The world’s leading artificial intelligence (AI) company, OpenAI, launched its most advanced model on September 12, called o1. Finbold then turned to OpenAI’s o1, looking for investment insights and a gold price prediction for the end of 2024.

Previously, we asked o1 for a Bitcoin (BTC) and Nvidia (NASDAQ: NVDA) price prediction, testing the AI’s capacities. As published, OpenAI’s model forecasted that BTC would trade at $90,000 and that NVDA stock would grow from here.

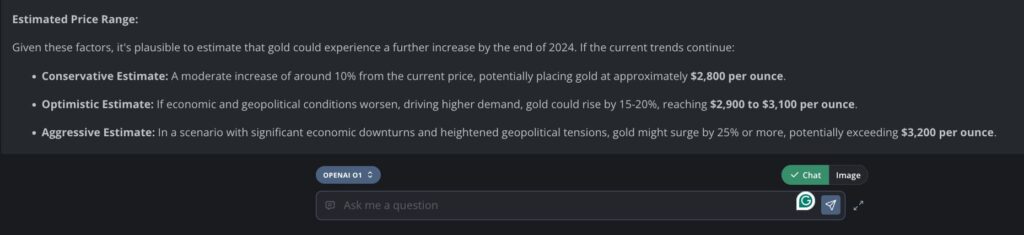

Overall, o1 does not have a bearish scenario for gold at current prices, dividing its forecast into three bullish predictions. The conservative estimate places gold at $2,800 per ounce, while the aggressive one sees the commodity above $3,200.

What the “PHD-level” AI called an “optimistic estimate” foresees gold trading between $2,900 and $3,100 by December 2024.

Gold price analysis

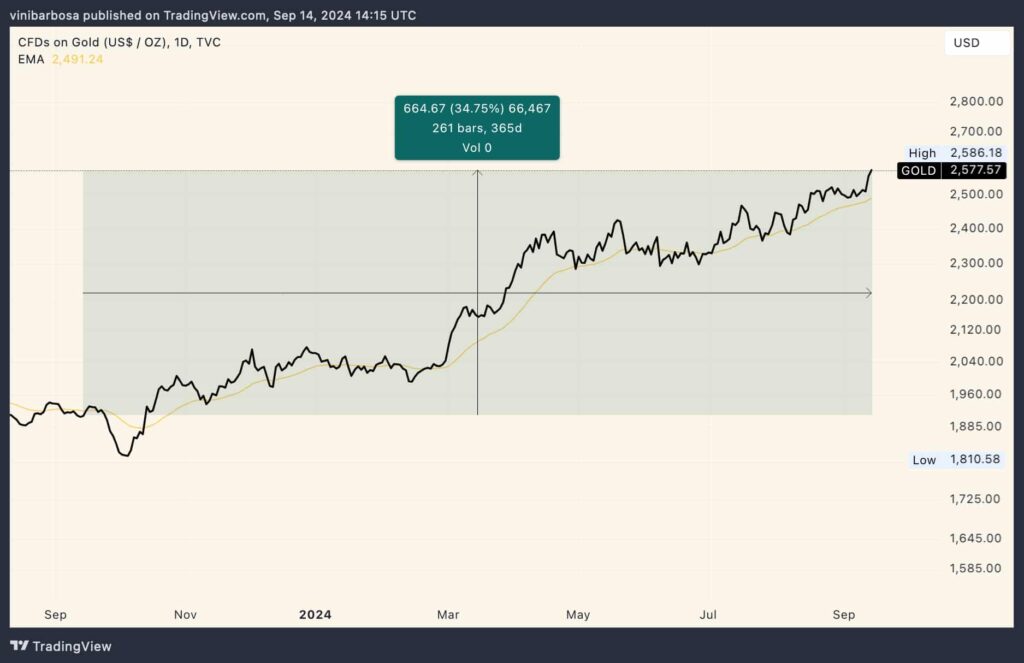

Right now, gold trades around the $2,577 price level, accumulating 34.75% growth year-over-year (YoY) since September 14, 2023. Notably, the precious metal recently made a new all-time high of $2,586, highlighting its record market demand.

As things develop, there is significant support at gold’s 30-day exponential moving average (1D 30-EMA) at $2,491. This technical analysis suggests the leading commodity could test this region close to the $2,500 psychological level before continuation.

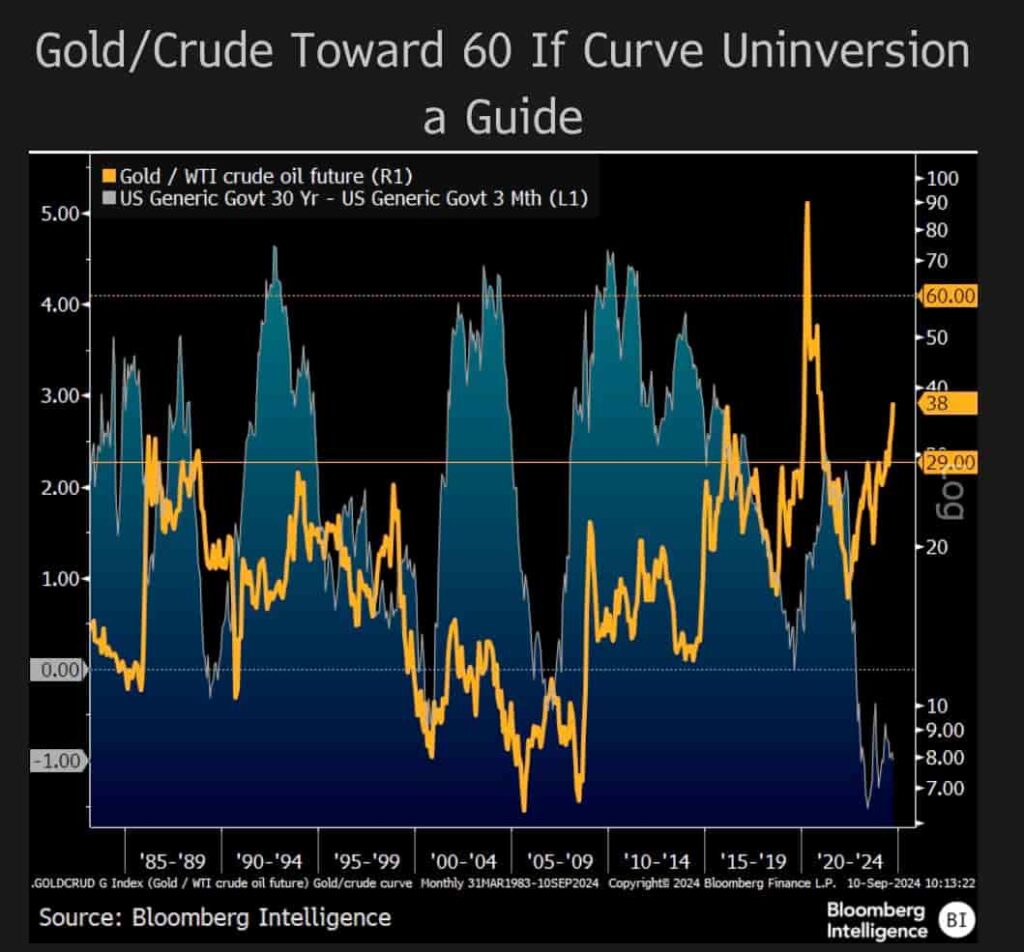

Mike Mcglone, Bloomberg‘s senior commodities strategist, forecasts that gold’s price will reach $3,000 per ounce, which is aligned with OpenAI’s o1 output. According to McGlone, hedge funds favor gold over crude oil, mostly thanks to a sticky yield curve inversion.

“Trends Toward Gold $3,000, WTI Crude Oil $50. Hedge funds are stretched long the metal, short the fossil fuel for good reason – Since WTI crudeoil futures started trading in 1983, never has the yield curve been more inverted for longer, with reversion implications that typically favor gold.”

– Mike McGlone

OpenAI’s o1 fundamental analysis for gold’s price prediction

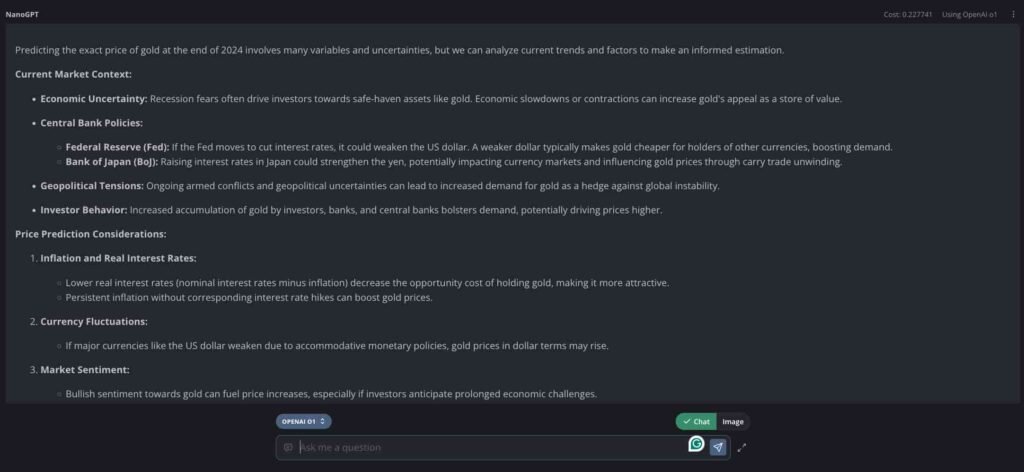

From a fundamental analysis, OpenAI’s o1 points to gold as a natural safe haven amid economic uncertainty. As geopolitical tensions grow worldwide and recession fears dominate investors’ minds, the precious metal shines among its alternatives.

Finbold has reported multiple of Robert Kiyosaki’s warnings on this climate and suggestions of gold as an asset to buy.

Furthermore, the AI also blames weakening currencies like the dollar for gold’s rise – partially caused by inflation, the Japanese Yen carry trade, and the current market expectations of the Federal Reserve’s first interest rate cut in years. Finbold has been consistently reporting about these aspects.

Investors and traders should closely monitor these aspects as the factors align for the last quarter of the year.

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.