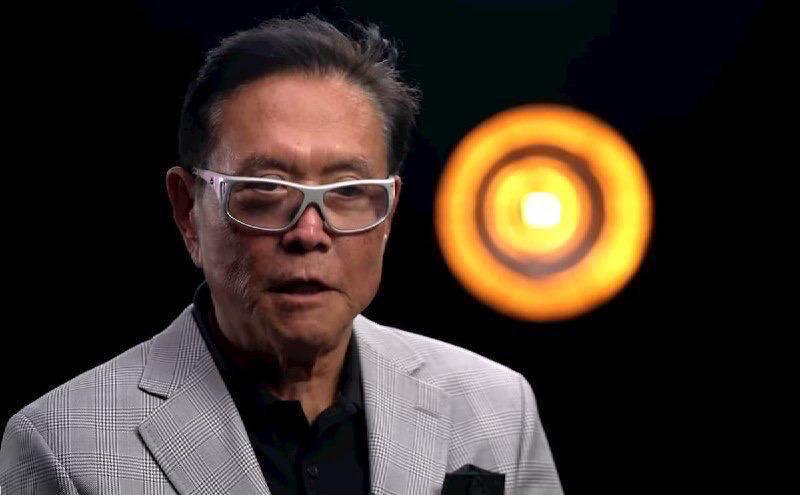

After incumbent United States President Joe Biden announced he was withdrawing from the election race against Republican candidate and former US President Donald Trump, Robert Kiyosaki has offered his predictions for Bitcoin (BTC), gold, and silver if Trump is President again.

Specifically, the renowned investor and author of the best-selling personal finance book ‘Rich Dad Poor Dad’ argued that the prices of the maiden cryptocurrency and the popular precious metals would increase if Trump wins, according to his X post on July 23. As he elaborated:

“I predict gold will rise from $2,400 an ounce to $ 3,300: silver from $29.00 an ounce to $79.00: and Bitcoin from $67,400 per coin to $105,000 by August 2025.”

Trump’s role in price growth

Explaining his reasoning, Kiyosaki said that “Trump wants a weaker dollar so America will begin export more than import” and that “with a weaker dollar, jobs will come back and assets will go up in price,” adding that “Trump is going to drill, drill, drill for oil and the price of oil will come down.”

By comparison, the finance educator pointed out that the current US President “did the exact opposite” by shutting down the Keystone XL pipeline, which led to the price of oil soaring from $30 to $130 a barrel and which, in turn, “caused massive inflation wiping out the poor and middle class.” On the other hand:

“Trump will Make America Great Again. He will ‘Drill baby drill.’ A weaker dollar will increase exports, create jobs, open new factories, and make gold, silver, Bitcoin, stocks, and real estate rise in price.”

Kiyosaki on Biden vs. Trump

As a reminder, Kiyosaki earlier stated that inflation was “eating American families alive,” brushing off President Biden’s economic policies as a “joke” and arguing that the only product coming down in price was the illegal drug fentanyl, as Finbold reported on April 9.

In May, he commented on the legal action against the former US President, arguing that “people are getting poorer and poorer in America because most of our school teachers are Marxists and they hate the rich, that’s why they’re going after Trump, they hate him because he’s a rich man.”

More recently, the ‘Rich Dad’ author has reiterated his opinion that the incumbent US President had “caused inflation to rise, making life harder for the poor and middle class” after cutting the Keystone XL pipeline, which “caused the price of oil to rise from $30 to $130 in just one week.”

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.