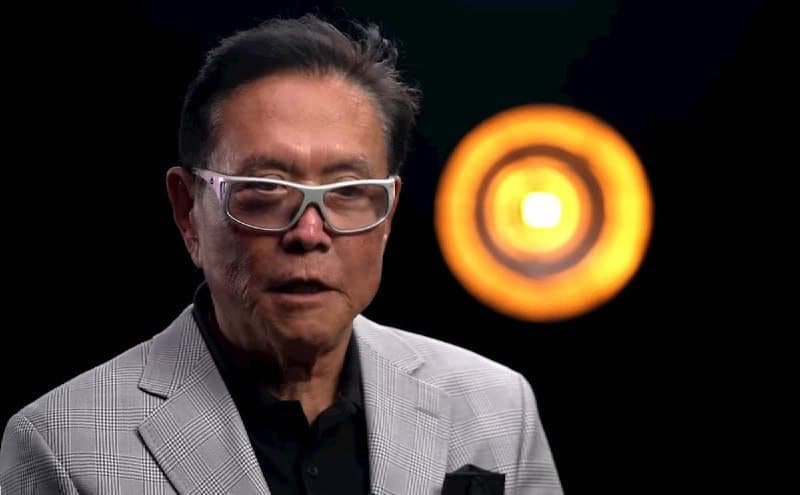

In his enduringly pessimistic assessment of the economy and overall financial markets, Robert Kiyosaki, the bestselling author of the personal finance book ‘Rich Dad Poor Dad,‘ continues to voice his criticism of the Federal Reserve.

The criticism aligns with Kiyosaki’s view that the Fed is responsible for undermining the economy.

In this line, Kiyosaki shared unfiltered views about the Fed through an X (formerly Twitter) post on February 17 and urged investors to explore non-traditional investment assets.

In his post, the author advised investors not to ‘fight the Fed’ but instead redirect their focus towards investing in assets such as gold, silver, and Bitcoin (BTC).

This statement echoes his persistent criticism of the institution, which he has previously characterized as a criminal organization responsible for the economic hardships faced by the poor and middle class.

“Sick and tired of hearing ‘experts’ ask ‘What is the Fed doing?’ The Fed is the problem. The Fed is a criminal organization. The Fed has destroyed the economy, made the poor and middle class poorer, and bailed out their rich banking friends,” he said.

Betting on Bitcoin

Instead of relying on the Fed, Kiyosaki has consistently advocated placing faith in assets such as gold, silver, and Bitcoin. Interestingly, as reported by Finbold, the financial educator warned that gold is poised to crash below $1,200.

He emphasized that banks were opting for the precious metal over US debt, posing a hypothetical question about how the world and the US would function without money.

At the same time, he believes that silver and Bitcoin will “take off,” although he admitted to having no knowledge about the maiden cryptocurrency. He stressed that the US dollar is likely to collapse, asserting that the American economy is on an alarming trajectory and suggesting a potential outcome akin to the collapse of the Roman Empire.

Meanwhile, Kiyosaki emphasizes that investors should brace themselves for a possible market crash. In his latest crash outlook, he contended that the stock market is poised for a downturn, noting that the S&P 500 index is likely to experience a 70% plunge, which he terms the ‘biggest crash in history.’