Amid widespread market volatility and concerns over the future of artificial intelligence (AI) shares, American hedge fund Elliott Management has issued a warning to investors that Nvidia (NASDAQ: NVDA) stock is in “bubble land” and relying on “overhyped” AI technology.

Specifically, the Florida-based hedge fund manager, which handles around $70 billion in assets, has told its clients in a recent letter that the megacap tech stocks, particularly Nvidia, were in “bubble land,” according to a Financial Times report published on August 2.

Future of GPU purchases

Indeed, as per the letter, Elliott’s team shared with its clients skepticism regarding Big Tech companies continuing to buy Nvidia’s GPUs in as large volumes as before, as well as arguing that AI is “overhyped,” with many applications “not ready for prime time.”

Furthermore, they said many of AI’s uses are “never going to be cost-efficient, are never going to actually work right, will take up too much energy, or will prove to be untrustworthy,” adding that “there are few real uses,” other than summarizing meeting notes, “generating reports, and helping with computer coding.”

On top of that, the hedge fund manager argues AI is, practically, software that has failed to deliver “value commensurate with the hype,” adding it has generally avoided bubble stocks like the Magnificent Seven, although regulatory filings show a tiny, $4.5 million position in Nvidia at the end of March.

At the same time, Elliott communicated to the clients its wariness around betting against high-end major tech stocks, saying that shorting them could be “suicidal” but also projecting that the Nvidia bubble might burst if the semiconductor behemoth reports poor numbers and “breaks the spell.”

Wall Street’s Nvidia stock price prediction 2025

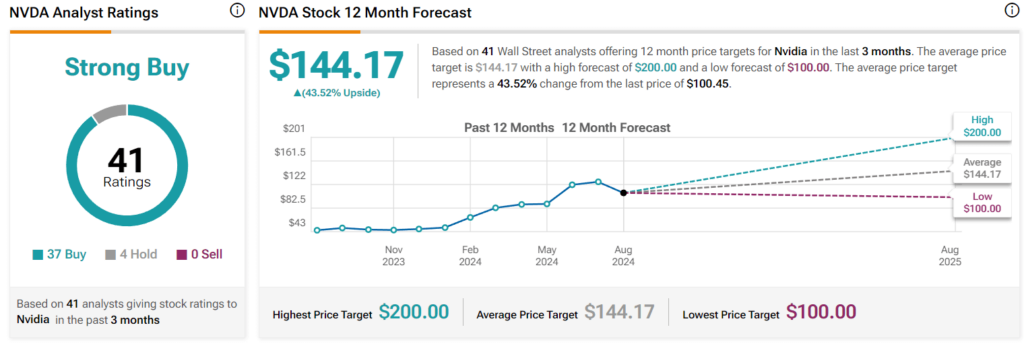

Elsewhere, Wall Street analysts remain bullish on the price of Nvidia stock in the future, retaining their consensus on the ‘strong buy’ score, with an average Nvidia stock price prediction 2025 looking at a $144.17 average, or 42.74% higher than its current price, as per TipRanks data.

As it happens, the experts’ lowest price target for NVDA shares in the next 12 months stands at $100, which would indicate a decline of 1.58% if correct, but the highest target currently resides at the $200 level, suggesting that it might improve by 98.02% from its present situation.

Nvidia stock price history

Meanwhile, the price of Nvidia stocks at press time stood at $101.60, recording an increase of 7.05% on the day, declining 11.21% across the previous week, as well as accumulating a loss of 20.60% on its monthly chart, while maintaining a 111.31% gain year-to-date (YTD), as per the latest data retrieved on August 6.

Ultimately, the major hedge fund manager might be correct in its analysis that Nvidia stock does not have much more room left for expansion and that its ‘bubble’ might burst. However, Wall Street analysts might disagree with these observations, as they maintain the ‘strong buy’ rating.

Buy stocks now with eToro – trusted and advanced investment platform

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.