Nvidia (NASDAQ: NVDA) is trading at $134.84, up slightly by +0.030 (0.022%) as of the latest data from Finbold.

But behind the stock’s modest gains, the short interest is telling a more dramatic story, revealing a surge in bearish bets and fluctuating sentiment over the past several months.

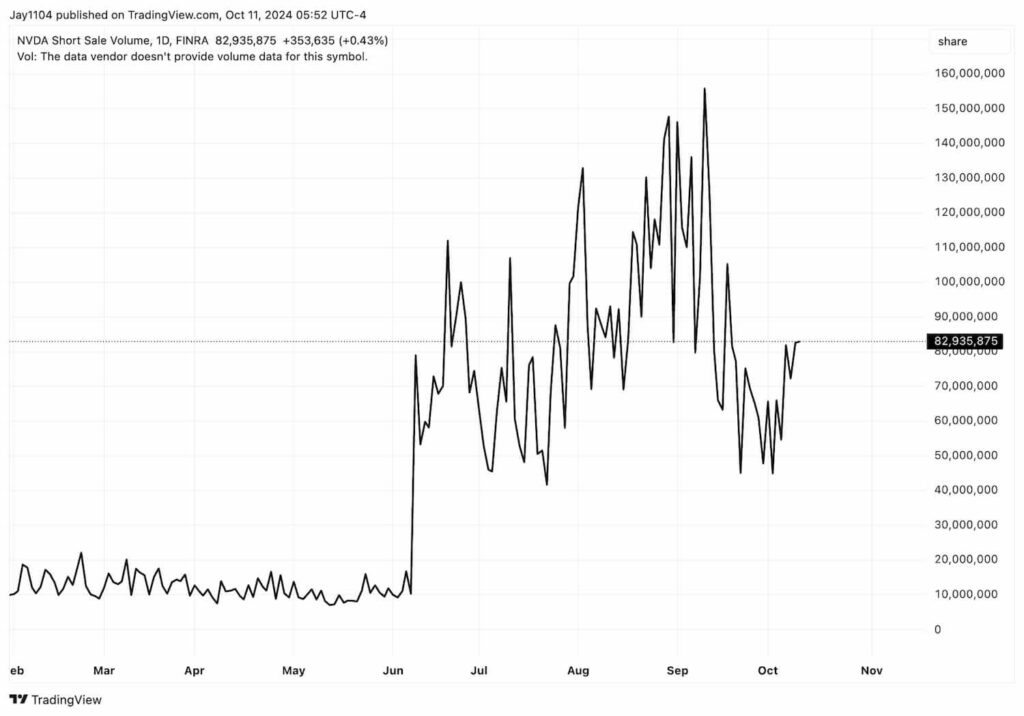

The latest data shows Nvidia’s short sale volume hovering around 83 million shares, marking a significant decline from the peaks seen over the summer but still indicating heightened investor caution.

Picks for you

While this recent uptick of +0.43% suggests a renewed, if cautious, interest in short selling, the big picture shows a roller-coaster ride for traders betting against the chip giant.

The story behind Nvidia’s numbers

From February through early June, short sale volume for Nvidia was relatively stable, averaging below 40 million shares. But that all changed in June, coinciding with the company’s 10-for-1 stock split on June 10, 2024, which ignited a surge in trading activity.

Short interest spiked above 140 million shares during the period, as traders responded to the split with a mix of speculative bets and repositioning.

Throughout the summer, short sale volume remained elevated, oscillating between 80 million and 150 million shares, reflecting uncertainty about Nvidia’s valuation. While some investors anticipated a price correction, others adjusted their positions based on the stock’s post-split behavior.

As the dust settled in October, short sale activity moderated to around 83 million shares, signaling a decline in bearish sentiment compared to the highs of the summer, though still elevated enough to suggest a wary market outlook.

Is Nvidia a bet or a business?

Michael Kramer, founder of Mott Capital Management, has likened Nvidia’s trading behavior to that of a “casino,” noting the heavy focus on short-term options like weekly calls.

“The stock appears to be a gambler’s haven,” Kramer said, as short-dated options dominate trading and investors place high-stakes bets on near-term movements rather than long-term fundamentals.

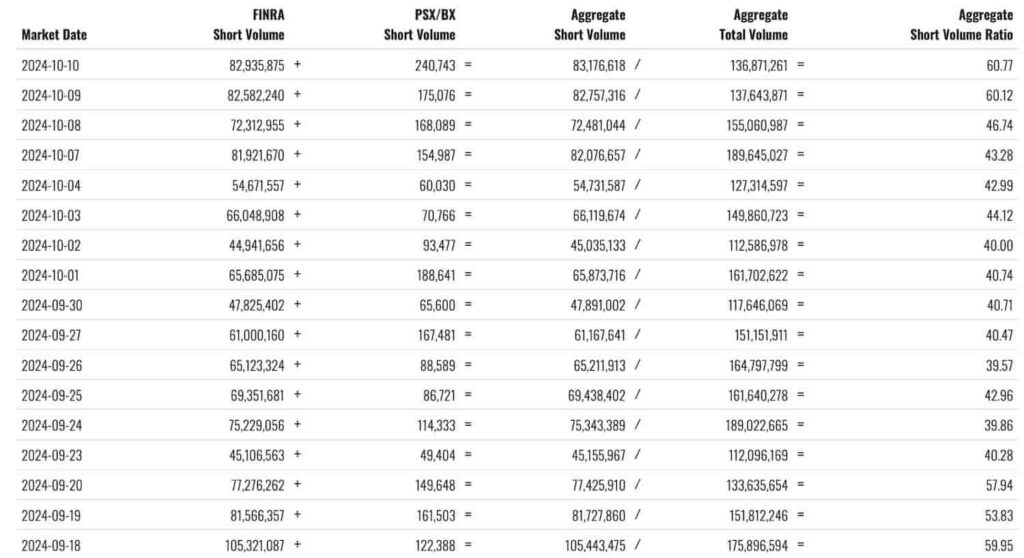

The latest spike in short sale volume to 82.9 million shares on October 10—nearly a third of all shares traded that day—reinforces his concerns.

Is there a broader trend of speculative trading? Well, short interest has climbed sharply on certain days, such as September 19, when it hit 105 million shares. The resurgence in short-selling could signal a looming pullback, or simply reflect traders hedging against Nvidia’s recent run-up. Either way, it’s clear that some investors are betting big on volatility rather than growth.

Analysts weigh in on Nvidia and AMD latest outlook

Adding fuel to the speculative fire is the competition heating up in the AI chip space.

Bernstein analyst Stacy Rasgon weighed in following AMD’s (NASDAQ: AMD) recent Advancing AI event, where the company showcased its MI325X accelerator.

While AMD touted performance benefits over Nvidia’s older H200 GPU, Wall Street is abuzz about Nvidia’s upcoming Blackwell chip, which promises to deliver a significant leap in capabilities.

Rasgon didn’t mince words, noting that the MI325X offers “zero challenge to Blackwell,” which is expected to ship for revenue sooner and perform better. Though AMD is projecting $4.5 billion in AI accelerator revenue for 2024, Rasgon remains skeptical about substantial upside beyond current expectations, stating, “We’d rather own [Nvidia] at this point in front of Blackwell.”

Meanwhile, AMD stock crashed as low as $162 from above $171 after the event, before recovering marginally.

Technical levels to watch for NVDA shares

With Nvidia now trading near the top of its recent range ($113.22 – $135.00), technical analysts are watching closely as the stock approaches resistance between $134.82 and $135.59.

Should the stock pull back, support levels around $121.90 to $122.83 could come into play. Nvidia’s alignment with the broader market, as the S&P 500 also nears new highs, may influence whether it breaks through resistance or retreats.

With short-term options dominating the landscape and short interest on the rise, Nvidia’s movements remain as volatile as ever, with traders gambling on the outcome of its latest moves—and the company’s next big product launch.

Whether it’s driven by casino-like speculation or genuine growth prospects, the stakes have never been higher for the chipmaker.