As geopolitical tensions continue to shape commodity prices, it’s unsurprising that oil has seen a significant uptick in recent months due to the escalation of the Iran-Israel conflict and regional instability.

However, an expert going by the pseudonym Northstar believes this surge is only the start. They predict that oil prices, denominated in US dollars, could potentially triple, soaring to a range of $200 to $300 per barrel of Brent crude oil.

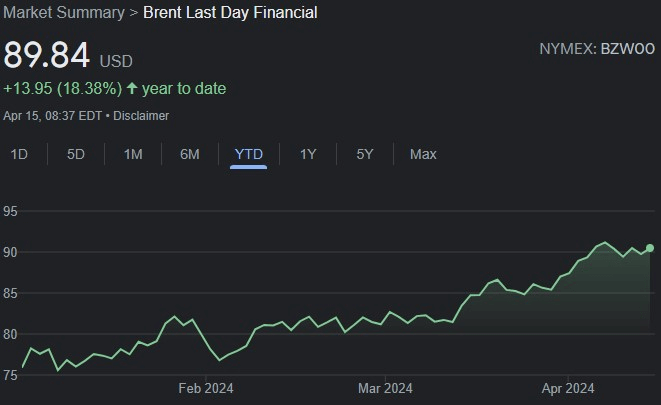

This implies that the already substantial gains of 18.38% since the start of 2024 would see even further growth, placing additional strain on the economy. This surge could lead to a spike in gas prices, potentially resulting in an economic disaster.

Who could benefit from this potential spike in oil prices?

The answer is quite simple: oil producers, energy sector players, and related companies would see significant boosts in their valuations, especially those employing modern and cost-effective refining methods, leading to higher profits.

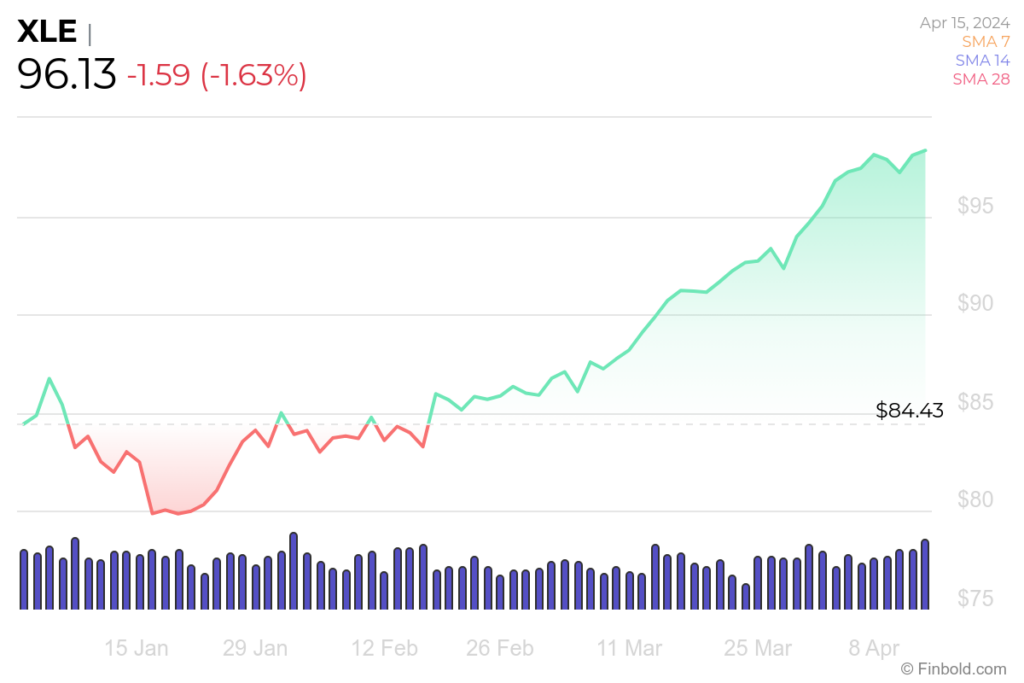

The Energy Select Sector SPDR Fund (NYSE: XLE) serves as the best benchmark for gauging the energy sector’s performance.

It includes companies like Exxon Mobil Corp (NYSE: XOM), Chevron Corp (NYSE: CVX), and ConocoPhillips (NYSE: COP), all of which have witnessed price increases since the beginning of 2024.

Others see this scenario as improbable

The increase in oil prices triggers a ripple effect across various sectors, impacting prices of essential goods and services like food, healthcare, and more.

These aspects are crucial for the overall well-being of the population. A surge in oil prices would lead to a broader spike in inflation, potentially exceeding 300%, and result in a significant devaluation of the US dollar.

Consequently, this would dampen oil demand. While a substantial rise in oil prices is possible, such a significant increase is less likely, with a strong possibility of a downturn by the end of the year. Nonetheless, any uptick is worth monitoring due to its far-reaching consequences.

Buy stocks now with eToro – trusted and advanced investment platform

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.