In the midst of a tumultuous market in which many industry experts and investors are uncertain where to make an investment, one prominent investor is encouraging people to store Bitcoin, in addition to the precious metals gold and silver.

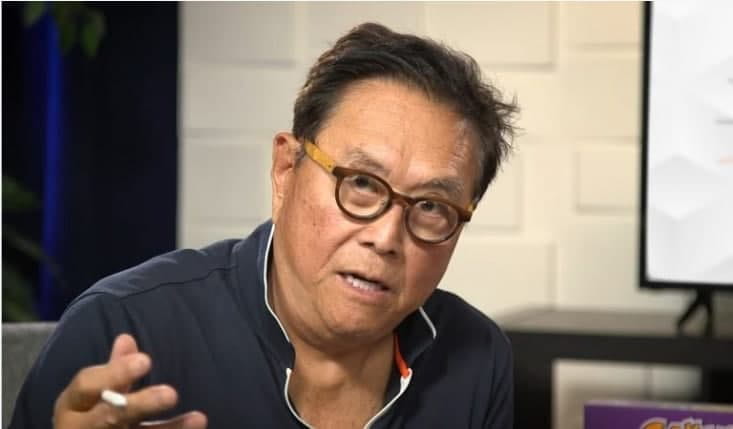

Indeed, the author of the personal finance book ‘Rich Dad, Poor Dad’ Robert Kiyosaki, took to Twitter on May 23 to stress his thoughts on the current global market situation in light of the Davos, Switzerland event and International Monetary Fund (IMF) warns that the globe is facing the worst financial crisis since World War II.

The outspoken financial guru hinted at a potential World War coming and, in turn, advised to save gold, silver, Bitcoin, food, guns, and bullets. He tweeted:

“May 23, 2022: DAVOS, Switzerland IMF warns world faces greatest financial challenges since WWII. Global disaster has been coming for years. Desperate leaders will do desperate things. World War coming? God have mercy on us. Save gold, silver, Bitcoin, food, guns, and bullets.”

World leaders head to Davos event

This week, some 2,500 world leaders from industry, politics, and civil society are slated to attend a rare springtime Davos.

In addition to the conflict in Ukraine, the recovery from the pandemic, addressing climate change, the future of work, advancing stakeholder capitalism, and making the most of new technology are some of the subjects that will be discussed at Davos.

Discussions on the deteriorating conditions of the world’s financial markets and economy are anticipated to take center stage on the agenda for the business meeting.

After a significant rebound from the recession that was brought on by the beginning of the pandemic two years ago, there are now a multitude of threats to that recovery, which has caused the IMF to downgrade its forecast for global growth for the second time since the beginning of the year.

Inflation, as a result of hampered supply chains, became a concern throughout the course of the last year, notably in the economy of the United States.

Since the beginning of 2022, further developments, such as Russia’s invasion of Ukraine and waves of COVID-19 lockdowns throughout China, have slowed or stopped a recovery. This has further complicated the situation.

Kiyosaki’s hedges against inflation

Interestingly, a tweet from Kiyosaki from last week said, “I remain bullish on Bitcoin’s future.” He also revealed that he is keeping an eye out for Bitcoin to reach a new low, speculating that it might be $20,000, $14,000, $11,000, or even $9,000 at this point.

The well-known author then went on to elaborate on the reasons why he continues to be positive about Bitcoin. According to Kiyosaki, both the Federal Reserve and the Treasury Department are corrupt institutions, and before they can restore their honesty, integrity, and moral compass, they will have to self-destruct first.

It’s also worth mentioning that Kiyosaki, along with Trends Research Institute’s founder and director Gerald Celente, both stated back in January when the equity markets crash, “reality will hit Main Street, and that’s why it’s GSB (gold, silver, Bitcoin).”

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.