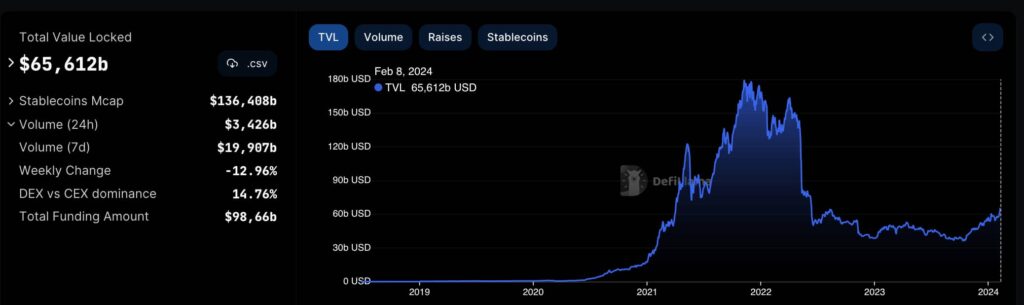

Decentralized finance (DeFi) is on a rally, surpassing $65 billion in total value locked (TVL). With this accomplishment, DeFi is among the top five largest U.S. hedge funds in assets under management (AUM).

On February 9, the total value locked in all DeFi protocols reached a multi-year high of $65.612 billion. Notably, the last time decentralized finance saw these numbers in TVL was in June 2022. This metric has currently surpassed the $64.658 billion of August 13, 2022, according to data from DefiLlama.

Interestingly, this TVL accounts for 48% of stablecoins’ market cap of $136.408 billion at the time of publication. In the last 24 hours, decentralized exchanges (DEX) moved over $3.4 billion in volume, while nearly $20 billion weekly.

The total value locked measures the amount of non-liquid tokens invested in DeFi protocols. In traditional finance, this would be the equivalent of assets under management (AUM), although not managed by a central entity.

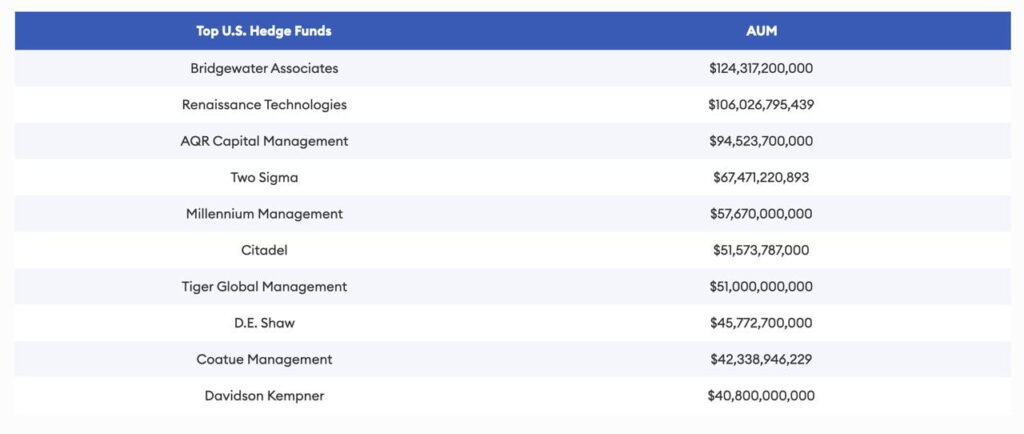

DeFi beats the top 4 hedge funds in the United States

In particular, such an amount would place DeFi as the fifth most valuable hedge fund in the United States.

Two Sigma has the fourth-highest AUM in the country, with $67.471 billion in assets under management. Followed by Millennium Management, with $57.67, according to a Forbes report from December 2023.

Therefore, decentralized finance has been growing in relevancy and managing to attract investors and capital to its live ecosystem. Despite being two different metrics, they can indicate capital allocation preferences.

There is still a long way to go moving forward while DeFi conquers further achievements and beats traditional finance entities.

Even giant finance names like BlackRock Inc. (NYSE: BLK) are flirting with DeFi and Web3. In this context, BlackRock’s recent interest in tokenization could fuel the growth, attracting more capital to the decentralized landscape.

Nevertheless, investors must be aware of the yet experimental nature of DeFi and invest cautiously.

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.