Bitcoin (BTC) briefly topped $123,000 on July 14, reaching a new all-time high amid rising institutional interest.

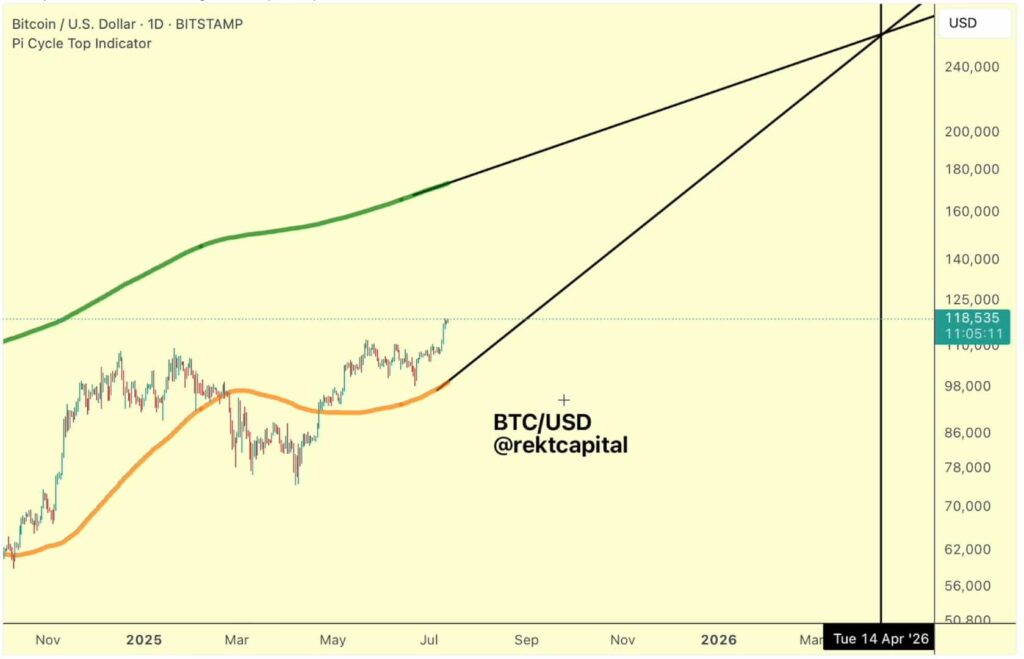

With a lot of speculation about the token’s upside circling around, the rally has brought a lot of attention to the Pi Cycle Top Indicator.

Using the 111-day and a modified 350-day moving averages to predict when the token might approach the end of the bull run, the Pi Cycle Top Indicator has historically been known as one of the most accurate market timing tools in crypto.

According to market analyst Rekt Capital, the averages now suggest that Bitcoin could peak between $130,000 and $170,000 as early as late 2025.

Bitcoin upside up to $170,000

According to Rekt Capital’s analysis, the recent momentum is pushing the 111-day moving average up rapidly.

Indeed, on June 1, the average was sitting around $92,000, but has since then jumped to approximately $98,000.

Accordingly, the projected date of the moving average crossover is being adjusted as well, now being expected to occur in February 2027 as opposed to April 2027, projected just days ago.

However, if Bitcoin maintains its upward trajectory, that projection could slide further forward into 2026, or even late 2025, when Bitcoin could potentially hit $170,000.

What do analysts say?

Last week, technical analyst Rich Ross from Evercore stated that Bitcoin was “coiled like a spring,” with potential upside targets of up to $170,000 as well.

Ross’s predictions were the result of bullish momentum Bitcoin was gaining due to rising geopolitical tensions, particularly following President Donald Trump’s announcement of sweeping new tariffs.

On July 15, prominent analyst Trader Tardigrade likewise reported a bullish outlook in a post on X.

Namely, the analyst pointed out that a slightly elevated Inverse Head and Shoulders (IH&S) weekly chart pattern suggests that Bitcoin could soon reach a target of approximately $160,000.

Featured image via Shutterstock