In this review, we are taking a look at dYdX, a decentralized exchange specializing in perpetuals and leverage trading to help more seasoned traders maximize their profits. To be specific, we’ll be taking a look at what dYdX is, what kind of vision propels it, what kind of services and tools it has to offer, and how safe it is. In addition, we’ll give you some tips on how to register an account to get started with the platform and provide you with a short list of pros and cons to give you a better sense of the platform’s strengths and weaknesses.

About dYdX

dYdX aims to combine the best aspects of both decentralized and centralized exchanges (CEX), emphasizing strong security, transparency, and efficient trade executions. With support for up to 20x leverage, dYdX is designed to attract more advanced crypto traders looking to maximize their potential gains since high leverage also brings significant risks, which makes it less suitable for novice traders.

dYdX leverages smart contracts and StarkWare’s STARK Rollups for zero-knowledge proofs to improve scalability and lower transaction costs. This enables a wide range of trading services, including spot trading and complex derivatives trading, making dYdX a versatile platform.

At the start of the year, dYdX celebrated the launch of its dedicated dYdX Chain, transitioning the platform from Ethereum (ETH) to a CosmosSDK-based blockchain network. Major industry players such as Binance, Anchorage, Coinbase, OKX, Crypto.com, Gate.io, and KuCoin quickly integrated with dYdX Chain, enabling smooth user transactions.

As a result, the dYdX Chain processed over $166 billion in trading volume within its first six months, reaching a daily peak of $2.6 billion and $129.9 million in open interest, with total value locked (TVL) climbing to $135 million.

Background and History

Founded in 2017, dYdX emerged with the goal of making financial markets as accessible as possible. The platform distinguished itself by bringing traditional finance (TradFi) features to the decentralized blockchain space. By adopting Layer-2 solutions, dYdX addressed common blockchain challenges such as high gas fees and slow transaction times, establishing itself as a preferred platform for serious traders.

Antonio Juliano, a former Coinbase employee and software engineer, founded dYdX. With a background in computer science from Princeton, Juliano envisioned a blockchain-based platform that could replicate the advanced trading mechanisms of traditional finance. His expertise has been instrumental in shaping the technology behind dYdX.

Who Can Benefit From dYdX?

Those who can potentially benefit from the dYdX exchange include:

- Advanced traders: If you’re an experienced trader looking for high leverage, dYdX offers up to 20x leverage on perpetual contracts and up to 5x on margin trading;

- Fee-conscious traders: dYdX utilizes ZK-rollups to reduce gas fees and enable gas-free trading on its Layer 2 protocol. Additionally, users with monthly trading volumes under $100,000 pay no fees;

- Traders looking for a decentralized trading platform: Those who prioritize privacy and decentralization will likely welcome the dYdX model.

DYDX Token

The upgrade to the dYdX Chain included updates in tokenomics, which impacted governance, token utility, and revenue distribution. The exchange now has its own native token, DYDX, which can be used as a staking and governance token.

Stakers earn a yield derived from transaction fees, which compensates them for securing the network. Similar to Proof-of-Stake (PoS) blockchains, DYDX earnings are proportional to the user’s stake compared to that of others. Those who opt not to stake can delegate their DYDX to others in exchange for a portion of the yield.

Governance rights allow users to vote on initiatives and shape the future of the platform. Initiatives include topics such as the introduction of new markets, trading incentives, funding, and technological enhancements.

Moreover, the token plays a critical role in decentralization offered by a distributed PoS validator set. The shift to a new chain not only reduced regulatory risks associated with operating a centralized sequencer but also enabled direct revenue distribution to token holders. The same principle applies to other on-chain proposals, all of which are executed following successful votes.

dYdX Products and Services

dYdX blends the functionalities of centralized and decentralized exchanges to ensure a smooth margin and futures trading experience, both on desktop and mobile. The main services offered by dYdX thus include:

- Margin trading;

- Perpetual trading;

- Mobile trading.

Let’s explore each of them in more detail.

1. Margin Trading

dYdX offers advanced margin trading tools, enabling traders to execute complex strategies and potentially increase their profits by trading with borrowed capital. With minimum margin requirements in place, the platform ensures that leveraged positions are maintained and protects the integrity of the platform.

2. Perpetual Trading

Perpetual trading on dYdX comes with leverage of up to 20x. Perpetual futures contracts come with key advantages, such as the ability to hold positions indefinitely (no expiration dates) and leverage options that cater to both conservative and aggressive trading styles. This flexibility makes the platform suitable for traders with varying risk appetites. Traders can also choose between isolated and cross-margin trading for personalized risk management and exposure.

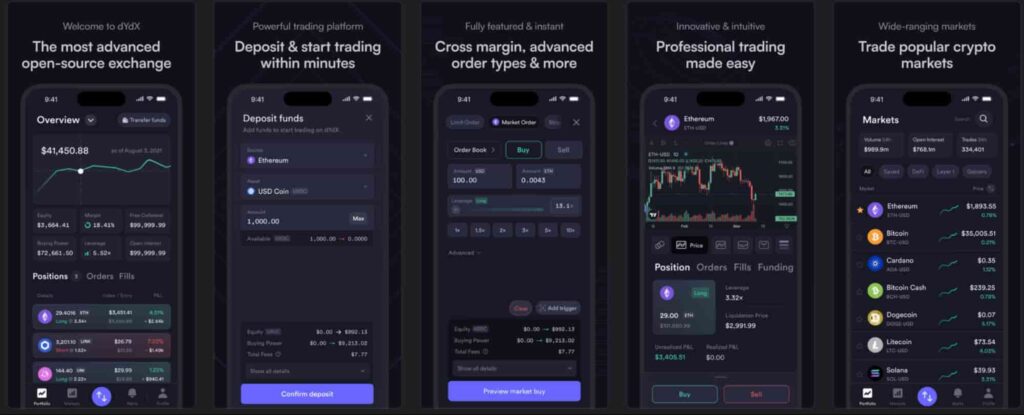

3. Mobile Trading

The dYdX iOS and Android app brings dYdX trading capabilities to users on the go. The app replicates the full functionality of the web platform, ensuring that traders can access the same powerful tools and features no matter where, no matter when.

How to Get Started With dYdX

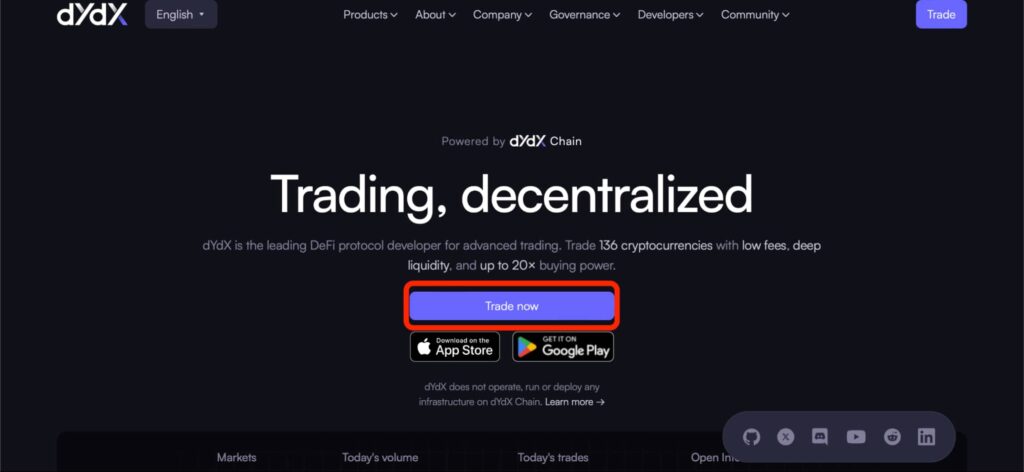

To start trading on dYdX, you will need to register an account. Registration is rather straightforward. First, head over to the dYdX homepage and click on the blue Trade now button (as shown below):

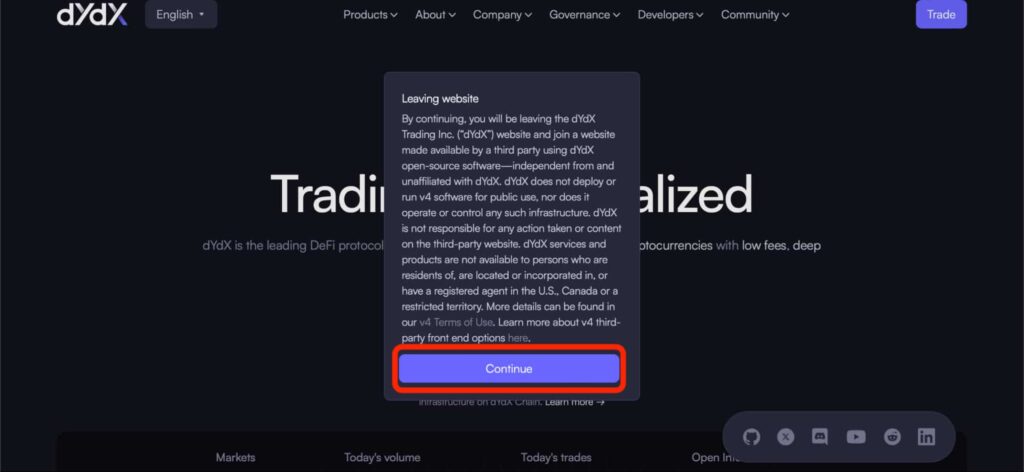

Next, you will be warned that you are being redirected from the site. Simply click on the Continue button to proceed (as shown below):

Once you’ve clicked on the Continue button, you will be taken to the dYdX trade interface. Once there, simply click on the Connect wallet button in the upper right corner (as shown below):

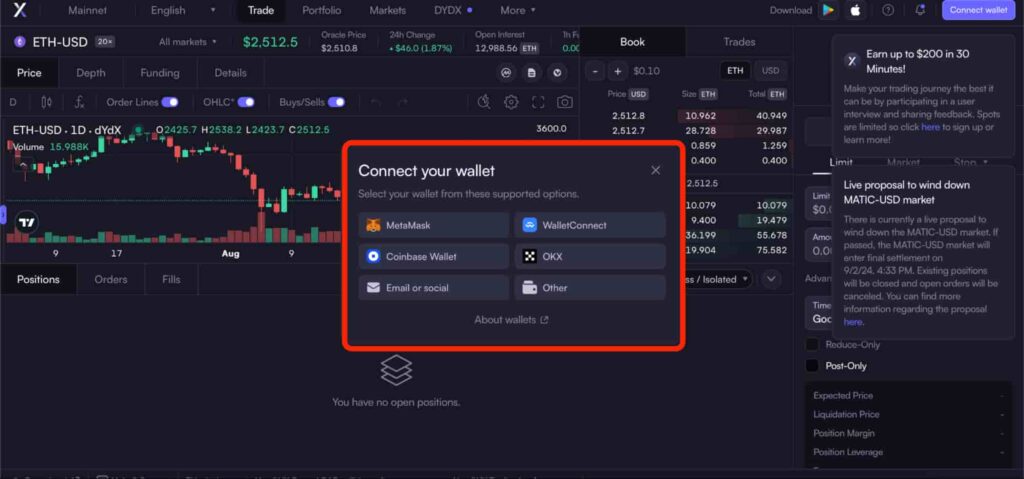

You will have a number of options available, including MetaMask, CoinBase, and others (as shown below). Simply choose your preferred wallet to proceed:

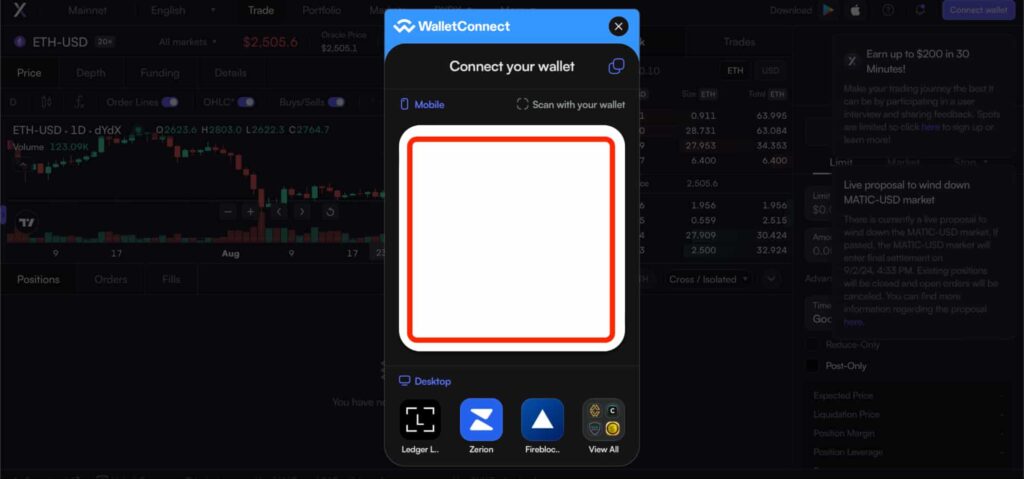

Once you’ve selected your preferred wallet, you will receive a QR code (as shown below). Simply head over to the wallet app on your phone and scan the code. Once you’ve done that, you will be ready to trade on dYdX.

Is dYdX Safe?

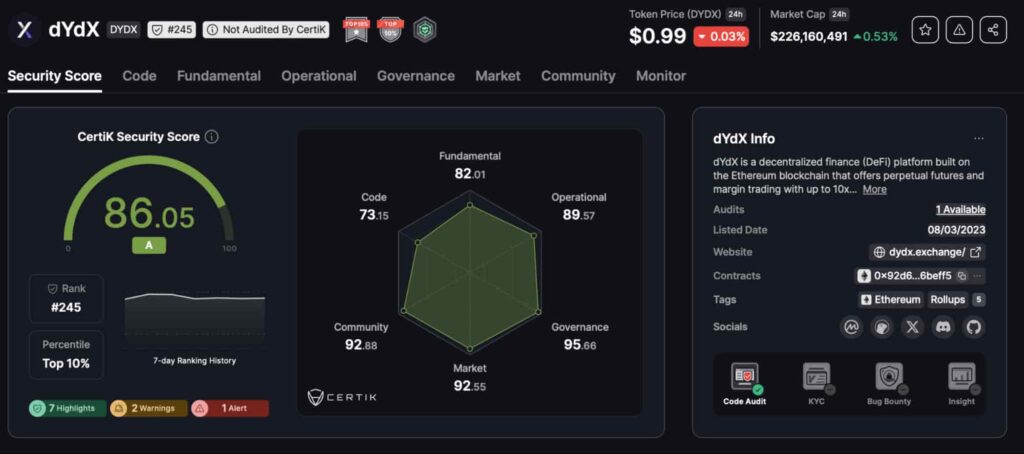

The dYdX chain relies on a PoS mechanism to secure data. Consequently, token holders stake their DYDX tokens to Validators, helping to strengthen the network’s security. As of the time of writing, the exchange has a score of 84.05/100 on CertiK, the leading blockchain safety analysis protocol.

In April 2024, the exchange took steps to further decentralize Validators and enhance security by liquid-staking 20 million DYDX with Stride. This reduced the risk of malicious attacks and bolstered overall network resilience.

The launch of the dYdX Chain marks a significant step towards full decentralization. Unlike dYdX v3, which operates as a non-custodial hybrid Layer-2 DEX on Ethereum with a centralized orderbook and matching engine, the dYdX Chain functions as a fully decentralized and independent Layer 1 network, supported by 60 active Validators.

This improves governance accessibility, with lower minimum deposits for proposals and a more streamlined market listing process, further empowering the community in the decentralized ecosystem.

Smart Contract Safety

Smart contracts have undergone rigorous scrutiny by reputable security firms, ensuring that user assets are well-protected. Comprehensive audits, along with internal testing, help mitigate potential vulnerabilities.

dYdX also prioritizes transparency. By making its smart contracts and audit reports publicly accessible, the platform allows for external verification, reinforcing confidence in its safety protocols.

Non-Custodial Trading

dYdX operates on a non-custodial framework, giving users complete control over their funds. Unlike traditional exchanges, there is no need for an intermediary to manage private keys, ensuring that users retain full ownership of their digital assets.

For those who prioritize control and decentralization, dYdX’s non-custodial model aligns perfectly with the core principles of blockchain, emphasizing the importance of reducing central points of failure.

dYdX Fees

dYdX operates on a maker-taker fee model, meaning the fees depend on the type of order you place.

Taker fees are calculated based on your total USD trading volume over the trailing 30-day period across all perpetual order books. There are no fees for deposits or withdrawals, but users must cover the gas costs for these transactions. An exception applies to fast withdrawals on the Layer-2 Perpetual product, where a 0.1% fee is charged to cover the liquidity costs for the quick withdrawal.

You won’t be charged a fee for cancelling an open order. Fees are only applied to orders that have been filled. When a position is liquidated, the collateral is sold to repay the borrowed funds. For Perpetuals, this process incurs a 1% fee.

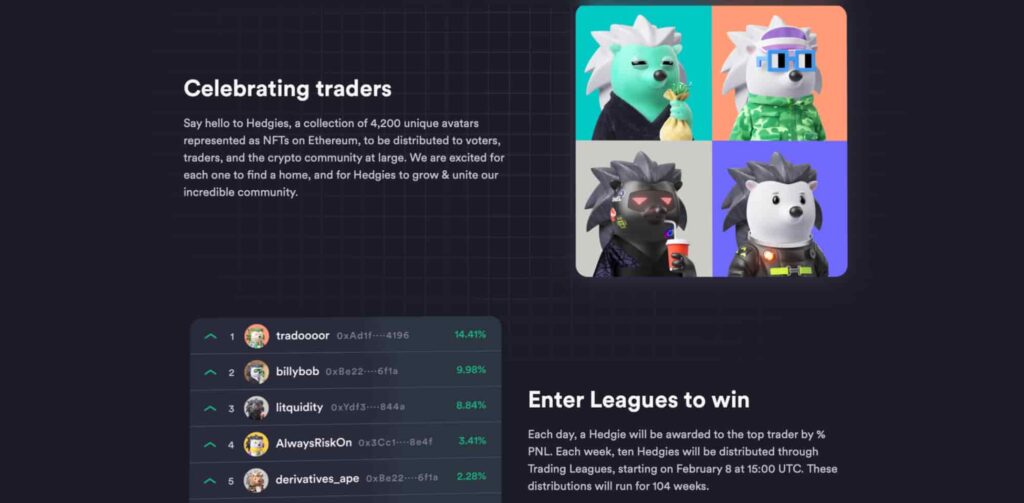

Hedgies: dYdX NFT discounts

dYdX has a presence in the non-fungible token (NFT) space with its Hedgies collection consisting of 4,200 unique collectible avatars that serve as symbols of distinction within the dYdX community and offer holders special discount perks.

Namely, Hedgie holders enjoy a one-tier increase in their DYDX fee discount. For example, users holding at least 5,000 DYDX will receive a 15% discount (Tier 4) instead of the standard 10% discount (Tier 3).

Why Do Users Choose dYDX?

There are several reasons why users might choose dYdX as opposed to some of its competitors, particularly users looking for more advanced financial instruments. After all, dYdX specializes in futures and margin trading, which allows users to leverage their positions while enjoying the security of decentralized trading without intermediaries. This is usually appealing to more experienced traders looking to diversify and tweak their trading strategies.

In addition, dYdX is known for its strong security measures. It leverages smart contracts to ensure trades are executed automatically and without custodial risks, giving traders full control over their assets.

Finally, dYdX’s is committed to transparency and has a solid reputation, which adds another layer of trust. Namely, the platform’s open blockchain operations allow users to verify transactions independently, creating a transparent trading environment.

dYdX Unlimited: The Road Ahead

dYdX announced it would be introducing dYdX Unlimited in autumn 2024. The most important update yet, dYdX Unlimited is set to bring a host of new features to the dYdX Chain.

Users will soon be able to list virtually any market on dYdX Chain without needing governance approval. By depositing a specified amount of USD Coin (USDC) into the newly introduced MegaVault, users can instantly launch new markets with automatic liquidity, a feature unique to dYdX.

In addition, users will have access to MegaVault, a master liquidity pool that ensures liquidity for all dYdX markets. Users will be able to participate passively by depositing USDC into MegaVault and earning a share of both its profits and protocol revenue. This is expected to simplify liquidity provision and offer a passive income opportunity for all types of users.

Further, a new affiliate program will allow users to earn rewards by inviting others to trade on dYdX. After trading $10,000, users unlock an affiliate link that can generate up to $1,500 per month per referral. Additional bonuses may also be available, depending on community governance.

The most important update, however, is likely the introduction of permissioned keys that will allow users to grant controlled access to their wallets. This feature is particularly beneficial for institutional and high-value traders and could pave the way for third-party integrations.

Pros and Cons of dYdX

Pros

- Low fees: dYdX has fairly competitive fees;

- Cybersecurity: The exchange employs some fairly robust security measures;

- Privacy: The exchange does not require a KYC which makes it attractive to privacy-oriented traders.

Cons

- Not available in some regions: The exchange is not available in some potentially large markets, such as the United States;

- Complexity: Leverage and futures trading can be somewhat complicated for new traders;

- Somewhat limited asset selection: dYdX has a somewhat limited asset selection.

dYdX’s Community and Support Channels

All information pertinent to the dYdX exchange, its products, and its services is readily available on the platform’s website, blog, and social media.

- Website: For the most important information, visit the official dYdX website;

- Blog: You can find educational posts and platform updates on the dYdX blog.

dYdX social media platforms:

- Twitter: Follow dYdX on X (Twitter) for additional notifications and updates;

- LinkedIn: Be sure to follow dYdX on LinkedIn as well if you like to network;

- YouTube: You’ll find video updates on the official dYdX YouTube channel;

- Discord: Join the dYdX community on Discord to discuss the platform with other users;

- Reddit: For forum-style discussions on the dYdX platform, join the official subreddit.

Conclusion

In conclusion, dYdX has established itself as a solid choice for high-risk traders in the decentralized exchange space, thanks to its focus on perpetual futures contracts and leveraged trading. The integration of the DYDX governance token also underscores the platform’s dedication to fostering a decentralized trading environment.

However, there are some limitations to consider, such as the platform’s lack of presence in the US market and the restricted range of margin trading pairs, which may make dYdX less appealing to certain traders. Hopefully, the upcoming updates are anticipated to address these issues.

Despite some shortcomings, dYdX offers valuable benefits for those interested in decentralized finance with its strong security features, competitive fees, and user-friendly interface.

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.

FAQs About dYdX

What is dYdX?

dYdX is a decentralized exchange (DEX) specializing in perpetuals and high leverage trading.

How to buy DYDX token?

To buy DYDX, you have to register and fund an account on a crypto trading platform. Once your account has been funded, find DYDX within your crypto exchange’s trading interface, specify how many tokens you wish to buy, and execute the trade.

Is dYdX available in the US?

No, dYdX is not available in the United States as of January 2026.

Is dYdX available in Canada?

No, dYdX is not available to Canadian residents as of January 2026.

Is dYdX safe to use?

Yes, dYdX is considered a safe trading platform.

What are the benefits of using the dYdX exchange?

The main advantages of the dYdX exchange include low fees, high leverage, and robust security systems.

Does dYdX require KYC?

No, KYC is not required when registering on dYdX.

How many cryptocurrencies can you trade on dYdX?

You can trade 136 cryptocurrencies on dYdX.