As Palantir (NASDAQ: PLTR) trades at a new all-time high, a Wall Street analyst is sounding caution, detailing key fundamental factors that could work against the stock.

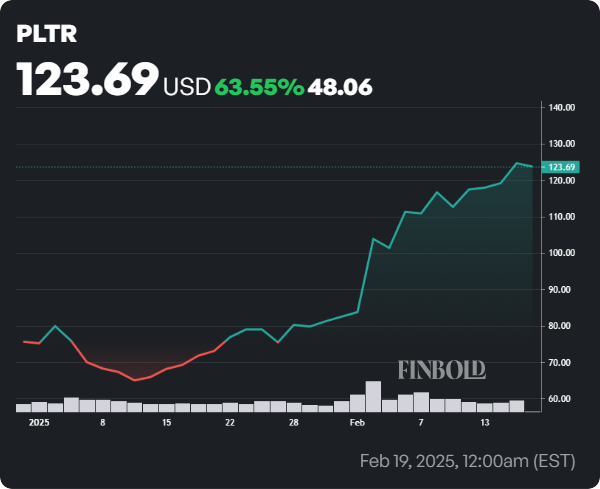

On February 18, PLTR continued its impressive run, triggered by the release of its Q4 2024 results, reaching $124.62, a new record high, gaining nearly 5% for the day.

The American software giant is up 65% in 2025. Meanwhile, before the market opening on February 19, PLTR’s share price slightly corrected by about 0.70% to $123.76.

Analyst projects PLTR stock price crash

Despite this impressive rally, Jefferies analyst Brent Thill is projecting that PLTR will likely crash to $60, a downside of about 51%. This price target was accompanied by the analyst reiterating his ‘Underperform’ rating on the stock.

To back the bearish outlook, Jefferies raised concerns about Palantir’s sluggish hiring growth, which may indicate a limited artificial intelligence (AI) opportunity, cost-cutting in non-engineering roles, or over-hiring in previous years.

Notably, the company’s total headcount increased by only 5% in 2024, adding just 201 new employees to reach 3,900. This follows a net reduction of 103 employees in 2023, pointing to a cautious approach to workforce expansion despite the company’s aggressive hiring in earlier years.

At the same time, Thill highlighted an imbalance in Palantir’s revenue growth. While U.S. revenue saw strong acceleration, rising 38% year-over-year in 2024 compared to 32% in 2023, international revenue remained flat at 14% growth. The disparity raises concerns about the company’s ability to scale globally as non-U.S. operations struggle to keep pace with domestic expansion.

Another troubling sign is the increase in insider selling. CEO Alex Karp and President Stephen Cohen have updated their Rule 10b5-1 trading plans, allowing for potential sales of nearly 10 million and 4 million shares, respectively. These moves suggest that top executives may lack confidence in the company’s near-term growth trajectory, a development that investors will likely scrutinize.

Additionally, the resignation of Chief Accounting Officer Heather Planishek, effective February 24, 2025, adds uncertainty to Palantir’s leadership. With no immediate successor named, Jefferies stated that this scenario raises concerns about the company’s financial stability.

Despite adding 214 net new customers in 2024 (up from 130 in 2023), Palantir remains reliant on a few major clients. Revenue from its top 20 customers grew to $64.6 million from $54.6 million, though its top three now account for 17% of total revenue, slightly reducing concentration risk. Still, Jefferies warned that heavy dependence on large contracts remains a key weakness.

PLTR stock valuation concerns

Beyond these possible headwinds, Jefferies has previously forecasted a PLTR stock crash due to concerns about its valuation. Despite the meteoric rise, one lingering concern has been overvaluation.

However, some analysts, such as Wedbush Securities’ Dan Ives, have dismissed these worries. Ives believes Palantir will likely lead the software AI segment, calling the company the “Messi of AI.”

Based on valuation concerns, as reported by Finbold, ChatGPT suggested that PLTR might see a correction within the next 12 months.

Adding to concerns, institutional investors have also been offloading PLTR stock recently. For instance, as per a Finbold report, Cathie Wood, CEO of Ark Invest Management, has been on a selling streak, reducing her stake in PLTR.

All in all, Palantir faces the challenge of addressing overvaluation concerns while continuing to deliver on investor expectations, relying on its existing government and commercial clients to sustain growth.

Featured image via Shutterstock