More false rumors about the Bitcoin spot ETF approval moved the cryptocurrency market in the last 24 hours. The volatility sent Bitcoin (BTC) price up and down on January 9.

Notably, Bitcoin traded as high as $47,975 and as low as $45,000 in the same hourly candle at 09:00 pm (UTC). This happened following a sequence of posts by the Securities and Exchange Commission (SEC) on X (formerly Twitter).

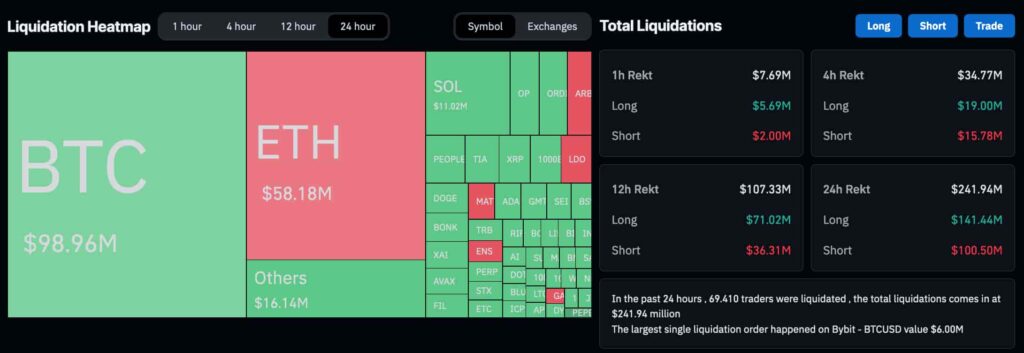

In this context, 69,410 traders were liquidated for a total of $241.94 million liquidations by press time. $141.44 million came from long positions, betting in a bullish outcome, while $100.50 million from bearish short-sellers.

Bitcoin (BTC) liquidations and price analysis

The volatility liquidated over $98.96 million worth of positions for Bitcoin alone. Particularly erasing $61.91 million (62.5%) of longs and $37.05 million (37.5%) of shorts.

In the meantime, Bitcoin just started liquidating short positions, currently trading at $46,430. These liquidations can be observed on CoinGlass’ liquidation heatmap, which also illustrates the aforementioned volatility event, erasing positions up and down.

Interestingly, no relevant liquidity pools are left in BTC’s liquidation heatmap amid the market’s waiting on the SEC’s decision. Most cryptocurrencies, including Bitcoin, register a low 24-hour exchange volume, insufficient to form meaningful pools.

In closure, further price action will directly depend on what Gary Gensler, President of the SEC, says about recent events. Regulators may choose to delay the Bitcoin ETF decision one more time. Nevertheless, if the decision is made today, an approval would probably drive BTC upwards, while a rejection would do the opposite.

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.