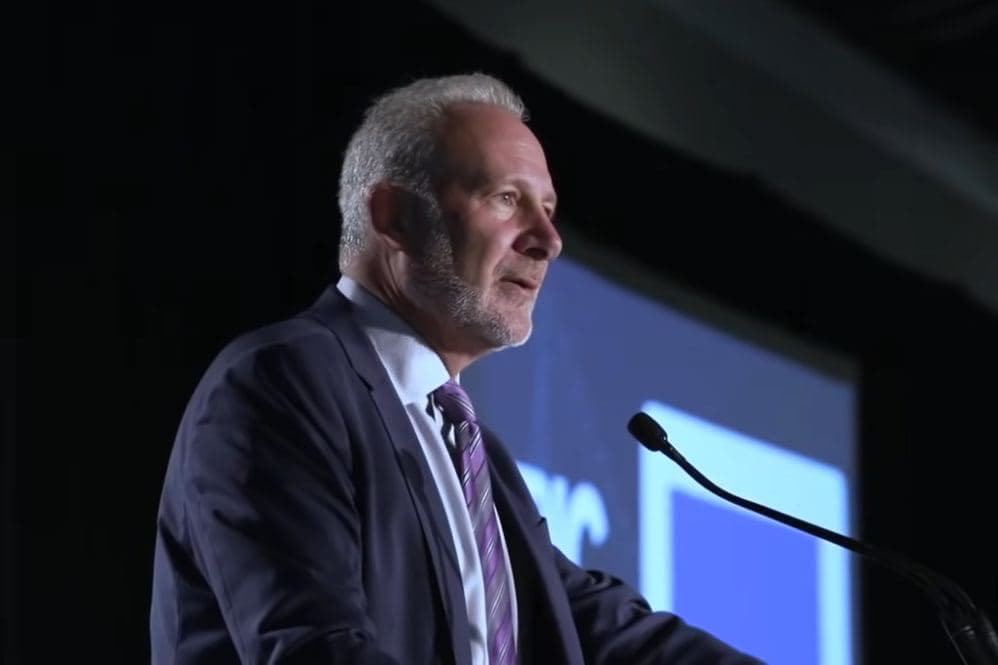

After Bitcoin (BTC) failed to live up to the hype of the recent launch of the first spot Bitcoin exchange-traded fund (ETF) in the United States, economist and prominent critic of the maiden cryptocurrency Peter Schiff has gone into an ‘I told you so’ mode, rubbing the losses into the crypto community’s nose.

Indeed, Schiff recently said the crypto industry ridiculed his earlier warning that the price of Bitcoin would fall victim to the ‘buy the rumor, sell the news’ sentiment after the United States Securities and Exchange Commission (SEC) gave the green light to the 11 spot Bitcoin ETFs:

“The Bitcoin ‘experts’ who ridiculed me and anyone else who claimed the new Bitcoin ETFs would be a ‘buy the rumor, sell the news’ event are now dismissing the significance of the decline, claiming it’s just a classic ‘buy the rumor, sell the news’ event that was to be expected.”

Bitcoin: $0 or $10 million?

With this in mind, he insisted on his earlier belief that the maiden crypto asset would ultimately collapse and its value would drop to zero, arguing that the recently approved spot Bitcoin exchange-traded funds “aren’t creating additional demand, but merely shifting demand.” As he specified:

“Investors who might have bought actual Bitcoin, Bitcoin-related equities like MSTR or GBTC are simply buying the new ETFs instead. Rearranging the deck chairs won’t stop the ship from sinking.”

Finally, Schiff took one last jab at Bitcoin’s supporters, stating that “no matter how low the price of Bitcoin falls, its proponents will always be able to claim it outperformed gold,” even if it drops “to $100 in 2031 and gold rises to $10,000, they will claim that Bitcoin is up 100x in the past 20 years, while gold is only up 5x.”

Interestingly, after popular investor and trader Harsh Dixit asked what would happen if the flagship decentralized finance (DeFi) asset reached the price of $10 million by 2031, the well-known gold proponent pretty much ended any further discussion by stating that:

“If the U.S. dollar goes the way of the German Papiermark then I suppose that’s possible.”

As a reminder, the Papiermark was the German currency from 1914 until 1923, when its value fell victim to the hyperinflation following the end of World War I, becoming almost worthless, due to which the government first replaced it with the Retenmark, and soon after with the Reichsmark.

Meanwhile, Bitcoin was at press time changing hands at the price of $42,256, down 1% on the day but nonetheless increasing 3.26% across the previous week and gaining 1.34% on its monthly chart, as per the latest data retrieved by Finbold on January 29.

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.