Apple (NASDAQ: AAPL) recently announced a move into the artificial intelligence (AI) sector with Apple Intelligence, navigating the AI boom. In a cross-over of Apple and AI, Finbold turned to Peplexity Online for an up-to-date AAPL stock price prediction.

While Apple stands out as a consolidated tech company, Perplexity is growing as a startup delivering a unique AI experience. On its growth, ChatGPT’s developer OpenAI indirectly listed Perplexity Online among the top five most relevant competitors, as Finbold reported.

The model can scan the web in real time, looking for up-to-date analysis and insights on multiple subjects, including stocks. At Finbold, we leveraged this capacity with a prediction of Nvidia’s (NASDAQ: NVDA) stock price and a list of the most popular investments for 2024.

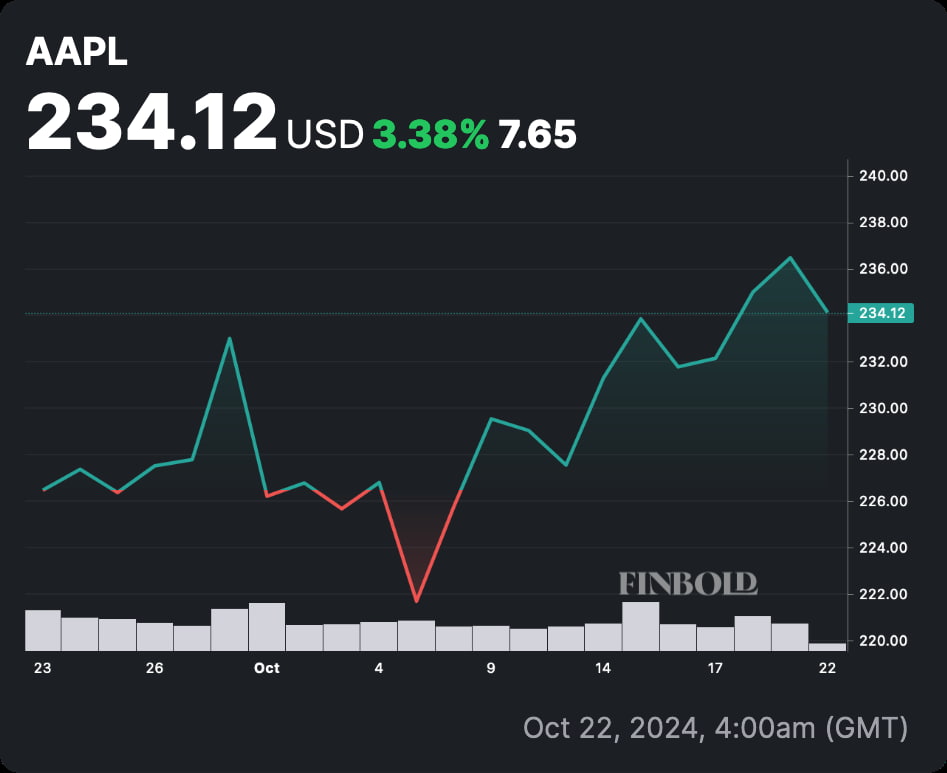

As of this writing, AAPL traded at $234.12, up 3.38% in the last 30 days and 20% year-to-date. Interestingly, Perplexity AI predicts Apple will trade as high as $300 per share or as low as $180 by 2025.

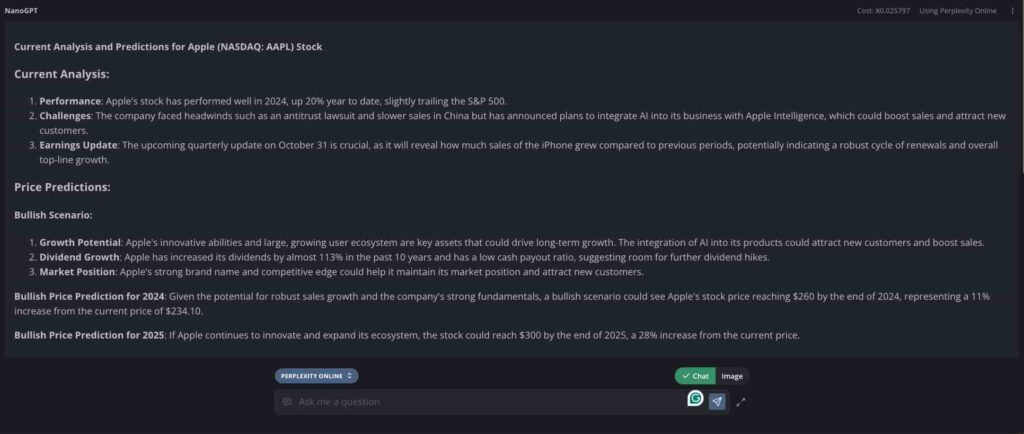

Apple stock price bullish case by Perplexity AI

Overall, Perplexity AI’s sources are looking forward to Apple’s quarterly earnings report on October 31 with optimistic expectations. Among other positive perspectives making the bullish case, analysts mentioned Apple Intelligence’s potential to attract more customers and dividends potential.

According to the sources, Apple has increased its dividends by 113% in the last ten years with further growth potential. In particular, analysts mentioned the company has a low cash payout ratio, suggesting future dividends can come even higher.

“Bullish Price Prediction for 2024: Given the potential for robust sales growth and the company’s strong fundamentals, a bullish scenario could see Apple’s stock price reaching $260 by the end of 2024, representing an 11% increase from the current price of $234.10. Bullish Price Prediction for 2025: If Apple continues to innovate and expand its ecosystem, the stock could reach $300 by the end of 2025, a 28% increase from the current price.”

– Perplexity Online AI

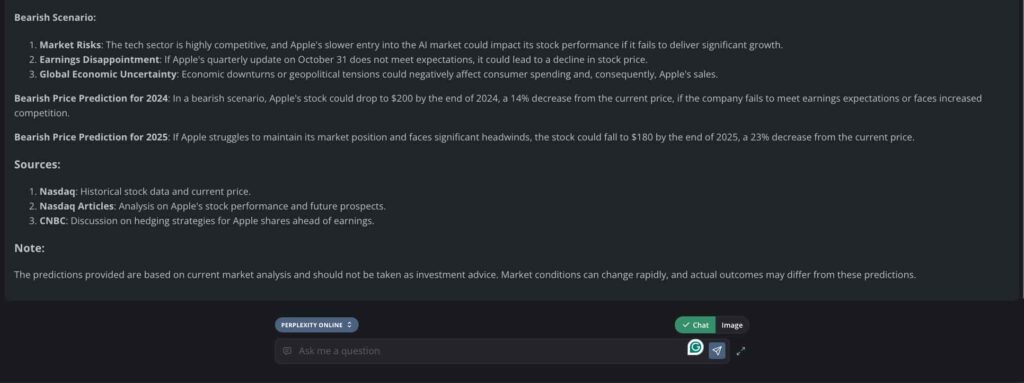

AAPL stock bearish scenario according to analysts’ insights

On the other hand, analysts warn that the quarterly results on October 31 could fail to meet expectations. This would create a negative forecast for AAPL stock moving forward, potentially affecting currently bullish fundamentals like dividends’ foreseen growth.

Notably, Apple’s slower sales in China could have impacted its Q3 earnings, along with a slow entry into artificial intelligence. Moreover, Perplexity AI mentioned macroeconomic and geopolitical uncertainties as a bearish catalyst in Apple’s price prediction.

“Bearish Price Prediction for 2024: In a bearish scenario, Apple’s stock could drop to $200 by the end of 2024, a 14% decrease from the current price, if the company fails to meet earnings expectations or faces increased competition. Bearish Price Prediction for 2025: If Apple struggles to maintain its market position and faces significant headwinds, the stock could fall to $180 by the end of 2025, a 23% decrease from the current price.”

– Perplexity Online AI

In summary, Apple stock’s risk-reward favors a bearish case short-term for 2024, with more downside potential and a controlled upside. Meanwhile, the mid-term projection is bullish, offering more upside potential with a controlled downside.

Perplexity AI used two sources for this AAPL price prediction and analysis, gathering insights from Nasdaq and CNBC. The model warns investors of rapidly changing market conditions requiring caution and monitoring to understand which scenario will play out.