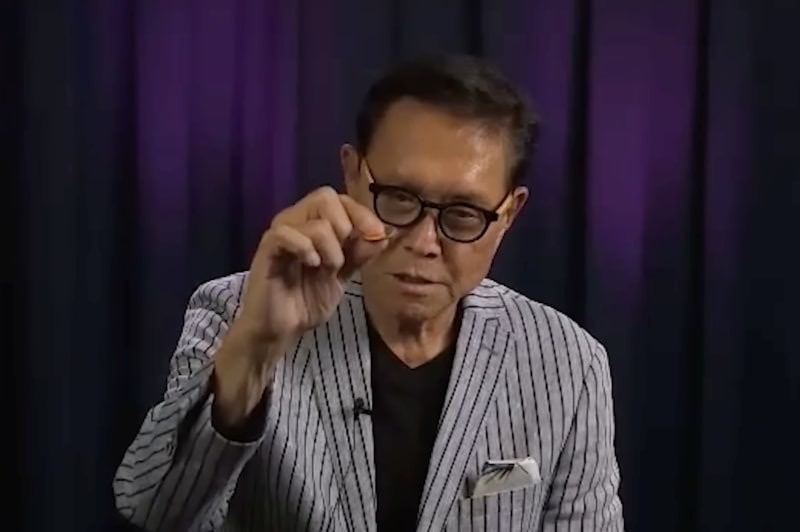

Renowned investor and author of the best-selling personal finance book ‘Rich Dad Poor Dad‘, Robert Kiyosaki, has continued to express concerns about the trajectory of the American economy and highlighted the need for strategic investments to safeguard against potential fallout.

In an X (formerly Twitter) post on February 10, Kiyosaki drew historical parallels, comparing the current state of the United States and the decline of the Roman Empire. Kiyosaki.

With the fall of the Roman Empire, Kiyosaki pointed to the historical tendency of great powers to face similar challenges in their twilight years. In both cases, he noted the prevalence of extravagant spectacles and the growing debt in the US.

He suggested that similarities arise when considering that the Roman Empire’s decline witnessed the currency’s devaluation to meet military and financial obligations.

“At the same time, America’s debt is the highest in world history, a debt America can never back. The Roman Empire ended in the same way with massive gladiators entertaining chubby Romans while their bankers debased their currency to pay soldiers and bills,” he said.

Kiyosaki’s views come as Americans gear up for the Super Bowl, which has seen a significant amount of betting interest, emphasizing the ironic spectacle of a nation indulging in extravagant entertainment while grappling with unprecedented debt levels.

The financial educator emphasized that “history repeats itself when stupidity prevails.”

Possible assets for investments

To steer investors toward more informed choices, Kiyosaki advised avoiding conventional investments and focusing on tangible assets with enduring value instead.

According to the author, gold, silver, and Bitcoin (BTC) remain top choices as they can be hedges against economic uncertainty and currency devaluation.

It is noteworthy that Kiyosaki’s cautionary message follows positive signs of recovery in the US economy, with slowing inflation and job creation exceeding analysts’ estimates. However, as reported by Finbold, Kiyosaki dismissed the notion that the economy is truly growing, asserting that only ‘suckers believe the economy is strong.’

“Suckers actually believe the economy is strong. Don’t be fooled. The Magnificent 7, financed by US government dollars, keeps the stock market up. Please be careful. Stock and bond markets are about to crash,” Kiyosaki stated.

In the meantime, Kiyosaki remains optimistic about Bitcoin, highlighting its potential as an asset alongside silver and gold to hedge against inflation.

Previously, Kiyosaki expressed a bullish projection for Bitcoin, noting that the cryptocurrency could surpass the $100,000 mark in 2024.