As UBS raised its price target on Nvidia (NASDAQ: NVDA) stock to $1,100, and Beth Kindig, a lead technology analyst at the I/O Fund, shared her prognosis of Nvidia stocks hitting a minimum $10 trillion market capitalization by 2030, investors are curious what price NVDA could reach by that time.

Indeed, Kindig, believes Nvidia will achieve her target mostly due to its artificial intelligence (AI) software and winning the future AI boom and bust, alongside Alphabet (NASDAQ: GOOGL), Meta (NASDAQ: META), and Microsoft (NASDAQ: MSFT), according to a report published on March 21.

Furthermore, the CEO of I/O Fund, which helps individuals gain an edge in investing in tech growth stocks, explained that Nvidia’s valuation was at the moment hovering around October 2022 low – “eerily low,”, adding that NVDA is a “buy on dips,” as opposed to Microsoft’s “Mount Everest valuations.”

“We’re waiting for a breather and we’ll probably continue to layer into Nvidia at that time.”

Raising Nvidia price prediction targets

Elsewhere, analysts at Swiss investment giant UBS believe that Nvidia is on the brink of an “entirely new wave of demand,” raising their NVDA price prediction target from $800 to $1,100 after Nvidia announced the launch of its new Blackwell GPU platform during its annual GTC developer conference.

Specifically, according to UBS analyst Timothy Arcuri:

“Following the Blackwell launch (…) we believe Nvidia sits on the cusp of an entirely new wave of demand from global enterprises and sovereigns – with each sovereign potentially as big as a large U.S. cloud customer.”

NVDA stock price analysis

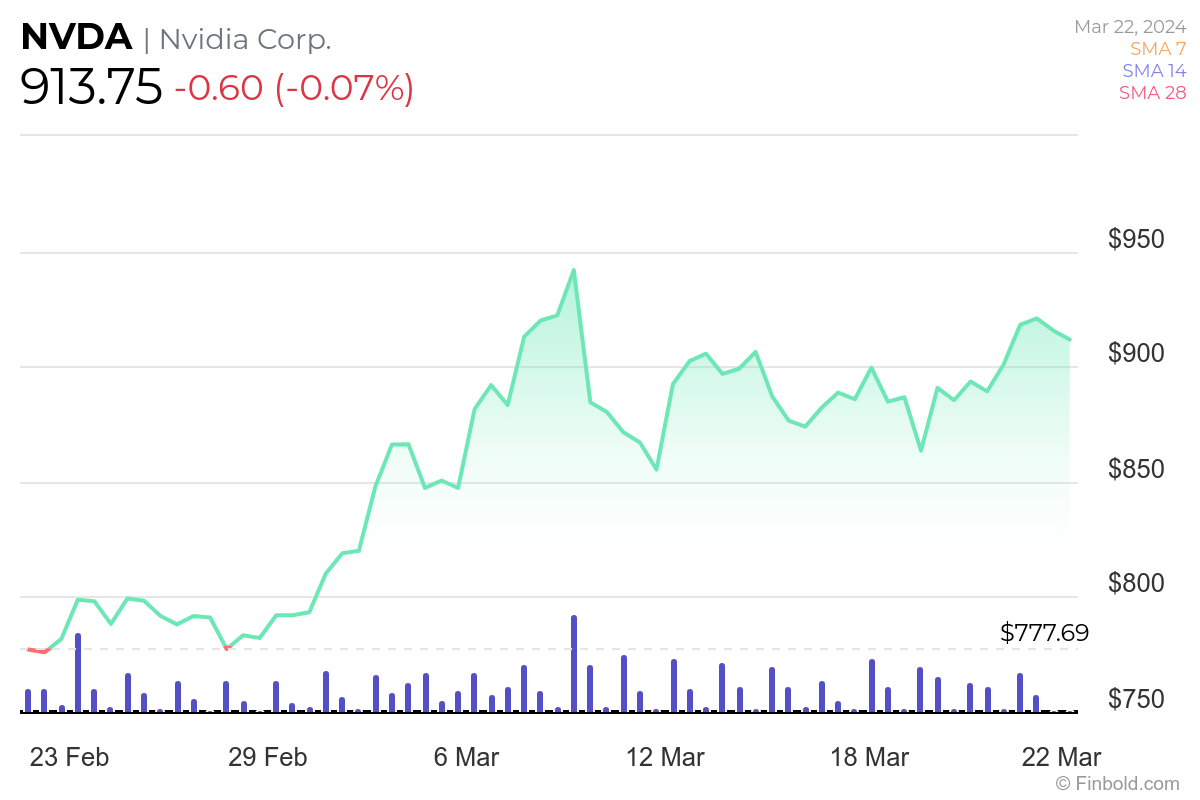

Meanwhile, Nvidia stock was at press time changing hands at the price of $913.75, recording a slight decline of 0.07% on the day but nonetheless advancing 1.81% across the past week, and growing 17.04% on its monthly chart, according to the latest chart data on March 22.

It is also worth noting that Nvidia is outperforming 98% of all other assets in the stock market in terms of its yearly performance, as well as doing better than 100% of the 106 other stocks in the semiconductor industry, trading near its 52-week high and close to the upper end of its monthly trading range.

Nvidia stock price prediction 2030

Taking into account Nvidia stock’s current price of $913.75 and its market cap that for now stands at $2.29 trillion, NVDA could reach the price of approximately $3,987.31 by 2030, if its market value increases to $10 trillion, according to the calculations made on March 22.

Although the NVDA stock price prediction 2030 estimate relies on the assumption that the number of outstanding Nvidia shares would remain constant, which may not be true in reality due to factors like stock issuance or buybacks, it still provides a good idea of what experts envision for its future.

However, the situation on the ground could easily change on a whim, which is why it is important to do one’s due diligence and carry out in-depth research, as well as weigh all the potential risks, before investing a significant amount of money in any asset.

Buy stocks now with eToro – trusted and advanced investment platform

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.