Finbold asked Perplexity AI, a ChatGPT feared competitor, to reveal the three most recommended stocks on the web in 2024.

The artificial intelligence (AI) race is full of innovation, with Perplexity Online standing out due to its real-time web scanning. Unlike popular AI models like ChatGPT, which work through a timestamped trained database, Perplexity outputs result from up-to-date web scanning.

Interestingly, Perplexity appeared in an OpenAI list, mentioning five competitors that the ChatGPT developer asked investors not to fund. The list, however, backfired, driving attention to the yet-unknown tool that the AI-leading company considered relevant.

Finbold is testing this relevancy, using the feature to get real-time finance and investment insights to share with our readers. In summary, Perplexity AI named Dow Inc (NYSE: DOW), CNH Industrial (NYSE: CNH), and Progressive Corporation (NYSE: PGR) the most recommended stocks for Q4 2024, according to two sources.

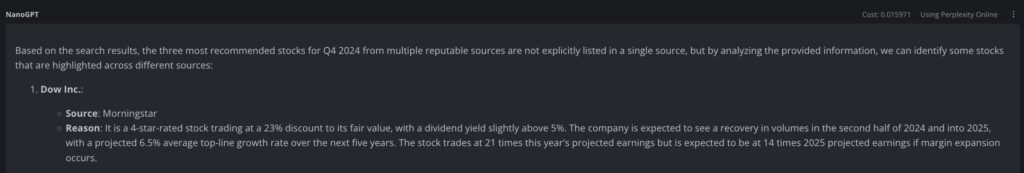

Most recommended stock by Perplexity AI: Dow Inc (NYSE: DOW)

After considering many reputable sources, Perplexity AI found Dow Inc. one of the most recommended stocks for this quarter. As reasoned, DOW is a four-star stock, according to Morningstar, potentially trading at a significant discount to its “fair value.”

Notably, the company’s dividend yield is above 5%, and sources expect a volume recovery in H2 2024 into 2025. Analysts project a 6.5% average top-line growth rate over the next five years.

“It is a 4-star-rated stock trading at a 23% discount to its fair value, with a dividend yield slightly above 5%. The company is expected to see a recovery in volumes in the second half of 2024 and into 2025, with a projected 6.5% average top-line growth rate over the next five years. The stock trades at 21 times this year’s projected earnings but is expected to be at 14 times 2025 projected earnings if margin expansion occurs.”

– Perplexity Online AI

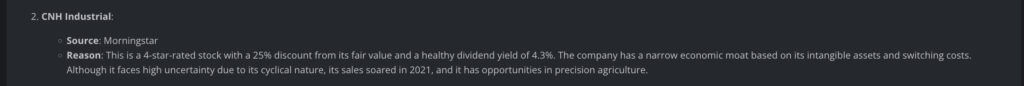

CNH Industrial (NYSE: CNH) stock

From the same source, Morningstar, Perplexity Online listed CNH Industrial as the second most recommended stock for Q4 2024. Essentially, CNH is also a four-star equity with a claimed 25% discount from its fair value and remarkable dividends.

However, the AI warned of seasonal performance and intangible assets that may bring uncertainties for investors.

“This is a 4-star-rated stock with a 25% discount from its fair value and a healthy dividend yield of 4.3%. The company has a narrow economic moat based on its intangible assets and switching costs. Although it faces high uncertainty due to its cyclical nature, its sales soared in 2021, and it has opportunities in precision agriculture.”

– Perplexity Online AI

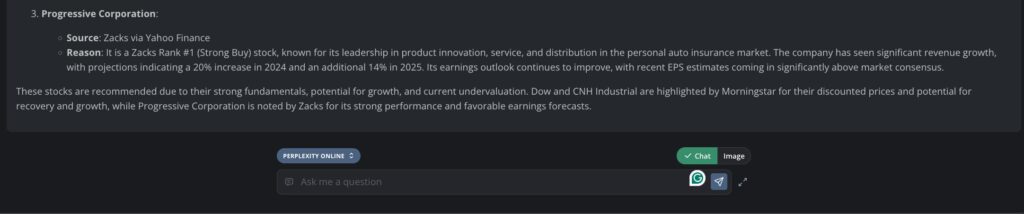

Progressive Corporation (NYSE: PGR) stock

Finally, the PGR stock is Perplexity AI’s third recommendation, based primarily on Zacks Rank, as featured by Yahoo Finance. The Progressive Corporation ranks in the number one position as Zacks’s “Strong Buy” recommendation.

The artificial intelligence highlights the company’s 20% growth projection in 2024 and 14% forecasted increase in 2025.

“It is a Zacks Rank #1 (Strong Buy) stock, known for its leadership in product innovation, service, and distribution in the personal auto insurance market. The company has seen significant revenue growth, with projections indicating a 20% increase in 2024 and an additional 14% in 2025. Its earnings outlook continues to improve, with recent EPS estimates coming in significantly above market consensus.”

– Perplexity Online AI

Overall, the mentioned stocks are being actively recommended as a buy for Q4 2024 due to their growth potential. Fundamental analysis’ calculated “fair value” compared to each stock’s current value presented relevant asymmetry considered by the tool.

Finbold has also asked Perplexity AI to indicate the most popular investment assets for this last quarter. On that note, research material from BlackRock and other sources rendered AI-related stocks and small-caps with high growth potential as the most popular investments – which this recent list fits well into.

Besides traditional investing and stocks, Perplexity Online also suggested the three most popular cryptocurrencies to consider in 2024, Finbold reported.

Just like the other reports, investors must still do proper research before making important financial decisions.