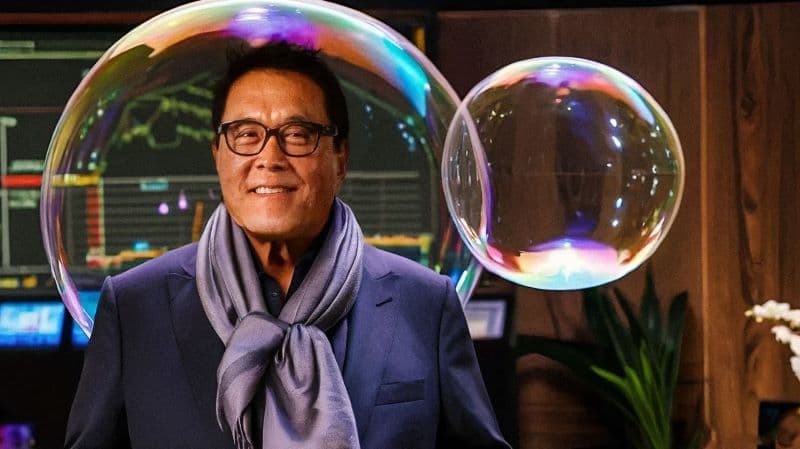

As he continues to warn about the looming financial catastrophe, the popular investor, entrepreneur, and author of the best-selling personal finance book ‘Rich Dad Poor Dad,’ Robert Kiyosaki, has revealed the best strategies to survive the economic crisis he believes is coming.

Specifically, Kiyosaki shared advice from investment banker James Rickards’ new book ‘MoneyGPT,’ including taking the “equivalent of two months expenses in cash and [putting] it in a safe place,” and “saving silver coins rather than saving cash in a bank,” in an X post on September 26.

Silver and Bitcoin

Indeed, offering his reasoning as to why he saves silver coins “such as the US Silver Eagle,” and not cash, the ‘Rich Dad Poor Dad’ author explained that “in a crisis, you can use 1 oz silver coins as cash,” and also advised acquiring more Bitcoin (BTC) to gain advantage during such a time:

“Obviously, if you have enough for two months of expenses in cash and silver coins such as the US Silver Eagle….then acquiring more Bitcoin and come out on top of the world.

As a reminder, Kiyosaki earlier made a bold prediction that the maiden cryptocurrency would reach the price of $500,000 in 2025 and then $1 million by 2030, in line with his already established bullish sentiment, because artificial intelligence (AI) “is going to shake up the world of money.”

Getting out of stocks

Furthermore, in his latest post, Kiyosaki also stressed that Berkshire Hathaway (NYSE: BRK.A, BRK.B) CEO Warren Buffett, the so-called ‘Oracle of Omaha,’ recently sold “a major position in Apple (NASDAQ: AAPL) stock and moved to cash,” referring to Buffett’s sale of Apple stocks this year.

That said, although Buffett’s company did sell 389 million Apple shares in the second quarter of 2024, representing a sharp decline from 51% in the same quarter last year, they continue to account for 30% of Berkshire Hathaway’s stock portfolio, as Finbold reported on September 17.

Meanwhile, Kiyosaki’s negative view of the stock market and preference for hard, tangible assets matches his previous statements that the biggest stock market crash in history had already started while at the same time echoing Rickards’ definition of a financial depression:

“It’s happening. The crash has already started. As Rickards says, we entered a depression in 2008, and the definition of a depression is subprime growth, so America and the world have not grown.”

All things considered, the ‘Rich Dad Poor Dad’ author might, indeed, be correct in his predictions, which makes his recommendations sensible, although some of his critics have been pointing out that Kiyosaki has been making such warnings for quite some time – as early as 2011.