Real-world assets (RWA) is a strong narrative growing in the cryptocurrency market, following the interest of BlackRock Inc. (NYSE: BLK). In this context, a Real Estate token, UBXS, surged 300% in a week amid allegedly institutional moves.

UBXS is a utility token part of an RWA project specializing in Real Estate, developed by the Web3 company, Bixos. The company aims to connect physical and virtual worlds through blockchain technology.

Interestingly, Real Estate property owners can use Bixos to tokenize their real-world assets, making an exchangeable non-fungible token (NFT). By using the UBXS token, the company promises fee discounts and other benefits to investors.

UBXS price analysis

Michaël van de Poppe, CEO and founder of MN Trading, showed public support for the token in January 2024. Since then, UBXS price has increased by more than 400%, as reported by the investor who awaits a “dip.”

However, the Real State utility token’s most significant increase happened in the last seven days, with a 300% gain. Van de Poppe attributes that accomplishment to Bixos’s first property sale.

Is BlackRock investing in UBXS Real Estate token?

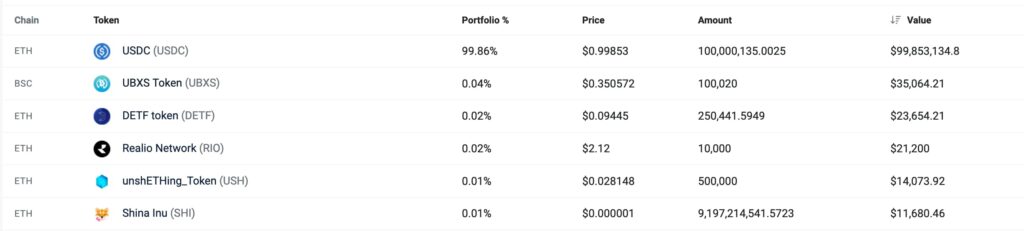

During its rally, Bixos’ official account on X (formerly Twitter) celebrated seeing 100,020 UBXS on what could be BlackRock’s tokenization fund account.

“There are great days. It is exciting to see UBXS token in BlackRock official portfolio on Bnb chain. RWA is the rising value and corporate companies are here now thank you.”

– Bixos Incorporation

Yet, the finance titan has not confirmed this address’ ownership, nor disclosed any investments in UBXS by press time. It is important to understand that anyone can send tokens to any address without a previous request from its owner.

Previously, this tactic has been used by new projects as a marketing gimmick to give the impression of validation by respected entities. For example, Shiba Inu (SHIB) first gained the market’s attention after being sent to Vitalik Buterin’s known address.

Moreover, the UBXS token stash represents only 0.04% of BlackRock’s non-confirmed portfolio. The total value of $35,000 is significantly low compared to the $100 million worth of USDC. Similarly, dozens of other tokens, most of them unknown, appeared in this account.

Therefore, it is unlikely that BlackRock is investing in UBXS through what is believed to be its tokenization fund account.

In conclusion, real-world assets and Real Estate blockchain interactions are promising use cases moving forward. Projects like UBXS are at the forefront of innovation, but investors must remain cautious and avoid making decisions based on the ‘Fear of Missing Out’ (FOMO).

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.