For the better part of 2024, the potential onset of a recession has ranked high among investors’ concerns.

Now, investors’ outlook suggests that the fears seem to be fading with rising expectations that central banks will step in and tilt economies in the right direction.

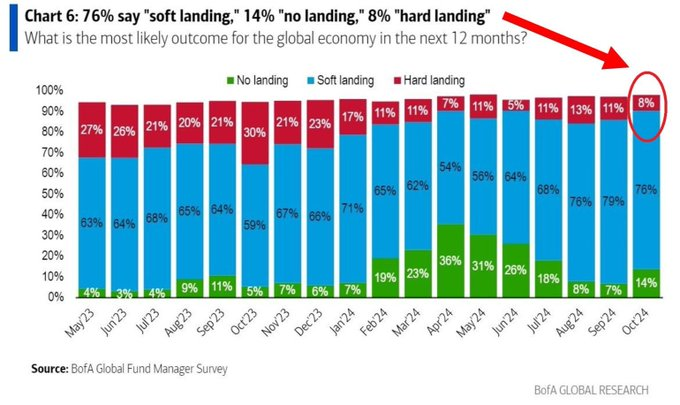

In this regard, as of October 2024, only 8% of global investors anticipate a “hard landing” for the economy in the next 12 months, marking one of the lowest levels of pessimism in two years, according to Bank of America (BofA) Global Fund Manager Survey.

A majority of investors, 76%, believe that the global economy is on track for a “soft landing,” alleviating the chances of a full-blown recession. Meanwhile, 14% of investors still expect “no landing” at all.

This trend is mirrored in prediction markets as well. According to PolyMarket data, the chances of the United States entering a recession in 2024 have dropped to 6% as of October 16, down from a high of 30% in early August.

Underlying recession risks

Indeed, this bullish sentiment coincides with a period during which the stock market and select commodities, including gold and silver, have rallied to historical highs. This shift comes at a period when the Federal Reserve implemented a first rate cut in four years, with many expecting additional cuts in the coming months.

On the flip side, some market players maintain that despite the current economic outlook characterized by declining inflation, there is still room for a possible recession in the coming months.

One concern stems from the movement in gold prices, which are trading at historical levels and going against traditional norms.

For instance, gold’s surge comes as bond prices have collapsed, a rare divergence given their usual correlation. To this end, analysis by The Kobeissi Letter suggests that gold behaves like a recession is imminent.

On the other hand, celebrity investor and author Robert Kiyosaki has warned that the recent gold rally should be viewed with caution since it might signal a potential downturn in the coming months. In the same vein, Kiyosaki remains among the vocal voices urging inventors to prepare for one of the biggest market crashes in history.

It can also be argued that the falling fears of a recession could be influenced by the stock market rally, which has seen the S&P 500 index rally to news. However, economist Henrik Zeberg maintains that the index rally is a precursor to the worst market crash in history.

Timelines for a possible recession

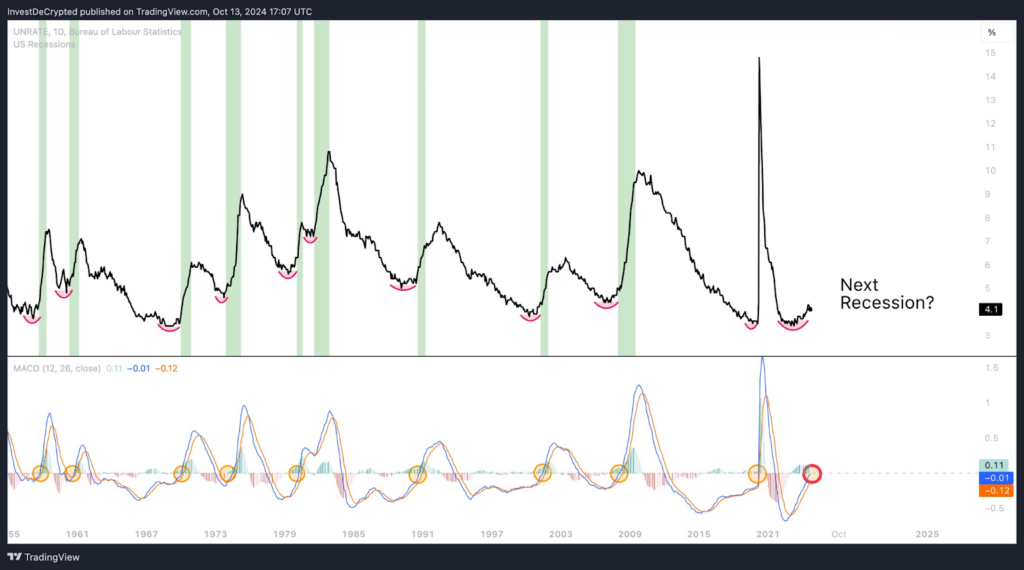

Meanwhile, an analysis by Investing DeCrypted, posted on X on October 13, suggests that the momentum of the U.S. unemployment rate—a historically reliable indicator for forecasting economic downturns—is once again raising red flags about a potential recession.

According to this outlook, the recent uptick in unemployment momentum suggests that the U.S. economy could face a significant market decline in the medium term, likely within the next three to six months.

In past cycles, a noticeable rise in this indicator has frequently coincided with periods of economic recession. Given the current setup, the odds appear high for another downturn as leading and coincident indicators align with recessionary trends.