Pharma stocks can be strong investments regardless of economic conditions, as this stability arises because the demand for medications and healthcare services remains steady, even when prices rise.

Pharmaceutical stocks tend to be more resilient during economic downturns due to steady demand, which is bolstered by the healthcare insurance that covers the cost of most drugs on the market, ensuring a steady supply.

This makes them a reliable option for investors looking for stability and picks to carry on their strong performance into the second half and end of 2024.

Eli Lilly (NYSE: LLY)

The current pullback offers a nice entry point before its Q2 earnings report scheduled for August 8, which Eli Lilly (NYSE: LLY) stock has experienced, potentially presenting investors with the opportunity to buy the dip due to the 8.88% loss in the previous month.

Despite this, LLY shares have showcased impressive growth in the first half of 2024, adding 38.67% to their value on a year-to-date basis and setting the price at $821.19 in the latest trading session.

Eli Lilly is experiencing significant growth due to its successful diabetes and obesity drugs, Mounjaro and Zepbound.

In the first quarter of 2024, the company’s revenue surged by 26% to nearly $8.8 billion, driven by strong demand for these medications.

Recent phase 3 clinical trial results show that tirzepatide, the active ingredient in both drugs, significantly reduces airway obstructions in patients with obesity and sleep apnea, opening up new market opportunities for Eli Lilly, as the sleep apnea treatment market is projected to reach $13.5 billion by 2028.

The Q2 earnings report looks set to beat analyst estimates, as they indicate a substantial increase from the recent analyst’s price targets, which indicate a potential 15.95% upside from the current price levels and an average price target of $952.16.

Wall Street analysts assign a “strong buy” rating to LLY stock based on 22 examinations. Of these, 18 advised “buy,” 4 to “hold,” and none recommended a “sell.”

Novo Nordisk (NYSE: NVO)

The recent U.S. stock market-wide pullback affected even pharmaceutical makers based in Europe, causing Novo Nordisk (NYSE: NVO), a Denmark-based pharma company’s stock, to lose 11% over the previous month.

NVO stock losses extended in the latest trading session by 2.84%; however, when zooming out, NVO shares are in the green on a year-to-date basis by 25.22%, rising to $128.56 as of the latest close.

Novo Nordisk is poised for significant growth thanks to its semaglutide molecule, known as Ozempic for diabetes and Wegovy for obesity. Clinical trials suggest semaglutide could treat other diseases, including chronic kidney disease (CKD) and potentially Alzheimer’s.

A recent trial showed it effectively prevents CKD progression and reduces kidney or cardiovascular-related deaths, leading Novo Nordisk to seek expanded approval in the U.S. in 2024.

With the CKD drug market potentially reaching $88.3 billion by 2028, Novo Nordisk’s revenue, already up 71% over three years, is expected to grow further.

Such potential is recognized on Wall Street, as analysts assign a “moderate buy” on NVO stock. Such valuation is based on 9 analysts, of which 7 recommended a “buy,” while one each advised “hold” and a “sell.”

The average price target is set at $144.36, indicating a potential 12.90% upside from current price levels.

Viking Therapeutics (NASDAQ: VKTX)

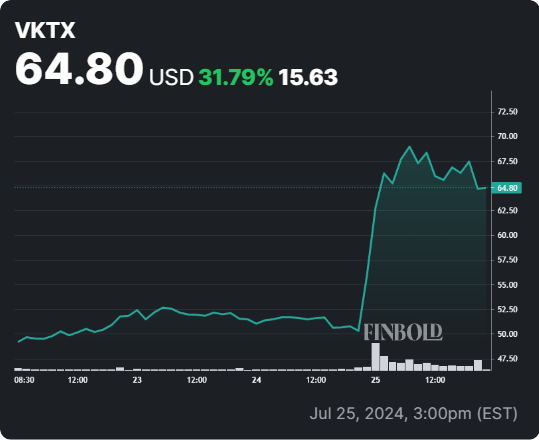

A lesser-known pick, Viking Therapeutics (NASDAQ: VKTX), surged by 28.31% on July 25. This spike followed the company’s second-quarter report, released after the market closed on July 24.

This surge follows an already impressive 253.83% year-to-date increase, making VKTX stock one of the best-performing pharma stocks of this year, which Finbold earlier recommended back in March.

Although Viking reported no revenue and a net loss of $22.3 million, or $0.20 per share, investors were more focused on the company’s announcement that it plans to advance its experimental obesity drug, VK2735, into a phase 3 clinical study.

This decision came after receiving positive written feedback from the U.S. Food and Drug Administration (FDA).

Earlier this year, Viking announced positive results from its phase 2 study of VK2735. Patients receiving the obesity drug achieved up to 13.1% placebo-adjusted mean weight loss after 13 weeks of treatment, surpassing the weight loss achieved by Eli Lilly’s Zepbound and Novo Nordisk’s Wegovy in their respective clinical trials.

The potentially successful launch of its brand carrying VK2735 drug could propel VKTX stock among the giants of the pharma industry.

Wall Street seemingly has full confidence in VKTX stock, as it assigned a “strong buy” recommendation based on 10 analysts, all of whom recommended a “buy.”

The average price target of $112.63 showcases a potentially impressive 74.13% upside from the current level.

The potentially successful launch of its brand carrying VK2735 drug could propel VKTX stock among the giants of the pharma industry.

Pharmaceutical stocks present an excellent investment for traders as they benefit from an ever-increasing demand that is set to expand by the innovation process driven by the same pharma companies in the future.

Buy stocks now with eToro – trusted and advanced investment platform

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.