As the tech industry continues to evolve, Nvidia (NASDAQ: NVDA) and Advanced Micro Devices (NASDAQ: AMD) remain at the forefront of the semiconductor sector, playing pivotal roles in AI and data center innovation.

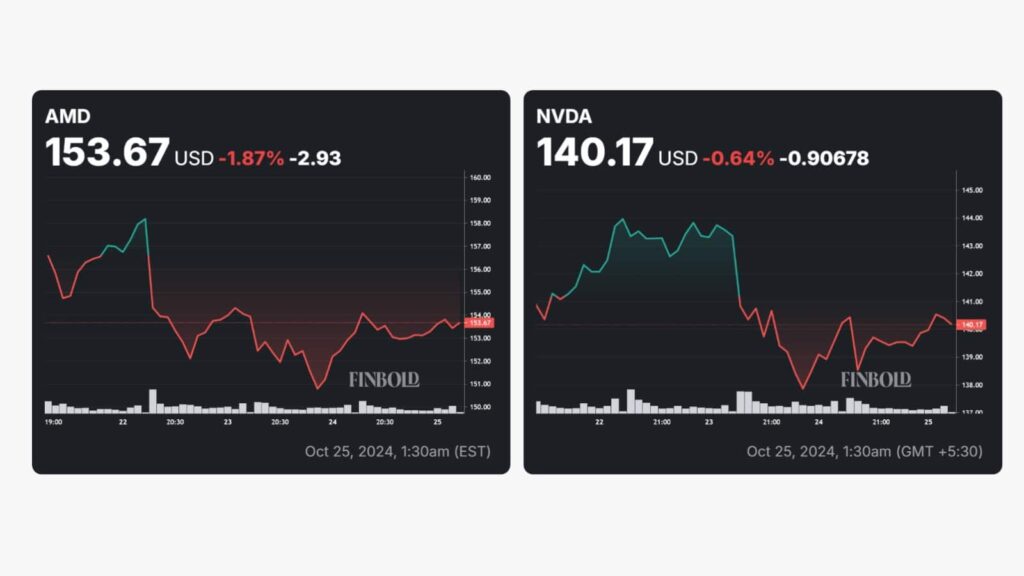

With Nvidia’s stock currently priced at $140 and AMD at $153, investors are wondering which of the two presents a better opportunity for 2025, especially in light of current market conditions. To provide clarity, Finbold consulted ChatGPT-4o for insights on which stock is likely to outperform in the year ahead.

Nvidia: AI powerhouse with market dominance

Nvidia has firmly established itself as a leader in AI hardware, with its stock price soaring by 223% over the past year.

The company’s cutting-edge Blackwell B200 chips, known for their powerful AI processing capabilities, recently faced production delays due to a design flaw. This setback impacted shipment timelines for key clients such as Meta Platforms (NASDAQ: META), Alphabet Inc. (NASDAQ: GOOGL), and Microsoft (NASDAQ: MSFT).

However, CEO Jensen Huang reassured stakeholders that the issue has been resolved in collaboration with Taiwan Semiconductor Manufacturing Company (NYSE: TSM), and shipments of the Blackwell AI chips are expected to resume by the end of the year.

In addition to the Blackwell chips, Nvidia’s H100 chips play a crucial role in powering generative AI platforms like ChatGPT, further solidifying the company’s dominance in AI technology.

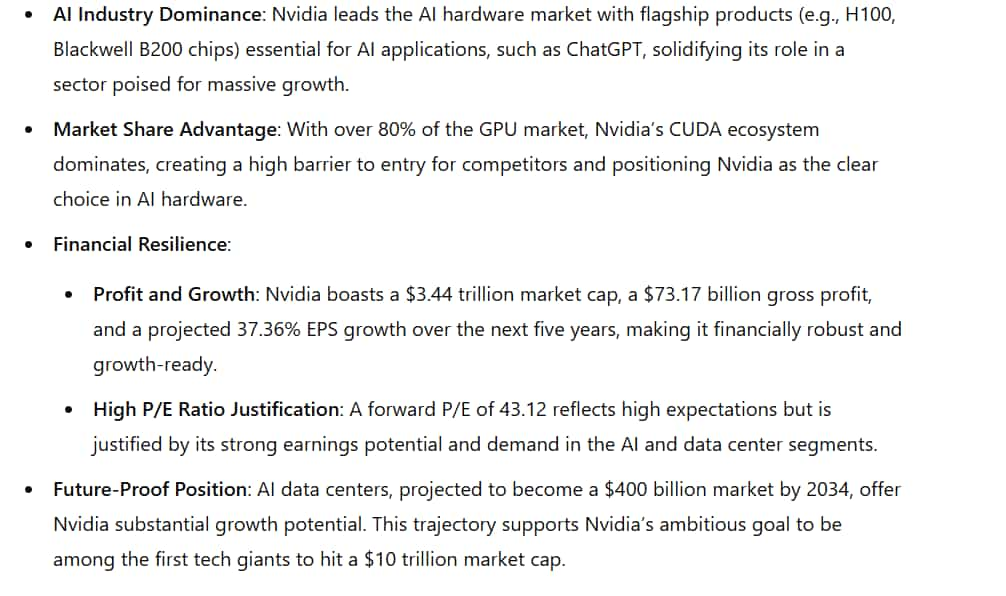

Nvidia’s data center segment has thrived, contributing significantly to its impressive $96.31 billion in revenue over the past year. With an 80% share of the GPU market, Nvidia’s CUDA software continues to outperform AMD’s ROCm platform, strengthening its competitive advantage.

From a growth perspective, Nvidia boasts a market cap of $3.44 trillion, a gross profit of $73.17 billion, and an EBITDA of $61.18 billion. Its forward P/E ratio of 43.12 indicates high growth expectations, with analysts forecasting a 5-year EPS growth of 37.36%.

Although its current stock price of $140 is close to the price target of $145.84, Nvidia remains a compelling investment due to its potential in AI accelerators and the rapidly expanding data center market, projected to reach $400 billion by 2034.

Industry experts, including Wedbush’s Dan Ives, anticipate that Nvidia could become the first semiconductor company to achieve a $4 trillion market cap, with speculation that it might even reach $10 trillion as AI continues to drive its growth

AMD’s Rise: Data center expansion and strategic AI investments

While Nvidia continues to dominate the AI hardware space, Advanced Micro Devices is emerging as a formidable competitor, particularly in the data center and AI markets.

Over the past year, AMD’s stock has climbed 53%, reflecting its increasing presence in these sectors. The company’s Instinct MI325X chip, set to begin production by late 2024, is specifically designed to capture a larger share of the data center market.

However, AMD faces growing pressure as its Instinct MI325X directly competes with Nvidia’s Blackwell chip, which launched at a lower-than-expected $30,000 price point.

Adding to the challenge, Morgan Stanley recently noted AMD’s reduced CoWoS wafer bookings at TSMC for 2025, driven by uncertain demand for the MI325X. Nvidia quickly absorbed this available capacity, further solidifying its market dominance

From a valuation perspective, AMD boasts a market cap of $248.34 billion and an annual revenue of $23.28 billion. Its forward P/E ratio of 34.89 and projected EPS growth of 83.10% highlight its significant upside potential.

AMD’s data center segment, which accounted for nearly half of its revenue in the most recent quarter, continues to expand, fueled by strong demand for its 4th-generation EPYC CPUs. Furthermore, the company holds an impressive 83% market share in gaming console processors, further diversifying its revenue streams.

With its current stock price at $153 and a target of $197.48, AMD presents a potential 28.70% upside, making it an attractive option for long-term investors seeking the next Nvidia.

Furthermore, AMD’s acquisition of Silo AI has significantly enhanced its AI capabilities. Leveraging Silo AI’s expertise in large language model (LLM) training on supercomputers, AMD is now positioned to deliver robust AI solutions across both hardware and software, effectively addressing the industry’s rapidly evolving demands.

ChatGPT-4o verdict: Nvidia or AMD for 2025?

In assessing the strengths of Nvidia and AMD, ChatGPT-4o’s analysis leans toward Nvidia as the stronger investment for 2025.

Nvidia’s leadership in AI hardware, with its chips powering the generative AI boom, makes it a top contender. Its market dominance and robust position in the AI space make it highly attractive for investors seeking immediate exposure to this rapidly growing sector.

However, AMD presents a significant upside with a more diversified product portfolio and higher projected growth rates. Its focus on data centers, AI hardware, and a broad range of products beyond GPUs positions it for sustained growth as the data center GPU market evolves.

Ultimately, Nvidia holds a slight edge for 2025 due to its established dominance in high-demand areas like AI, but AMD offers a compelling alternative for growth-oriented investors.

Both stocks carry substantial upside potential, but Nvidia’s larger market cap and entrenched position in high-performance GPU markets make it the more robust choice amid the AI boom.