John Wu, the President of DeFi projects launchpad Ava Labs, has said the current cryptocurrency market correction had been triggered by a recurring macro trend over the last few months that has also impacted all asset classes.

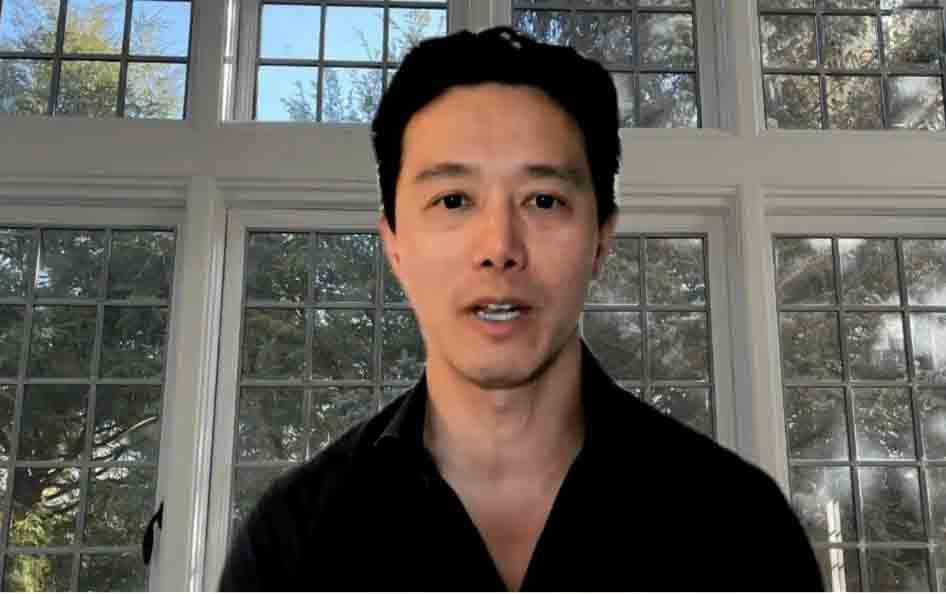

Speaking to TD Ameritrade Network, Wu singled out prolonged concerns about a possible spike in inflation rates as the primary catalyst for the correction. He notes that besides bitcoin and the entire crypto sector, high-tech stocks have also been hit by inflation worries.

“I don’t think what we saw today in the crypto asset class was caused today, or even the last couple of days. This has been a recurring macro trend. That’s affected all asset classes in the last couple of months. Investors and the market has been worried about inflation,” said Wu.

Picks for you

According to Wu, the correlation in all asset classes results from institutional investors joining the crypto market. He said that investors now have options in both sectors. However, Wu states that bitcoin and the entire crypto sector are the last to experience inflation worries.

Wu maintained that inflation is still good for bitcoin because its finite supply makes it a perfect store of value. He acknowledged that bitcoin has not benefited from the current inflation concerns because leading players in the equity market are also influential in the cryptocurrency sector. Some of the institutions have liquidated their digital currency to fund other operations.

Notably, institutions like electric vehicle manufacturer Tesla (NASDAQ: TSLA) invested $1.5 billion in bitcoin. During Q1 2021 results, the company revealed that it had sold some of its bitcoin holdings. Furthermore, the firm recently suspended bitcoin payments for vehicle purchases triggering the asset’s price correction.

Bitcoin store of value status tested

Wu states that bitcoin’s store of value status was tested following anticipation of an inflation environment in the last six months. Over the period, gold and bitcoin surged in value. Bitcoin sustained a bull run in 2021, hitting an all-time high price of $64,800 as of April 14th.

He noted that bitcoin has exhibited its store of value capabilities by beating gold, the presumptive store of value assets. According to Wu:

“At least looking at it annually, a 12 month moving average, it’s always been beating gold. So I don’t think you can use that argument for an extended period of time, whether it’s 12 months or 24 months or three years, it’s historically been beating gold, especially when the markets started pricing in the future, probably inflation when the Fed started printing a lot of money. That was definitely a period of time when bitcoin far outperformed gold.”

Wu added that as more institutions adopt bitcoin, the financial market should expect more correlation between the two asset classes. By press time, bitcoin was trading at $39,600, according to data provided by CoinMarketCap.

Watch the video: John Wu Of Ava Labs On What The Swings In Bitcoin Mean For Equity Markets

[binance]