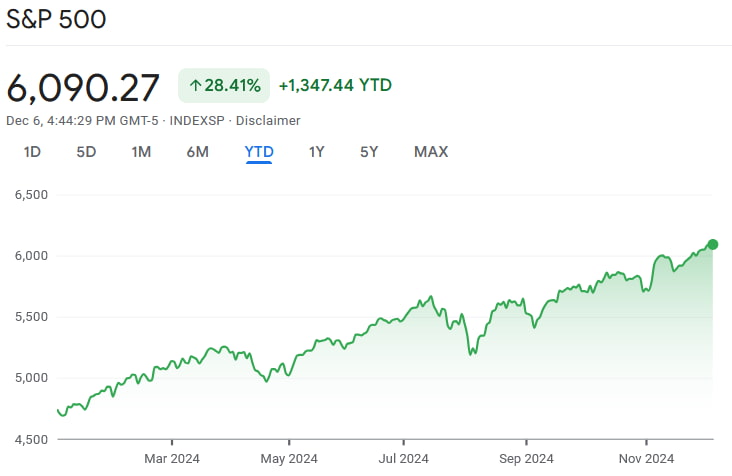

The S&P 500 has managed to deliver quite outstanding returns over the course of the last two years.

On a year-to-date (YTD) basis, the index has risen by 28.41% — marking a record-breaking 53 all time high (ATH) closes over the course of 2024 alone.

Thus far, the year has been one of the best on record — since the inception of the index in 1957, returns in excess of 20% have only occurred eight times.

At press time, the index was at a level of 6,090, having rallied by 1.48% over the course of the last thirty days.

Technical analysis suggests that the bull run is far from over, that the current long term trend remains intact, and that the index will most likely reach a level of 6,300 without significant trouble.

Up to this point, there has been a strong undercurrent of bearish sentiment — with notable economists like Henrik Zeberg predicting that such high levels are unsustainable, and that they would be followed by a crash.

It would seem, however, that institutional players have had a change of heart — Wells Fargo (NYSE: WFC) set a target of 7,000 for the end of 2025, while HSBC sees the index reaching 6,700 in that timeframe.

Now, an even higher target has been set — Oppenheimer’s chief investment strategist, John Stoltzfus, sees the index reaching 7,100 by the end of 2025 — making this the most bullish outlook on the Street.

Oppenheimer sees AI driving big gains in the equity market

Although he did note that worries are present concerning the wider market, Stoltzfus believes that the current uptrend is strong enough to persevere, stating that: the current bull market likely has legs strong enough to climb the proverbial ‘wall of worry’ into and through 2025.

In a note shared with investors, he cited the development of artificial intelligence as the primary reason behind his new price target. Having called it a watershed moment, the analyst also stated that: ’Companies in all eleven sectors could benefit from improved productivity via AI to further serve the needs of business and customers.’

‘We’re not suggesting paradise on earth nor are we expecting a ‘Goldilocks world’ but rather a genuine potential for AI to provide greater efficiencies in key areas that are challenging progress today across the sectors and society.’

If reached, the 7,100 mark would represent a 16.58% upside from the index’s current level. Stoltzfus’s optimistic outlook isn’t a new development — as he was already one of the most bullish analysts on Wall Street, with a target of 6,200 for the end of 2024 set back in November. If his analysis for the short term holds true, the index could rise by another 1.8% by the end of the month.

However, this outlook is far from universal — Google (NASDAQ: GOOGL) chief executive officer (CEO) Sundar Pichai, for example, recently stated that AI development is in fact slowing down and that the ‘low-hanging fruit’ is gone.

Pichai expects only incremental progress in the space in 2025. At the same time, investors are increasingly wary of increased AI spending with little to show for it, and concerns about a potential AI bubble remain.

Featured image via Shutterstock