Buy Now, Pay Later (BNPL) is a popular way to spread the cost of a purchase over several installments, usually four, at 0% interest, making it an attractive option for many.

Between 2019 and 2021, the number of BNPL loans increased by nearly 1100%, raising concerns among analysts about the potential rise in consumer debt. While this type of debt is growing rapidly, the exact amount remains unclear, often called “phantom debt.”

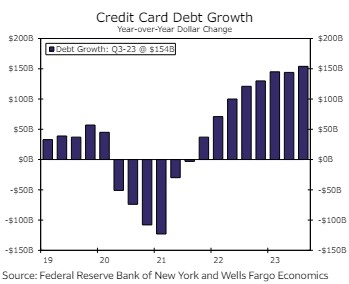

Estimates put the BNPL market at around $50 billion, suggesting that household debt could be significantly underestimated because this burgeoning sector isn’t fully accounted for in traditional financial metrics.

The hidden risks of Phantom Debt

Phantom debt, a term popularized by a Wells Fargo report, highlights the lack of comprehensive data on BNPL loans. There’s no hard measure of how many BNPL loans exist, how well consumers are managing them, or how many are falling behind.

This lack of visibility is problematic because it can lead to an incomplete assessment of household debt burdens. Analysts worry that this missing piece could misrepresent the overall health of the consumer economy.

While some argue that the concern over phantom debt is exaggerated, with default rates reportedly low, others highlight the increased financial vulnerability of frequent BNPL users, especially those using it for essential goods.

The absence of centralized data on BNPL loans complicates efforts to understand the full extent of consumer debt and its potential impact on the economy.

Regulating the BNPL industry

The BNPL industry’s regulations are still evolving. In May 2024, the Consumer Financial Protection Bureau (CFPB) issued a rule requiring BNPL firms to comply with certain credit card laws, including refunding for returned products, investigating merchant disputes, and providing clear fee disclosures.

While these steps are significant, they don’t fully address the underlying issue of phantom debt. Experts argue that more stringent measures are needed, such as requiring BNPL providers to report data to credit reporting agencies and assessing consumers’ ability to repay.

These measures would help monitor the growing BNPL sector more effectively and protect consumers from becoming overextended, especially in an era of rising inflation and economic pressures.

Despite the challenges, BNPL is likely here to stay, making it crucial for regulators and consumers alike to stay vigilant about its potential risks.