock ended the last week in the red amid a broader market sell-off, dropping nearly 10% to close at $188.

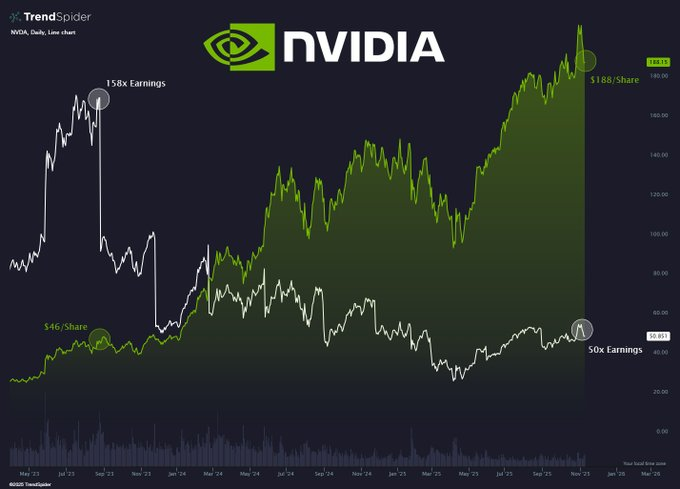

The chipmaker’s stock has surged from roughly $46 per share in 2023 to around $188, even as its valuation multiple compressed from 158x to 50x earnings, a rare and powerful combination in equity markets.

This pattern, where a company’s price climbs steeply while its valuation multiple contracts, is often seen as a hallmark of a sustainable bull market.

It suggests that Nvidia’s earnings growth is outpacing its stock price appreciation, meaning the rally is driven by fundamental performance rather than speculative excess.

Nvidia’s Q3 earnings outlook

Indeed, this outlook comes at a crucial time, as there is growing debate about the future of the artificial intelligence space, which Nvidia dominates, amid fears of a potential bubble.

The upcoming earnings will be critical in determining whether NVDA can break through the $200 mark and possibly reach its $250 record high.

For the quarter, Nvidia expects $54 billion in revenue, a 54% year-over-year increase, with gross margins projected at 73.3% (GAAP) and 73.5% (non-GAAP).

Operating expenses are forecasted at $5.9 billion (GAAP) and $4.2 billion (non-GAAP). Analysts are predicting adjusted EPS of $1.25, up from $0.81 last year, and a 56% jump in revenue to $54.77 billion.

Despite the bullish outlook, a section of the market remains cautious about Nvidia stock.

Notably, Michael Burry, the contrarian investor who predicted the 2008 financial crisis, has warned of a potential bubble. He has placed bearish put options on 1 million Nvidia shares and 5 million Palantir shares, with notional values of $187 million and $912 million, respectively.

Featured image via Shutterstock